- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Here's Why First Horizon (FHN) Stock Is Worth Betting On Now

From the vast universe of banking stocks, today we pick First Horizon National Corporation (NYSE:FHN) for you. The company offers a profitable investment opportunity based on inorganic growth expansion and robust fundamentals.

The company has been witnessing upward estimate revisions, reflecting analysts’ optimism about its earnings growth potential. Over the past 60 days, the Zacks Consensus Estimate for 2020 has displayed an upward trend.

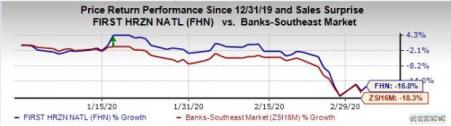

However, this Zacks Rank #2 (Buy) stock has depreciated around 16%, in the last six months, compared with the industry’s decline of 18.3%.

Why is First Horizon a Golden Egg?

Earnings Strength: First Horizon recorded an earnings growth rate of 16.2% over the last three to five years. Retaining the earnings momentum, the long-term earnings growth rate is anticipated to be 8.13%. Good news is that the company generated an average positive earnings surprise of 6.95%, over the trailing four quarters.

Revenue Strength: Organic growth remains a key strength at First Horizon, as suggested by its decent loan growth. First Horizon witnessed continued loan growth on increase in commercial and consumer loans with a compound annual growth rate (CAGR) of 15.1% in the last five years (2015-2019) with some annual volatility. Further, deposits witnessed a CAGR of 14.7% during the same time period.

The company’s projected sales growth (F1/F0) of 36.7% indicates constant upward momentum in revenues.

Strategic Moves: First Horizon has executed several strategic repositioning efforts to improve the company’s long-term profitability after being affected by its exposure to national mortgage and construction lending, and focused on growing its core Tennessee banking franchise. Also, the company was involved in a number of acquisitions, which diversified its product offerings, and strengthened footprint in the Carolina and Florida markets.

Superior Return on Equity (ROE): First Horizon’s ROE of 10.94%, compared with the industry’s 9.75% average, highlights the company’s commendable position over its peers.

Stock Looks Undervalued: The stock currently has a Value Score of B. The Value Score condenses all valuation metrics into one actionable score that helps investors steer clear of “value traps” and identify stocks that are truly trading at a discount. Our research shows that stocks with a Style Score of A or B, when combined with a Zacks Rank #1 (Strong Buy) or 2, offer the best upside potential.

Strong Leverage: First Horizon’s debt/equity ratio is 0.16 compared with the industry average of 0.22, displaying low debt burden relatively. It highlights the company’s financial stability even in an unstable economic environment.

Other Stocks to Consider

Farmers National Banc Corp. (NASDAQ:FMNB) has been witnessing upward estimate revisions for the past 60 days. Moreover, this Zacks #1 Ranked stock has rallied more than 12% in the last six months. You can see the complete list of today’s Zacks #1 Rank stocks here.

MidWestOne Financial Group, Inc. (NASDAQ:MOFG) has been witnessing upward estimate revisions for the past 60 days. Further, the company’s shares have gained 3.4% in six months’ time. At present, it carries a Zacks Rank of 2.

First Business Financial Services, Inc. (NASDAQ:FBIZ) has been witnessing upward estimate revisions for the past 60 days. Additionally, the stock has jumped 8.8% in the last six months. It currently holds a Zacks Rank #2.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our latest Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

See 5 Stocks Set to Double>>

First Business Financial Services, Inc. (FBIZ): Free Stock Analysis Report

First Horizon National Corporation (FHN): Free Stock Analysis Report

MidWestOne Financial Group, Inc. (MOFG): Free Stock Analysis Report

Farmers National Banc Corp. (FMNB): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Defense stocks took a tumble heading into 2025 as President Trump returned to the White House for his second term. Trump has stated his intent as a peacemaker to bring the wars in...

Using the Elliott Wave Principle (EWP), we have been tracking the most likely path forward for the Nasdaq 100 (NDX). Although there are many ways to navigate the markets and to...

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.