- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Hain Celestial (HAIN) Meets Q1 Earnings, Sales Top Estimates

The Hain Celestial Group, Inc. (NASDAQ:HAIN) commenced the first quarter of fiscal 2018 on a mixed note. The quarterly earnings came in line with the Zacks Consensus Estimate, while revenues surpassed the same.

The company reported adjusted earnings per share of 23 cents that met the consensus mark and increased 64.3% year over year. Moreover, on a GAAP basis earnings increased to 19 cents from 8 cents reported in the prior-year quarter.

Net sales increased 4% year over year to $708.3 million and also beat the Zacks Consensus Estimate of $698 million. Rise in sales were driven by double-digit growth in Canada and Europe. It was also aided by low-single digit growth in the United States, UK and Hain Pure Protein segments. The company’s sales increased 4% on a constant currency basis.

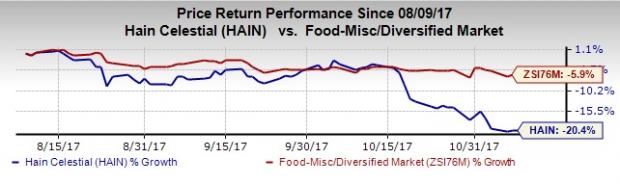

Following the results, not much movement was witnessed in after-hour trading session yesterday. However, the company’s shares have tanked 20.4% in the past three months, wider than the industry’s dip of 5.9%.

Segment Performance

In the reported quarter, net sales at U.S. segment rose 4% year over year to $263.7 million. Net sales in U.K. inched up 1% to $222.4 million. Further, operations in the Rest of World segment witnessed a 14% increase in net sales to $103.1 million, while Hain Pure Protein Corporation (HPPC), acquired in July 2014, observed a gain of 2% in net sales amounting to roughly $199.1 million.

The company continues to focus on 500 SKUs as well as top 11 brands to drive growth. These brands include Terra, Celestial Seasonings, Dream, Earth’s Best, MaraNatha, Imagine, Garden of Eatin', The Greek Gods, Sensible Portions and Spectrum, along with Alba Botanica.

Gross profits were up 19.8% year over year to $131.6 million. Adjusted operating income surged 46% to $39.7 million, while adjusted operating margin expanded 160 basis points to 5.6%.

Other Financials

The company ended the quarter with cash and cash equivalents of $126.8 million, long-term debt (excluding current maturities) of nearly $746.4 million, and shareholders’ equity of $1,767.5 million. Cash flow from operating activities was negative $19.4 million, compared with the prior-year quarter figure of positive $12.8 million, while capital expenditures were roughly $14.9 million. The company generated operating free cash flow of negative $34.4 during the quarter, compared with negative free cash flow of $1.7 million in the first quarter fiscal 2017.

The Hain Celestial Group, Inc. Price, Consensus and EPS Surprise

Guidance

The company reiterated fiscal 2018 guidance. For fiscal 2018, the company continues to expect net sales between $2.967 billion and $3.036 billion, representing growth of 4-6% on a year-over-year basis. Growth in the United States and HPP are projected to be in the range of low to mid-single digit. Meanwhile, U.K. and the Rest of World segment are projected to witness growth of low to mid-single-digit, compared with prior estimate of mid to high-single digits. Profits in fiscal 2018 are anticipated to be robust with adjusted EBITDA ranging between $350 million and $375 million, up nearly 27% to 36% year over year. Cash flow from operation is anticipated in the range of $235-$270 million, while capital expenditure is projected to be $75 million. The company projects adjusted earnings per share to be in the range of $1.63 to $1.80, up nearly 34-48% from fiscal year 2017.

Strategic Initiatives

During the fourth quarter of fiscal 2017, the company completed two strategic acquisitions. Hain Celestial revealed that one of its wholly-owned subsidiaries acquired England based, The Yorkshire Provender Limited. Founded in 2007, Yorkshire Provender prepares superior soup brands, with its products being sold to major retailers, on-the-go food joints and other food service providers in UK. Hain Celestial is likely to benefit from this deal, as it will enhance its soup offerings, alongside leading to infrastructural growth. Moreover, Hain Celestial Group also acquired Portland, OR, based firm, The Better Bean Company.

The company, which began a strategic review under Project Terra in fiscal 2016, anticipates to generate worldwide cost savings worth $350 million through fiscal 2020 (comprises annual productivity). To achieve the savings, the company intends to optimize plants, co-packers and procurement, along with rationalizing product portfolio. Further, it plans on reinvesting the additional savings through brand development and household penetration.

Previously the company had announced that in an attempt to augment sales and margin growth, it plans to create five strategic platforms in U.S. segment, including Fresh Living, Better-for-You Baby, Better-for-You Snacking, Better-for-You Pantry and Pure Personal Care.

Zacks Rank & Other Stocks to Consider

Hain Celestial currently carries a Zacks Rank #2 (Buy). Other top-ranked stocks which warrant a look in the same sector include B&G Foods, Inc. (NYSE:BGS) , McCormick & Company, Incorporated (NYSE:MKC) and Lamb Weston Holdings, Inc. (NYSE:LW) . All these stocks carry the same rank as Hain Celestial. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

B&G Foods has reported better-than-expected earnings in the trailing two quarters, out of three quarters.

McCormick & Company has an impressive long-term earnings growth rate of 9.4%.

Lamb Weston Holdings earnings have surpassed the Zacks Consensus Estimate in the trailing four quarters, with an average beat of 11%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

The Hain Celestial Group, Inc. (HAIN): Free Stock Analysis Report

B&G Foods, Inc. (BGS): Free Stock Analysis Report

McCormick & Company, Incorporated (MKC): Free Stock Analysis Report

Lamb Weston Holdings Inc. (LW): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Professional traders get paid because of one skill and one skill only: the ability to foresee what the world (or the economy, at least) might look like in six to nine months....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.