- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Here's Why It Is Wise To Hold On To GOL Linhas (GOL) For Now

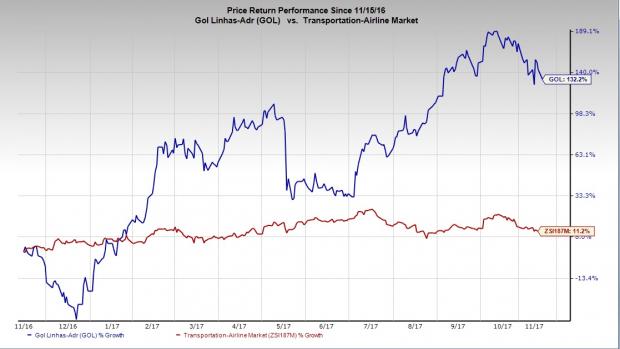

Shares of GOL Linhas Aereas Inteligentes S.A. (NYSE:GOL) ) have surged more than 100% in a year, outperforming the industry’s gain of 11.2%.

The carrier recently increased guidance for 2017 owing to the impressive third-quarter earnings numbers and the robust traffic figures till September. The airline’s improved operating and financial performance plus focus on capacity discipline were among other factors responsible for its revised outlook.

The company now expects earnings before interest and taxes (EBIT) margin — a measure for its earnings ability — around 9% (previous guidance had projected the metric between 7% and 9%). The guidance for EBITDA margin stands at approximately 14% (previous guidance had projected the metric between 12% and 14%). The carrier expects capacity (available seat kilometers) to be nearly 0.5% (previous guidance had projected the metric to either remain flat or decline at the most 2% on a year-over-year basis).

Another important metric, load factor (percentage of seats filled by passengers), is now projected to be around 79% (previous forecast had the metric in the range of 77-79%). Going forward, we expect the company’s focus on capacity discipline to result in increasing yields.

The carrier’s outperformance in the third quarter is very encouraging. Earnings per share of $1.49 outpaced the Zacks Consensus Estimate of 47 cents, aided by higher revenues. Net sales came in at $858.8 million (R$2.7 billion), surpassing the Zacks Consensus Estimate of $783.3 million. The top line expanded 13.2% on the back of a strong demand for air travel. Passenger revenues accounting for the bulk of the top line increased 14.1% year over year.

The carrier’s October traffic figures also raise optimism in the stock. Load factor in the month rose to 80.6% from 76% in October 2016. The metric improved as traffic growth exceeded capacity expansion.

The steps taken by the carrier to overcome its struggles also hold promise. The carrier has been undergoing a thorough restructuring process and is also making constant efforts to reduce debt levels. This should bode well for its strong revival in the near term.

In light of these positives, we believe investors should retain GOL Linhas stock for now.

Zacks Rank & Key Picks

GOL Linhas carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader Transportation sector are International Consolidated Airlines Group (LON:ICAG) SA (OTC:ICAGY) , Deutsche Lufthansa (DE:LHAG) AG (OTC:DLAKY) and C.H. Robinson Worldwide, Inc. (NASDAQ:CHRW) . While International Consolidated Airlines sports a Zacks Rank #1 (Strong Buy), Deutsche Lufthansa and C.H. Robinson carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares ofInternational Consolidated Airlines, Deutsche Lufthansa and C.H. Robinson have gained more than 34%, 100% and 8%, respectively, in a year.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Gol Linhas Aereas Inteligentes S.A. (GOL): Free Stock Analysis Report

Deutsche Lufthansa AG (DLAKY): Free Stock Analysis Report

International Consolidated Airlines Group SA (ICAGY): Free Stock Analysis Report

C.H. Robinson Worldwide, Inc. (CHRW): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Palantir Technologies (NASDAQ:PLTR) continues to sell off. On March 6, PLTR stock fell over 10% on nearly double the daily volume, bringing its 30-day decline to over 27%. A drop...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.