- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Haemonetics (HAE) At 52-Week High: What's Driving The Stock?

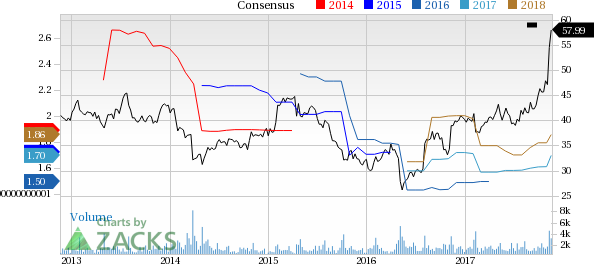

Shares of Haemonetics Corporation (NYSE:HAE) scaled a new 52-week high of $58.02 on Nov 17, closing nominally lower at $57.99. The company has gained 43.9% in the last six months, much higher than the S&P 500’s gain of 7.8%. Haemonetics has also beat the broader industry’s gain of 7.3%. The stock has a market cap of $3.06 billion.

Further, Haemonetics’ estimate revision trend for the current year is favorable. In the past 30 days, five estimates moved up with no movement in the opposite direction. Consequently, estimates were up from $1.61 per share to $1.70.

The company also has a trailing four-quarter average positive earnings surprise of 9.1%. Its long-term growth of 7.8% holds promise as well.

Growth Drivers

The market is upbeat about Haemonetics’ impressive second-quarter performance, with year-over-year growth in earnings and revenues. Continued expansion in newer geographies has helped the company deliver strong results in the recent past. Meanwhile, a strong cash position boosts investors’ confidence. Further, the raised fiscal 2018 adjusted earnings guidance is encouraging.

The company is now focusing on the development and launch of NexSys PCS plasmapheresis system. Management is optimistic about strong market adoption of its NexSys PCS plasmapheresis system. Notably, the NexSys PCS plasmapheresis device recently received FDA approval. The company has also planned a limited market release of the device this winter. Also, the company plans a second and more advanced limited market release wherein some enhancements will be introduced.

All these factors are expected to boost the company’s share price.

Zacks Rank & Key Picks

Haemonetics carries a Zacks Rank #3 (Hold).

A few better-ranked medical stocks are PetMed Express, Inc. (NASDAQ:PETS) , Align Technology, Inc. (NASDAQ:ALGN) and Myriad Genetics, Inc. (NASDAQ:MYGN) . Notably, PetMed, Align Technology and Myriad Genetics sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

PetMed has a long-term expected earnings growth rate of 10%. The stock has rallied roughly 76.6% in a year.

Align Technology has a long-term expected earnings growth rate of 28.9%. The stock has gained 163.9% in a year.

Myriad Genetics has a long-term expected earnings growth rate of 15%. The stock has gained 91.6% over a year.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Haemonetics Corporation (HAE): Free Stock Analysis Report

Myriad Genetics, Inc. (MYGN): Free Stock Analysis Report

Align Technology, Inc. (ALGN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Walgreens Boots Alliance Inc. (NASDAQ:WBA) is on the brink of a significant transformation as it nears a deal with Sycamore Partners to become a private entity. The transaction,...

Using the Elliott Wave Principle (EWP), we have been successfully tracking the most likely path forward for the S&P 500 (SPX) over several months. Although there are many ways...

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.