- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Here's Why Should You Hold On To Woodward (WWD) Stock Now

Woodward, Inc. (NASDAQ:WWD) has a strong foothold in the defense market. With rising geo-political uncertainty across the world, Woodward’s involvement in a variety of defense programs in fixed-wing aircraft, rotorcraft and weapons systems has provided relative stability for its defense market sales.

Recently, the U.S. Senate has approved the fiscal 2018 defense policy, which in turn has authorized the United States to spend $700 billion on defense. May be this, along with strong demand for its products, has induced Woodward’s management to expect modest production rate increases, for its weapons programs in fiscal 2018. This in turn is likely to boost the company’s defense business.

Woodward’s commercial aftermarket business has been witnessing strong growth, following the selection of the company’s products for new aerospace platforms. Notably, consistent growth in global air traffic has boosted the commercial aerospace markets in fiscal 2017. As aircraft operators continue to replace their older fleet of jets with new models that are more fuel efficient, solid order backlogs for the new aircraft models are expected toboost Woodward’s production.

Coming to its earnings performance, Woodward delivered positive earnings surprise in three of the last four quarters, with an average beat of 14.41%. Notably, the company’s Zacks Consensus Estimate for fiscal 2018 earnings per share is $3.44, reflecting an annual improvement of 8.8%, on the back of 5.8% revenue growth.

However, Woodward’s defense aftermarket business suffered in fiscal 2017. Nevertheless, considering the fact that the current U.S. government is in favour of increasing expenditure on the nation’s defense, this business of Woodward can be expected to recover in days ahead.

On the flip side, the company’s Industrial business continues to perform weakly as is evident from the declining segment sales in the fiscal fourth quarter. The decline is attributable to lower sales delivered by industrial gas turbines and renewable power businesses.

Moreover, further deterioration of the natural gas truck market in China and continued weakness in reciprocating engine power generation and other OEM large capital equipment projects has been hampering Woodward’s results.

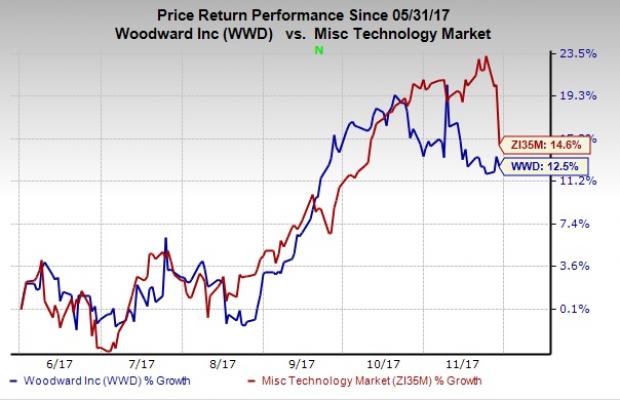

These may have rendered a negative impact on Woodward’s price performance. The company’s shares have returned 12.5% in the last six months compared with the industry’s rally of 14.6%.

Zacks Rank & Key Picks

Woodward presently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the space are Allied Motion Technologies, Inc. (NASDAQ:AMOT) and Thermon Group Holdings, Inc. (NYSE:THR) . While Allied Motion sports a Zacks Rank #1 (Strong Buy), Thermon Group carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Another stock, Watts Water Technologies, Inc. (NYSE:WTS) in this space carries the same Zacks Rank as Woodward.

Allied Motion delivered a positive earnings surprise of 22.2% in the third quarter. Itcurrently has a solid long-term earnings growth rate of 16%.

Thermon Group delivered a positive earnings surprise of 25% in the last quarter. Its Zacks Consensus Estimate for fiscal 2018 has improved by 5 cents in the last 60 days.

Watts Water delivered a positive earnings surprise of 2.56% in the third quarter. It currently hasa solid long-term earnings growth rate of 12%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Woodward, Inc. (WWD): Free Stock Analysis Report

Thermon Group Holdings, Inc. (THR): Free Stock Analysis Report

Watts Water Technologies, Inc. (WTS): Free Stock Analysis Report

Allied Motion Technologies, Inc. (AMOT): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

With 2 full months of the year completed, the S&P 500 (SPY) is up +1.38% while the Barclay’s Aggregate is +2.76% YTD, leaving a 60% / 40% balanced portfolio up +1.93% YTD as...

• Trump’s trade war, U.S. jobs report, and last batch of Q4 earnings will be in focus this week. • Costco's earnings report is seen as a potential catalyst for growth, making it a...

The market has taken a turn this past month, with volatility picking up and key technical indicators signaling caution. The S&P 500, which had been trading within a...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.