- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Here's How Five Below (FIVE) Looks Just Ahead Of Q4 Earnings

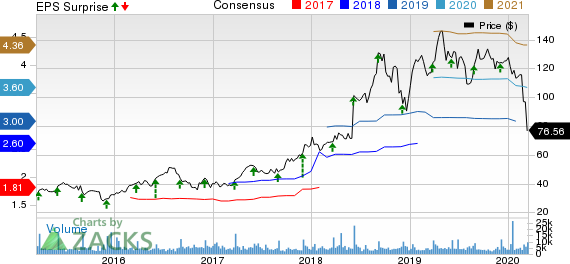

Five Below, Inc. (NASDAQ:FIVE) is scheduled to report fourth-quarter fiscal 2019 results on March 18, after the closing bell. This specialty value retailer has a trailing four-quarter positive earnings surprise of 1.6%, on average. In the last reported quarter, the company reported positive earnings surprise of 5.9%.

After registering a bottom-line decline of about 25% in the third quarter, Five Below is likely to witness year-over-year increase in the fourth quarter. Notably, the Zacks Consensus Estimate for the quarter under review is pegged at $1.94, which indicates a sharp growth of 22.8% from the year-ago quarter’s figure.

The Zacks Consensus Estimate for revenues stands at $687.2 million, which suggests an improvement of approximately 14% from the year-ago quarter. We note that total revenues of this Philadelphia, PA-based company had increased 20.7% in the last reported quarter.

Key Factors

Five Below’s holiday sales results for the period from Nov 3, 2019 through Jan 4, 2020 came below management’s expectations. Six fewer shopping days between Thanksgiving and Christmas hurt comparable sales performance. Although net sales during the period grew 13.4%, comparable sales fell 2.6%. Based on the results, the company trimmed its view for the fourth quarter, which coincides with the holiday season.

For the final quarter, management anticipates net sales between $685 million and $688 million and comparable sales decrease of 2-2.5%. Five Below guided earnings between $1.93 and $1.96 per share. The company’s prior estimate showed net sales between $717 million and $732 million and earnings in the range of $1.97-$2.05 per share. The company had previously expected comparable sales increase of 2-3%.

Despite shortfall in sales during the festive period, management believes that the company remains on track to meet gross margin expectations on the back of effective inventory management and cost containment efforts. Management had earlier projected expansion in operating margin on account of improved merchandise margin on toy product, slight leverage from the new distribution center, and the benefit of tariff mitigation efforts including cut in corporate expenses.

Certainly, the company’s commitment toward enhancing customer experience via refresh store format, remodel program and Ten Below test is commendable. Moreover, it has been focusing on enhancing merchandise assortment, improving supply chain, strengthening digital capabilities, delivering better WOW products and reimagined front-end. These are likely to have contributed to the company’s overall fourth-quarter performance.

What the Zacks Model Predicts

Our proven model predicts an earnings beat for Five Below this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Five Below has a Zacks Rank #3 and an Earnings ESP of +0.32%.

3 More Stocks With Favorable Combination

Here are some other companies you may want to consider as our model shows that these too have the right combination of elements to post an earnings beat:

Children's Place (NASDAQ:PLCE) has an Earnings ESP of +1.16% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Fastenal Company (NASDAQ:FAST) has an Earnings ESP of +1.07% and a Zacks Rank #3.

KB Home (NYSE:KBH) has an Earnings ESP of +0.39% and a Zacks Rank #3.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Fastenal Company (FAST): Free Stock Analysis Report

KB Home (KBH): Free Stock Analysis Report

Five Below, Inc. (FIVE): Free Stock Analysis Report

The Children's Place, Inc. (PLCE): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

• Trump’s trade war, U.S. jobs report, and last batch of Q4 earnings will be in focus this week. • Costco's earnings report is seen as a potential catalyst for growth, making it a...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.