- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

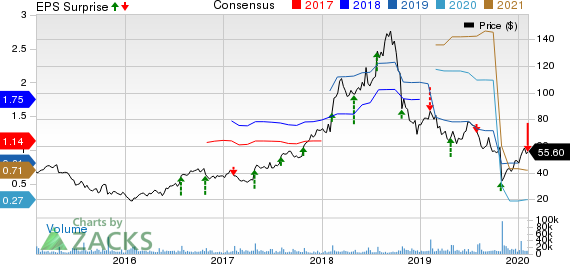

Grubhub's (GRUB) Q4 Earnings Lag Estimates, Revenues Beat

Grubhub (NYSE:GRUB) reported fourth-quarter 2019 loss of 5 cents per share, missing the Zacks Consensus Estimate by 66.7%.

Notably, the company had reported earnings of 19 cents per share in the year-ago quarter.

The loss can be attributed to higher investments in operating & support and sales & marketing that fully offset top-line growth.

Revenues increased 18.6% year over year to $341.3 million, which beat the consensus mark by 4.4%.

The company’s capture rate, net revenues divided by gross food sales, was 22% and included nearly 100 basis points (bps) of technology-oriented revenues from LevelUp and Tapingo.

Operating Details

Total costs & expenses increased 26% year over year to $366.1 million. Operations & support, sales & marketing, technology, and general & administrative expenses grew 32.1%, 23.2%, 16.8% and 2.3%, respectively.

Grubhub stated that advertising cost per new diner in the reported quarter was relatively unchanged from the first three quarters of the year.

Revenues excluding operations and support costs were $3.26 per order, down from $3.82 in the previous quarter.

Adjusted EBITDA decreased 36.6% from the year-ago quarter to $26.7 million. Adjusted EBITDA per order was 58 cents, down from $1.28 in the previous quarter and 98 cents in the year-ago quarter.

The sequential decline in adjusted EBITDA per order was due to less frequent ordering by new cohorts compared with prior cohorts, co-marketing and free delivery for certain enterprise partners, including KFC, McDonald’s (NYSE:MCD) , Panera Bread (NASDAQ:PNRA) and Taco Bell, and continued investments.

Gross Food Sales & Active Diners Increase

Gross food sales rose 13% year over year to $1.6 billion. Average order size increased 5% to $34.

Active diners were 22.6 million, up 28% year over year. The company added 1.4 million net new active diners sequentially.

However, the company stated that a lower number of frequent orders, particularly from newer diners in newer markets, affected growth. The unfavorable shift in mix from New York and Corporate, both of which have very high activity rates, and increasing dependence on free delivery and food offers to attract customers are negatively impacting the quality of customers.

Daily Average Grubs (DAGs) were 502,600, up 8% year over year and 10% sequentially. Favorable weather added 150 bps of DAG growth.

Orders delivered on behalf of restaurant partners accounted for approximately 40% of Grubhub’s DAGs during the quarter.

Grubhub now has more than 300K restaurants on its platform, including more than 155K restaurant partners. The company added roughly 15K net new partnered restaurants during the quarter.

The company added thousands of new, partnered locations of Applebee’s, Dunkin’, McDonald’s, Popeyes, Shake Shack (NYSE:SHAK) and Wendy’s. In terms of regional chains, the company added stores and witnessed significant order volumes for Bertucci’s, Hale & Hearty, honeygrow, La Madeleine, Mimi’s Café, Round Table Pizza and Smokey Bones.

Grubhub stated that McDonald’s pilot in New York City and the Tristate area, which commenced in September, is progressing well. Moreover, the company is in the process of rapidly adding thousands of Wendy’s locations to its marketplace. Additionally, its partnership with Shake Shack continues to expand to new locations and regions.

Guidance

For first-quarter 2020, GrubHub forecasts revenues between $350 million and $370 million. The Zacks Consensus Estimate is currently pegged at $360.7 million, indicating year-over-year growth of 11.4% from the figure reported in the year-ago quarter.

Order growth is expected to remain a drag in the first quarter.

Adjusted EBITDA is anticipated to be $15-$25 million.

For 2020, GrubHub forecasts revenues between $1.40 billion and $1.50 billion. The Zacks Consensus Estimate is currently pegged at $1.45 billion, indicating year-over-year growth of 11.9%.

DAG growth on a year-over-year basis and order growth are expected to improve in 2020.

Adjusted EBITDA is anticipated to be at least $100 million compared with $186.2 million reported in 2019.

Grubhub anticipates sales and marketing expenses to grow at a more normalized rate in 2020.

Zacks Rank & A Key Pick

GrubHub currently has a Zacks Rank #3 (Hold).

GoDaddy (NYSE:GDDY) , sporting a Zacks Rank #1 (Strong Buy), is a stock worth considering in the same industry. You can see the complete list of today’s Zacks #1 Rank stocks here.

GoDaddy is set to report quarterly results on Feb 13.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Grubhub Inc. (GRUB): Free Stock Analysis Report

GoDaddy Inc. (GDDY): Free Stock Analysis Report

McDonald's Corporation (MCD): Free Stock Analysis Report

Shake Shack, Inc. (SHAK): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Tesla (NASDAQ:TSLA) (NYSE: TSLA), the electric vehicle giant, has recently experienced a significant drop in its stock value, which has fallen nearly 45% since December. This...

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.