- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Is National Australia Bank (NABZY) A Suitable Value Pick?

Value investing is easily one of the most popular ways to find great stocks in any market environment. After all, who wouldn’t want to find stocks that are either flying under the radar and are compelling buys, or offer up tantalizing discounts when compared to fair value?

One way to find these companies is by looking at several key metrics and financial ratios, many of which are crucial in the value stock selection process. Let’s put National Australia Bank Ltd. (OTC:NABZY) stock into this equation and find out if it is a good choice for value-oriented investors right now, or if investors subscribing to this methodology should look elsewhere for top picks:

PE Ratio

A key metric that value investors always look at is the Price to Earnings Ratio, or PE for short. This shows us how much investors are willing to pay for each dollar of earnings in a given stock, and is easily one of the most popular financial ratios in the world. The best use of the PE ratio is to compare the stock’s current PE ratio with: a) where this ratio has been in the past; b) how it compares to the average for the industry/sector; and c) how it compares to the market as a whole.

On this front, National Australia Bank has a trailing twelve months PE ratio of 12.21. This level compares pretty favorably with the market at large, as the PE ratio for the S&P 500 comes in at about 20.22.

If we focus on the long-term trend of the stock, the current level puts National Australia Bank’s current PE among its lows over the past five years. This suggests that the stock is undervalued compared to its own historical levels and thus it could prove to be a suitable entry point from a PE perspective.

Further, the stock’s PE also compares considerably favorably with the Zacks classified Banks - Foreign industry’s trailing twelve months PE ratio, which stands at 14.05. At the very least, this indicates that the stock is relatively undervalued right now, compared to its peers.

We should also point out that National Australia Bank has a forward PE ratio (price relative to this year’s earnings) of 12.21 – which is the same as the current figure. So it is fair to say that National Australia Bank stock is likely to continue on its value-oriented path in the near term too.

PS Ratio

Another key metric to note is the Price/Sales ratio. This approach compares a given stock’s price to its total sales, where a lower reading is generally considered better. Some people like this metric more than other value-focused ones because it looks at sales, something that is far harder to manipulate with accounting tricks than earnings.

Right now, National Australia Bank has a P/S ratio of about 2.52. This compares favorably with the Zacks categorized Banks - Foreign industry’s average, which comes in at 3.10 right now.

NABZY is actually in the higher zone of its trading range in the time period per the P/S metric, which suggests that the company’s stock price has already appreciated to some degree, relative to its sales.

Broad Value Outlook

In aggregate, National Australia Bank currently has a Zacks Value Style Score of ‘B’, putting it into the top 40% of all stocks we cover from this look. This makes National Australia Bank an apt choice for value investors, and the above listed metrics make this pretty clear too.

What About the Stock Overall?

Though National Australia Bank might be a good choice for value investors, there are plenty of other factors to consider before investing in this name. In particular, it is worth noting that the company has a Growth grade of ‘F’ and a Momentum score of ‘C’. This gives NABZY a Zacks VGM score—or its overarching fundamental grade—of ‘D’. (You can read more about the Zacks Style Scores here >>)

Meanwhile, the company’s recent earnings estimates have been mixed at best. The current year has seen one estimate go higher in the past thirty days compared to none lower, while the next year estimate has seen no upward revisions and one downward revision in the same time period.

This has had a small impact on the consensus estimate though as the current year consensus estimate has moved north by 2.2%, while the next year estimate has inched lower by 1.1%. You can see the consensus estimate trend and recent price action for the stock in the chart below:

National Australia Bank Ltd. Price and Consensus

This somewhat mixed trend is why the stock has just a Zacks Rank #3 (Hold) despite strong value metrics and why we are looking for in-line performance from the company in the near term.

Bottom Line

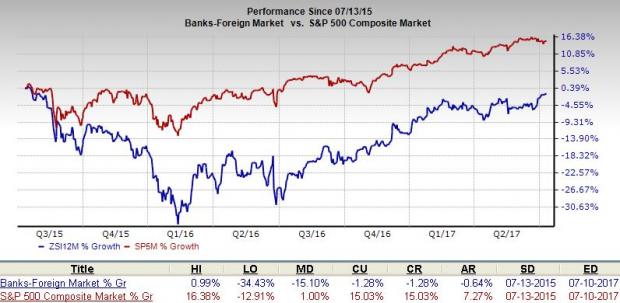

National Australia Bank is an inspired choice for value investors, as it is hard to beat its incredible lineup of statistics on this front. However, with a sluggish industry rank (Bottom 36% out of more than 250 industries) and a Zacks Rank #3, it is hard to get too excited about this company overall. In fact, over the past two years, the Zacks Banks – Foreign industry has clearly underperformed the broader market, as you can see below:

So, value investors might want to wait for estimates and analyst sentiment to turn around in this name first, but once that happens, this stock could be a compelling pick.

More Stock News: 8 Companies Verge on Apple-Like Run

Did you miss Apple (NASDAQ:AAPL)'s 9X stock explosion after they launched their iPhone in 2007? Now 2017 looks to be a pivotal year to get in on another emerging technology expected to rock the market. Demand could soar from almost nothing to $42 billion by 2025. Reports suggest it could save 10 million lives per decade which could in turn save $200 billion in U.S. healthcare costs.

A bonus Zacks Special Report names this breakthrough and the 8 best stocks to exploit it. Like Apple in 2007, these companies are already strong and coiling for potential mega-gains. Click to see them right now >>

National Australia Bank Ltd. (NABZY): Free Stock Analysis Report

Original post

Related Articles

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Emini S&P March collapsed on Thursday from strong resistance at 6010/6015The low and high for the last session were 5873 - 6014.(To compare the spread to the contract you...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.