- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Here???s Why You Should Add Deere (DE) To Your Portfolio Now

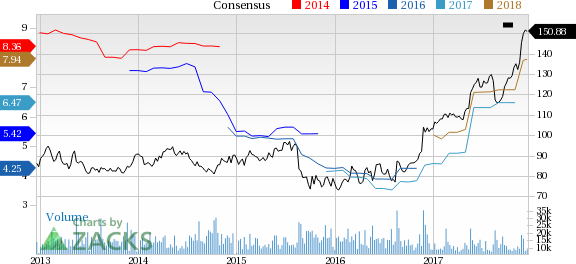

Shares of Deere & Company (NYSE:DE) have rallied around 46.4% year to date. We believe this is the right time to add the stock as the company has solid prospects and is poised to maintain its bullish momentum.

Let’s delve deeper into the factors that make this agricultural equipment maker an attractive investment option.

What Makes Deere an Attractive Pick?

Solid Rank & VGM Score: Deere currently sports a Zacks Rank #1 (Strong Buy) and a VGM Score of B. Our research shows that stocks with a VGM Score of A or B, when combined with a Zacks Rank #1 or 2 (Buy), offer the best investment opportunities. Thus, the company appears to be a compelling investment proposition at the moment.

Above the Industry: Deere has outperformed the industry it belongs to over the past year. The company’s shares have jumped 47.6% compared with roughly 42.5% growth recorded by the industry during the same time frame.

Positive Earnings Surprise History: Deere has an impressive earnings surprise history. It outpaced the Zacks Consensus Estimate in each of the trailing four quarters, delivering an average positive earnings surprise of 19.52%.

Estimates Northbound: Estimates for Deere have moved up in the past 30 days, reflecting analysts’ confidence in the stock. The Zacks Consensus Estimate has climbed nearly 14% to $7.94 and 20% to $9.52 for fiscal 2018 and 2019, respectively, during this period.

Superior Return on Equity (ROE): Deere’s ROE of 26.3%, as compared with the industry average of 23.9%, highlights the company’s efficiency in utilizing shareholders’ funds.

Attractive Valuation: Going by the price earnings (P/E) multiple, Deere is currently trading at a trailing 12-month P/E multiple of 22.7x — lower than the industry average of 26.1x.

Growth Drivers in Place: Deere recently posted strong fourth-quarter fiscal 2017 results and provided an upbeat outlook for fiscal 2018. The company’s earnings in the reported quarter surged around 74% year over year. Also, net sales of equipment operations climbed 26% from the prior-year period.

For fiscal 2018, Deere estimates total equipment sales to be up about 22% and net sales to rise around 19% from fiscal 2017. Segment wise, Agriculture and Turf is projected to witness 9% increase in sales. Sales for the Construction & Forestry segment are projected to soar roughly 69%.

Notably, Deere’s recent acquisition of Germany-based Wirtgen — the world’s leading road-construction equipment maker — also remains a tailwind. The buyout will help Deere expand its North America-centric construction business and make it an industry leader in road construction. The acquisition is anticipated to boost earnings immediately.

We remain optimistic about Deere’s solid order activity, improving conditions in the dairy and livestock sectors, as well as its encouraging harvest outlook. Additionally, higher housing starts in the United States and an improving oil and gas sector are expected to fuel the company’s growth.

Other Stocks to Consider

Some other similarly-ranked stocks in the sector include Atlas Copco AB (OTC:ATLKY) , Caterpillar Inc. (NYSE:CAT) and Chart Industries, Inc. (NASDAQ:GTLS) . You can see the complete list of today’s Zacks #1 Rank stocks here.

Atlas Copco has a long-term earnings growth rate of 12.5%. Its shares have rallied 36.1%, year to date.

Caterpillar has a long-term earnings growth rate of 10.3%. The stock has appreciated 58.2% in the year so far.

Chart Industries has a long-term earnings growth rate of 20%. So far this year, the stock has gained 26.2%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Caterpillar, Inc. (CAT): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

Atlas Copco AB (ATLKY): Free Stock Analysis Report

Chart Industries, Inc. (GTLS): Free Stock Analysis Report

Original post

Related Articles

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Nvidia is scheduled to release its Q4 earnings report at 4:20PM ET on Wednesday. A call with CEO Jensen Huang is set for 5:00PM ET. The chipmaker’s results will serve as a...

Warren Buffett has always critiqued airline stocks for being overly capital-intensive, exhibiting low growth, and relying heavily on cyclical consumer travel patterns—further...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.