- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Here's Why Enova International (ENVA) Stock Is A Must Buy

Amid coronavirus pandemic, it seems to be a wise idea to add Enova International Inc. (NYSE:ENVA) to your portfolio. The company — which has strong fundamentals and promising prospects — will see a rise in loan demand, given near-zero interest rates. Solid loan and finance receivable balances will likely continue enhancing the company’s profitability.

The stock has been witnessing upward estimate revisions, reflecting analysts’ optimism about its earnings growth potential. Over the past 60 days, the Zacks Consensus Estimate for 2020 earnings has moved 7.9% upward.

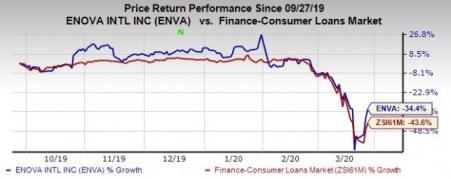

The Zacks Rank #1 (Strong Buy) stock has lost 34.4% over the past six months compared with the industry’s fall of 43.6%.

Factors Favoring Enova International

Revenue growth: Revenue growth remains a key strength for Enova International. The top line witnessed a five-year CAGR of 15.8% (2015-2019), driven by solid loan and finance receivable balances. Also, its projected sales growth rate of 15.3% for 2020 and 11.5% for 2021 indicates continuation of the momentum.

Earnings strength: Over the past three to five years, Enova International’s earnings have increased 14.7%, outperforming the industry average of 12.4%. The uptrend is anticipated to continue as the company’s earnings are projected to be up 13.7% and 13.2% for 2020 and 2021, respectively.

Enova International has an impressive earnings surprise history. Its earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters, with the average positive surprise being 11.6%.

The company has a Growth Score of A. Our research shows that stocks with the combination of a Style Score of A or B and a Zacks Rank #1 or 2 (Buy) offer the best upside potential.

Superior Return on Equity (ROE): Enova International’s ROE of 29.98% compares favorably with the industry average of 16.68%. This highlights the company’s commendable position over its peers in using shareholders’ funds.

Stock Seems undervalued: Enova International looks undervalued, with respect to price/earnings (P/E) (F1) and price/sales (P/S) ratios. It has a P/E (F1) ratio of 2.74, which is below the industry average of 3.76. Also, its P/S ratio of 0.33 is lower than the industry average of 0.69.

Additionally, the stock has a Value Score of A. The Value Score condenses all valuation metrics into one actionable score that helps investors steer clear of “value traps” and identify stocks that are truly trading at a discount.

Other Key Picks

Navient Corporation (NASDAQ:NAVI) has witnessed 4.4% upward earnings estimate revision for 2020 over the past 60 days. Nonetheless, the Zacks Rank #2 stock has lost 38.8% over the past six months.

SLM Corporation’s (NASDAQ:SLM) earnings estimates for the current year have moved 11.9% north in the past 60 days. The stock has lost 21.1% over the past six months. It currently sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Encore Capital Group, Inc (NASDAQ:ECPG) has witnessed upward earnings estimate revision of 3.7% for 2020 in the past 60 days. This Zacks #2 Ranked stock has declined 17.9% over the past six months.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.5% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

SLM Corporation (SLM): Free Stock Analysis Report

Encore Capital Group Inc (ECPG): Free Stock Analysis Report

Navient Corporation (NAVI): Free Stock Analysis Report

Enova International, Inc. (ENVA): Free Stock Analysis Report

Original post

Related Articles

When a company is at the top of its industry, it is often afforded benefits that smaller players are not. Industry leaders often have key traits like economies of scale, top...

Often as dividend investors we buy stocks that provide us with income now. We take the current yield and happily collect the monthly or quarterly payout. Sometimes, though, it is...

At the end of February, Lululemon (NASDAQ:LULU), DoorDash (NASDAQ:DASH), and Ulta Beauty (NASDAQ:ULTA) were among the Most Upgraded Stocks tracked by MarketBeat. Investors should...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.