- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Guidewire (GWRE) Reports Loss In Q1 Earnings, Revenues Beat

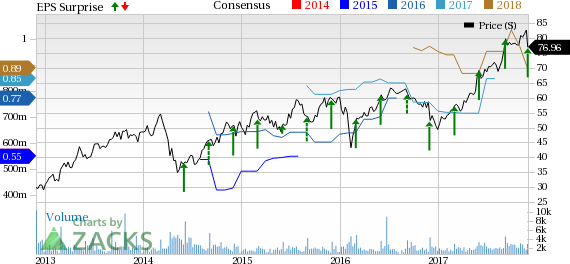

Guidewire Software, Inc. (NYSE:GWRE) reported first-quarter fiscal 2018 non-GAAP loss of 6 cents per share, outpacing the Zacks Consensus Estimate of a loss of 14 cents per share. The reported figure was, however, much lower than the year ago bottom-line figure of 2 cents per share.

The company posted revenues of $108.2 million, which increased 15% from the year-ago quarter. The figure also surpassed the Zacks Consensus Estimate of $101 million and was above the guided range.

Management noted that the recent consolidated release of the Guidewire platform has been instrumental in the enhancement of its product suite. The company is also banking on its strategic partnership with Salesforce (NYSE:CRM) for its growth.

Notably, the company is transforming to a subscription based model from a term license based one, which might hurt the top line in the near term. This is because term license revenues include advance payments and subscription-based revenues are a bit delayed.

Nevertheless, management is extremely optimistic about the several cloud-based products launched in the quarter, at a time when the P&C insurance industry is moving steadily toward adoption of cloud solutions.

So far this year, Guidewire stock has gained 56.0%, substantially outperforming the 27.5% rally of the industry it belongs to.

Revenue Details

The company has three main segments namely Maintenance, License and Other and Services.

Maintenance revenues amounted to $18.9 million, up 15% year over year. However, the same from License and other decreased 22% from the year-ago quarter to $30.1 million. Service revenues surged 52% from the year-ago quarter to $59.1 million.

Management stated that a substantial majority of the first quarter’s revenues were from subscription based products. Backed by the strong performance of subscription products, management expected increase from subscription sales were in the range of 30% to 40% from 20% to 30% for fiscal 2018.

However, growth of the Maintenance revenues that are part of subscriptions will be negatively impacted while the change in the company’s business model is in progress, because of the delayed revenue recognition from the subscription based products.

Per management, the license revenues will have a negative impact in fiscal 2018. The sales process might be a bit elongated due to the time taken by customers to choose between on-premise and cloud delivery options. Perpetual license revenues facing a decline will be a further drag to the license and other revenues.

Meanwhile, services revenues were better than expected in the quarter. The segment is anticipated to improve its performance in the near term backed by proper implementations of InsuranceNow. Also, the corrective measures taken up via use of sub-contractors to eradicate the capacity related constraints have been beneficial for the revenue generation at the Services segment.

Additionally, management is optimistic about the completion of the Cyence buyout that determines the economic impact of a cybercrime via a software platform, which is built on cyber-security related data science. The integration of Cyence would imply that the company would be able to provide an entire life cycle to the insurance products starting from designing to transaction management.

Margin Details

In first-quarter fiscal 2018, non-GAAP operating margin was 50.9% compared with 62% in the year-ago quarter. The decline was slight owing to the negative impact of higher mix of low-margin services revenues and shift in investments to the cloud based model.

According to management, Guidewire is investing more over impressive product suite that might prove to be tailwinds for future growth. As of now, these are affecting the company’s margins.

Balance Sheet

The company had cash and cash equivalents of $653.5 on Oct 31, 2017 as compared with $687.8 million in July 31, 2017.

Guidance

For second-quarter fiscal 2018, revenues are expected to be in the range of $152 to $156 million.

Non-GAAP operating income is expected to be between $18 and $22 million, while non-GAAP net income is anticipated to be within $13.2 million to $15.8 million.

Non-GAAP net income per share is expected to be between 17 cents and 21 cents.

For fiscal 2018, total revenues were anticipated to be in the $631 to $641 million band.

Non-GAAP net income is expected to be between 82 cents and 90 cents per share.

Zacks Rank and Key Picks

Guidewire Software carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the broader technology sector include NetApp, Inc. (NASDAQ:NTAP) and NVIDIA Corporation (NASDAQ:NVDA) sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

NetApp and NVIDIA has a long-term earnings growth rate of 11.34% and 11.2%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

NetApp, Inc. (NTAP): Free Stock Analysis Report

Guidewire Software, Inc. (GWRE): Free Stock Analysis Report

Salesforce.com Inc (CRM): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

• Trump’s trade war, U.S. jobs report, and last batch of Q4 earnings will be in focus this week. • Costco's earnings report is seen as a potential catalyst for growth, making it a...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.