- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Hello Treasury Bears: About That 3.0% Treasury Yield Line In The Sand

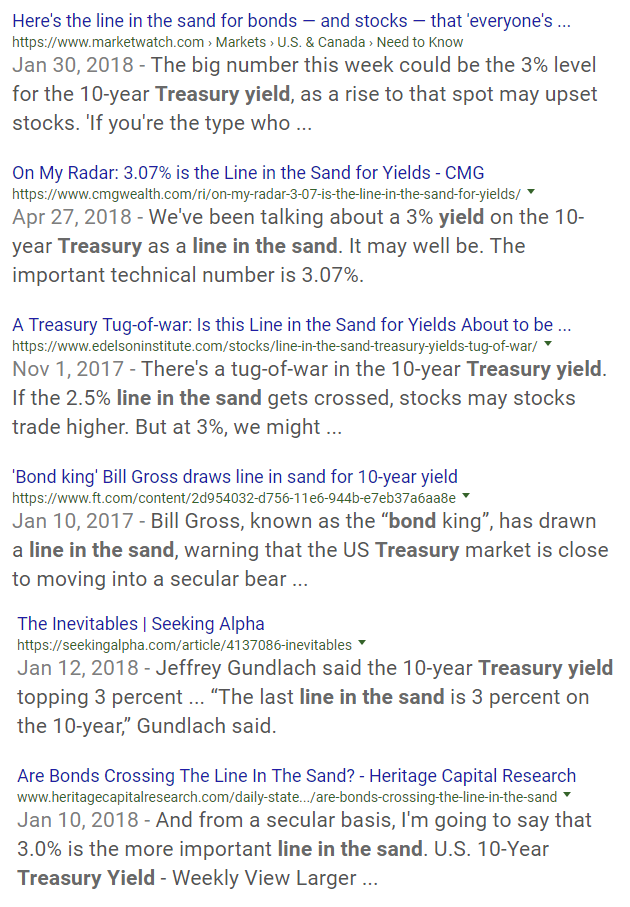

According to numerous treasury bears, yields would soar out of control once the 3.0% threshold broke. Well?

Here are some amusing predictions.

No Such Thing As Lines in the Sand

Note to Bill Gross, MarketWatch, the Edelson Institute, the Financial Times, Jeffrey Gundlach, Heritage Capital, and numerous other forecasters not caught up in that precise search: The is no such thing such as a line in the sand that when breached cannot be crossed back.

Technical lines in the sand are one thing and fundamentals another. This is not like nuclear war which cannot be reversed.

The same people have been calling for the the end of the bond bull market for a decade. Perhaps they have it right, but the fundamentals suggest otherwise.

The economy is slowing and the Fed is hiking. The stock market is likely headed for another bust. There is a new worry in Europe. China is slowing.

Yes, we have late stage inflation, but so what?

There is no magic line in the sand. Neither the economy nor the bond market work that way.

Related Articles

- Reflections on Late-Stage Inflation

- Economic Recovery in Italy: NY Times vs. Alhambra Investments' Zombification

- Rate Hike Expectations Dive On Housing Data

- Grave Consequences: Italy Bond Yields Soar, Protests Called, Euro Referendum

Treasury bears, please not that asset bubble burstings are inherently deflationary. If you think an asset bubble burst is likely, then you should believe that treasury yields will sink.

Of course, if you think the economy is on the verge of overheating, be my guest, short treasuries.

Related Articles

When it comes to the economy, we’re in a bit of a weird spot: The data tells us that, despite inflation fears, interest rates are likely to fall in the year ahead. Falling rates...

Telegram Group Inc. is a globally recognized messaging service company, offering a cloud-based mobile and desktop messaging application. Known for its strong focus on security,...

Many investors regard passively managed index mutual funds or ETFs as favorable options for stock investing. However, they may also find that actively managed funds offer...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.