- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Here's Why It Is Worth Investing In Regal Beloit (RBC) Now

Regal Beloit Corporation (NYSE:RBC) can currently be considered a smart choice for investors seeking exposure in the manufacturing space. It boasts solid growth prospects on restructuring measures, impressive liquidity and shareholder-friendly policies.

The Beloit, WI-based company belongs to the Zacks Manufacturing – Electronics industry, which belongs to the broader Zacks Industrial Products sector. The company’s earnings are predicted to rise 10% in the next five years. It currently has a Zacks Rank #2 (Buy) and a VGM Score of A.

In the past three months, the company’s shares have dipped 2.8% compared with the industry’s decline of 6.8%. Despite the weak price performance, the stock is worth investing in. Let’s delve on the factors backing the stock’s investment appeal.

Healthy Projections: For 2020, Regal Beloit anticipates benefiting from its initiatives (discussed below), solid product offerings and effective services.

It anticipates adjusted earnings per share of $5.65-$6.05 for 2020, suggesting growth of 6.6% (at the mid-point) from the previous year’s reported figure. Also, 80/20 measure followed by the company will likely be advantageous.

Initiatives: Regal Beloit’s decentralization efforts are likely to bring in a radical change in its operations. It anticipates the efforts to simplify decision-making process, talent development easier, boost the speed of execution and improve operational efficiency.

In addition, the company’s business reorganization last December is expected to boost focus, transparency and accountability mainly for Industrial Systems and Commercial Systems segments. Regal Beloit shifted to reporting results under four segments — Industrial Systems, Climate Solutions, Power Transmission Solutions and Commercial Systems. Notably, the company earlier reported results under three segments.

Further, it anticipates benefits from footprint consolidation and simplification programs. Annual savings of $38 million are expected from the company’s restructuring measures.

Rewards to Shareholders: Regal Beloit is committed toward rewarding shareholders handsomely through dividend payments and share buybacks. In fourth-quarter 2019, the company’s dividend payout amounted to $12.3 million and shares worth $15 million were repurchased.

It is worth mentioning here that Regal Beloit announced a 7% increase in its quarterly dividend rate in April 2019. Also, a $250-million buyback program was announced in October 2019.

We believe that healthy cash flow position will help Regal Beloit in rewarding shareholders going forward.

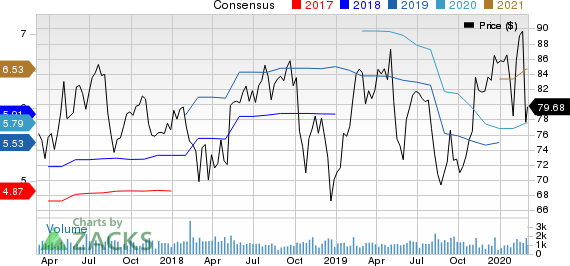

Trend in Earnings Estimates: In the past 30 days, the company’s earnings estimates have shown an upward trend, with 3 positive revisions recorded for 2020 and one for 2021. There was no downward revision for the years in the same time frame.

Notably, the Zacks Consensus Estimate for earnings per share was pegged at $5.79 for 2020 and $6.53 for 2021, reflecting growth of 1.2% and 2.2% from the respective 30-day-ago figures. Also, estimates suggest year-over-year growth of 5.5% for 2020 and 12.6% in 2021.

Regal Beloit Corporation Price and Consensus

Emerson Electric Co. (EMR): Free Stock Analysis Report

Regal Beloit Corporation (RBC): Free Stock Analysis Report

Graco Inc. (GGG): Free Stock Analysis Report

Tennant Company (TNC): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.