- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Guidewire (GWRE) Beats On Q2 Earnings & Revenues, Revises View

Guidewire Software, Inc. (NYSE:GWRE) reported second-quarter fiscal 2020 non-GAAP earnings of 21 cents per share, outpacing the Zacks Consensus Estimate by 61.5%. However, the bottom line declined 36.4% from the year-ago quarter.

The company reported revenues of $173.5 million, surpassing the Zacks Consensus Estimate by 5%. Further, the top line surpassed the higher end of management’s guided range of $162-$166 million. Moreover, the top line improved 3% from the year-ago quarter.

The growth can primarily be attributed to higher License and subsription revenues.

Further, management remains optimistic on growing clout of its several cloud-based products and InsuranceSuite Cloud deal wins.

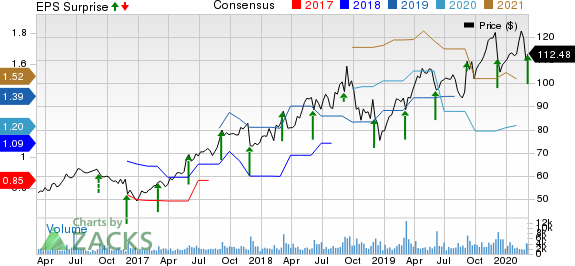

Notably, shares of Guidewire have returned 30.1% in the past year, outperforming the industry’s rally of 10.8%.

Quarter in Detail

License and subscription revenues (60.5% of total revenues) improved 21% from the year-ago quarter to almost $105 million, driven by growth in subscription revenues.

Term license revenues improved 3.7% year ago quarter to $74.3 million.

Subscription revenues soared 93.9% year over year to $28.6 million on solid adoption of InsuranceSuite cloud. In the fiscal second quarter, 63% of new software sales were subscription-based, compared with 53% in the year-ago quarter.

During the reported quarter, new and existing customers selected multiple components of Guidewire InsurancePlatform, which included InsuranceSuite, digital, data and analytics.

Management is banking on adoption of InsuranceNow to increase with the implementation of latest InsuranceSuite 10 and InsuranceSuite Cloud offerings.

Perpetual license revenues came in at $2 million.

Maintenance revenues (12.2%) amounted to $21.1 million, down 0.7% year over year. Management expects maintenance revenues to be muted as customers opt for cloud-based subscription services over term licenses.

Services revenues (27.3%) decreased 21.7% from the year-ago quarter to $47.4 million.

Annual recurring revenues (or ARR) were $474 million as of Jan 31, 2020, compared with $463 million as of Oct 31, 2019.

Margin Details

Non-GAAP gross margin contracted 100 basis points (bps) on a year-over-year basis to 59%, on increasing investments to enhance cloud capabilities that more than offset growth in license and subscription revenues and ongoing shift to subscription-based solutions.

Non-GAAP gross margin for Licensing contracted 880 bps to 80.5%. Non-GAAP gross margin for Maintenance contracted 120 bps to 82.8%. Meanwhile, non-GAAP gross margin for Services came in at 0.8%, compared with 9.6% reported in the year-ago quarter.

Total operating expenses climbed 15% year over year to $86.9 million.

Non-GAAP operating income came in at $15.4 million during the reported quarter, down 39.1% year over year. Non-GAAP operating margin during the quarter contracted 610 bps from the year-ago quarter to 8.9%.

Balance Sheet & Cash Flow

As of Jan 31, 2020 cash and cash equivalents and short-term investments came in at $1.055 billion, compared with $1.011 billion as of Oct 31, 2019.

The company generated cash from operating activities of $19.5 million in the fiscal second quarter. During fiscal second quarter, free cash flow came in at $16.7 million.

Guidance

For fiscal third-quarter 2020, revenues are expected to be in the range of $153-$157 million. The Zacks Consensus Estimate for revenues is currently pegged at $186.5 million.

License and subscription are expected to be in the range of $78-$82 million. Maintenance revenue is anticipated to be in the range of $20-$20.5 million. Services revenues are projected between $53 million and $57 million.

Non-GAAP operating loss is anticipated to lie between $11 million and $7 million.

The company projects non-GAAP loss of 6-2 cents per share in fiscal 2020. The Zacks Consensus Estimate for earnings is currently pegged at 23 cents per share.

Guidewire revised fiscal 2020 outlook on increasing cloud implementations and higher allegiance of large customers to manage software in-house, which is reducing the demand for the company’s software management services. The company now expects total revenues between $702 million and $714 million, compared with prior guided range of $759-$771 million. The Zacks Consensus Estimate for revenues is currently pegged at $764.2 million.

License and subscription are now expected to be in the range of $415-$425 million compared with prior guided range of $443-$455 million. Maintenance revenues are now anticipated to be in the band of $83-$84 million, compared with previous range of $85-$87 million. Services revenues are now anticipated between $202 million and $208 million, compared with prior range of $224-$236 million.

Management now expects 70-80% of new sales to be subscription-based, compared with prior guided range of 55-75%.

The company is focused on enhancing Guidewire Cloud platform with new capabilities including digital frameworks, automation, tooling, and other cloud services.

The company now anticipates non-GAAP operating income in the band of $61-$73 million, compared with prior range of $96-$108 million.

The company anticipates non-GAAP earnings of 82-94 cents per share in fiscal 2020. The Zacks Consensus Estimate for earnings is currently pegged at $1.20 per share.

Zacks Rank & Stocks to Consider

Guidewire currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are Microchip Technology Incorporated (NASDAQ:MCHP) , Qorvo, Inc. (NASDAQ:QRVO) and Garmin Ltd. (NASDAQ:GRMN) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Microchip, Qorvo and Garmin is currently pegged at 13.28%, 11.78% and 7.35%, respectively.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our latest Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

See 5 Stocks Set to Double>>

Microchip Technology Incorporated (MCHP): Free Stock Analysis Report

Garmin Ltd. (GRMN): Free Stock Analysis Report

Guidewire Software, Inc. (GWRE): Free Stock Analysis Report

Qorvo, Inc. (QRVO): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Defense stocks took a tumble heading into 2025 as President Trump returned to the White House for his second term. Trump has stated his intent as a peacemaker to bring the wars in...

Using the Elliott Wave Principle (EWP), we have been tracking the most likely path forward for the Nasdaq 100 (NDX). Although there are many ways to navigate the markets and to...

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.