- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Here's Why You Should Add Cosan (CZZ) To Your Portfolio

We believe that Cosan Limited (NYSE:CZZ) is a solid choice for investors seeking exposure in the agriculture space. The company’s strengthening foothold in the sugar and ethanol business, initiatives to enhance productivity and efficiency and strengthening of distribution network bode well.

The stock has been upgraded to a Zacks Rank #1 (Strong Buy) on Nov 11.

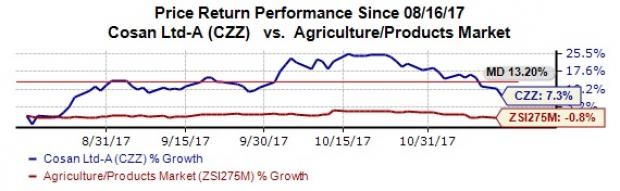

In the last three months, the American Depository Receipts of this agriculture products company have yielded 7.3% return, outperforming 0.8% decline recorded by the industry.

Why the Upgrade?

Cosan performed well in third-quarter 2017, marking this as the second consecutive quarter of quarterly profits. Adjusted net income increased remarkably from the year-ago tally on the back of revenue growth and a fall in financial expenses. Fuel volumes sold in the quarter jumped 4.2% year over year on the back of growth in gasoline and diesel volumes sold. Sugar volume sold grew 16.7% and ethanol volume sold increased 27.3% year over year.

For the Raizen Energia segment, Cosan anticipates volume of sugarcane crushed to be within 59-63 million tons for the crop year April 2017-March 2018. Volume of energy sold is expected to be within 2.2-2.4 million MWh, up from the previous expectation of 2-2.2 million MWh. Also, for the Comgas segment, the company anticipates volume of gas sold to fall within 4.3-4.4 million cbm, above the previous projection of 4-4.3 million cbm for 2017.

In the quarters ahead, we believe that Cosan’s initiatives to improve its production capabilities and services will enable it to capitalize on the growing sugar and ethanol demand. The Comgas business will gain from recovery in industrial activity in the country, increasing industrial applications of natural gas and expansion in networks. Moove will benefit from its customer base in Brazil while will expand internationally to tap business opportunities. Rumo will gain from investments to strengthen its rail yards, terminals and rail lines as well as from its cost reduction efforts.

Cosan’s Raizen business will likely gain from its network of Shell (LON:RDSa) branded service stations, roughly 6,138 at the end of the third quarter. Also, Raizen’s efforts to enhance distribution network, improve efficiency and selective positioning of logistics will aid growth.

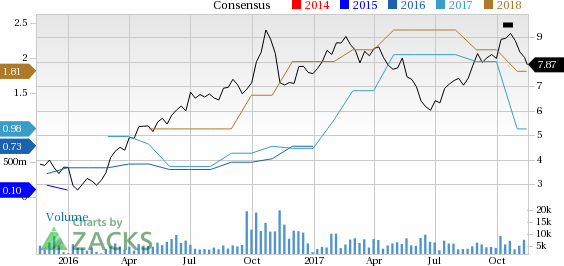

The stocks’ earnings estimates for 2017 and 2018 have been revised upward in the last 30 days. Currently, the Zacks Consensus Estimate stands at 98 cents for 2017 and $1.81 for 2018, up from their estimates 30 days ago of 31 cents and 54 cents, respectively.

Cosan Limited Price and Consensus

Kraton Corporation (KRA): Free Stock Analysis Report

Internationa Flavors & Fragrances, Inc. (IFF): Free Stock Analysis Report

Cosan Limited (CZZ): Free Stock Analysis Report

Monsanto Company (MON): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Defense stocks took a tumble heading into 2025 as President Trump returned to the White House for his second term. Trump has stated his intent as a peacemaker to bring the wars in...

Using the Elliott Wave Principle (EWP), we have been tracking the most likely path forward for the Nasdaq 100 (NDX). Although there are many ways to navigate the markets and to...

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.