- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Here Are Factors Influencing Target's (TGT) Upcoming Q3 Earnings

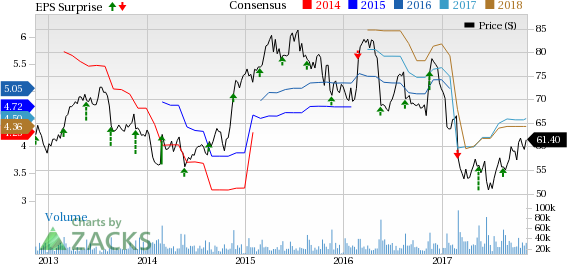

Target Corp. (NYSE:TGT) is scheduled to release third-quarter fiscal 2017 results on Nov 15. Well, the obvious question that comes to mind is will this operator of general merchandise stores be able to deliver positive earnings surprise in the quarter to be reported.

In the trailing four quarters, the company outperformed the Zacks Consensus Estimate by an average of 15.1%.

The Zacks Consensus Estimate for the third quarter is pegged at 85 cents down from $1.04 reported in the year-ago period. Analysts polled by Zacks expect revenues of $16,521 million compared with $16,441 million in the prior-year quarter. Target envisions third-quarter earnings in the band of 75-95 cents a share.

Factors at Play

Target’s initiatives such as the development of omni-channel capacities, diversification and localization of assortments along with emphasis on flexible format stores are encouraging. Additionally, the company intends to deploy resources to significantly develop online platform as well as store facilities to make shopping more convenient for customers.

In a bid to stimulate its digital sales this holiday season, Target is also strengthening its relationship with Google (NASDAQ:GOOGL) by allowing customers nationwide to shop through Google Express including voice-activated shopping. We observed that comparable digital channel sales surged 32% during the second quarter of fiscal 2017 and added 1.1 percentage points to comparable sales.

Meanwhile, Target plans to expand merchandise assortments with special emphasis on Style, Baby, Kids and Wellness categories that are performing well. Also, the company has adopted a cost reduction strategy including rationalization of supply chain, technology and process improvements.

The company also rolled out Target Restock program that allows customers to restock their shipping box with essential items online and get them delivered at door steps by the next business day for a nominal charge. These endeavors are of vital importance with regard to sales and margins, which might be affected by adverse retail conditions like increasing online penetration and aggressive pricing.

What Does the Zacks Model Suggest?

Our proven model does not conclusively show that Target is likely to beat earnings estimates this quarter. This is because a stock needs to have both — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Target carries a Zacks Rank #2 but an Earnings ESP of -1.60%, thus making surprise prediction difficult.

Stocks With Favorable Combination

Here are three companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Burlington Stores, Inc. (NYSE:BURL) has an Earnings ESP of +1.27% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Home Depot, Inc. (NYSE:HD) has an Earnings ESP of +0.57% and a Zacks Rank #2.

Wal-Mart Stores, Inc. (NYSE:WMT) has an Earnings ESP of +0.96% and a Zacks Rank #3.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Home Depot, Inc. (The) (HD): Free Stock Analysis Report

Wal-Mart Stores, Inc. (WMT): Free Stock Analysis Report

Target Corporation (TGT): Free Stock Analysis Report

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.