- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

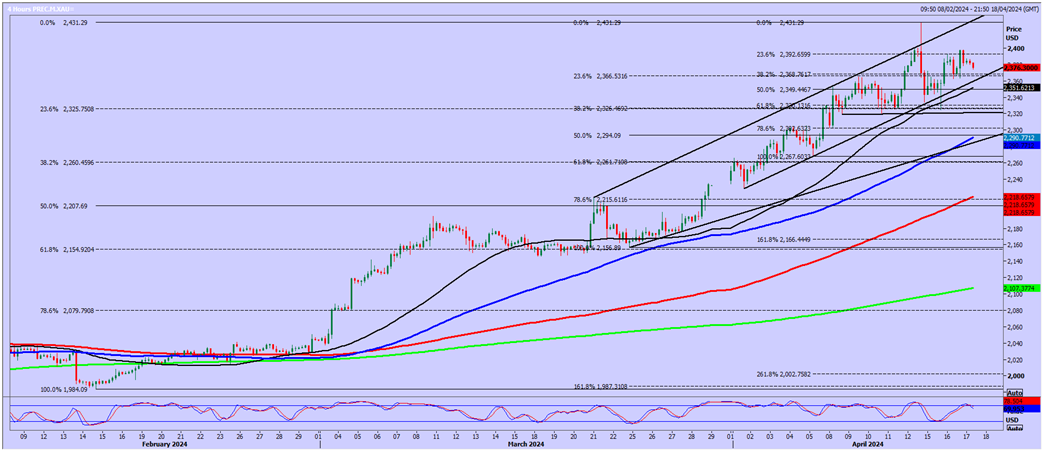

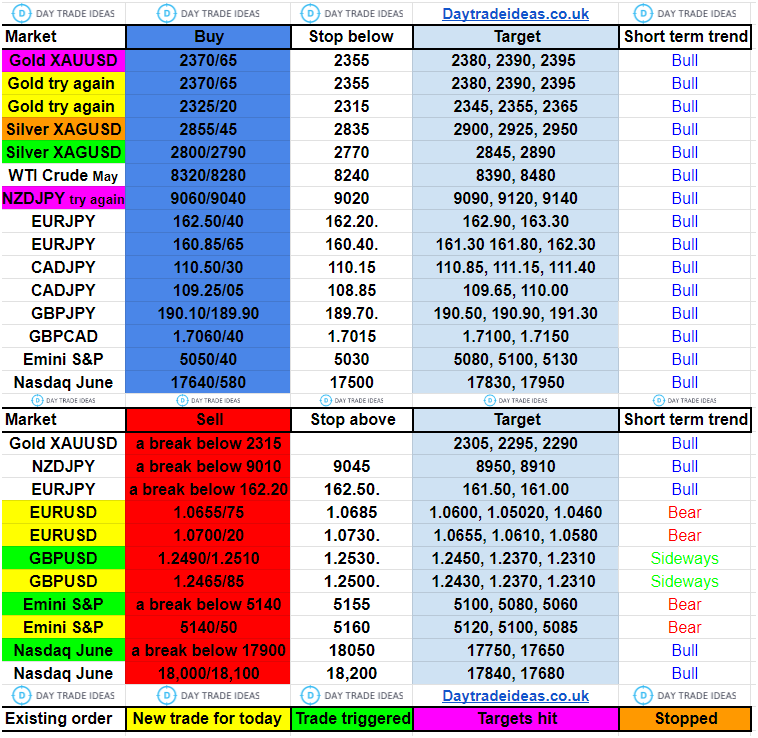

Gold Makes a Low for the Day Exactly at First Support at 2370/65

Gold :

XAU/USD made a low for the day exactly at first support at 2370/65 and longs worked on the bounce to all my targets of 2380, 2390, 2395.

- First support again at 2370/65 and longs need stops below 2355.

Targets again are: 2380, 2390, 2395. - A break lower however risks a retest of KEY SUPPORT AGAIN AT 2325/20 TODAY. Longs need stops below 2315. Targets: 2345, 2355, 2365.

- On a break above 2400 take this as a buy signal and look for 2418/22 before a retest of the all-time high at 2428/31.

- We saw strong selling pressure here last week. I still think it would be risky to short here again today but if you try (hoping to see a negative double top form) place a stop above 2435.

A break below 2315 suggests the important support at 2325/20 has been broken and it should then act as resistance and trigger further significant losses towards 2305, 2295, and 2290/85 for profit taking on shorts. Just be aware that a break below 2280 targets a buying opportunity at 2265/60 and longs need stops below 2250.

Silver:

XAG/USD, however, collapsed through first support at 2855/45 but made a low for the day at support at 2800/2790 and longs need stops below 2770.

- First support at 2800/2790 and longs need stops below 2770.

Targets: 2845, 2890. - A break lower however risks a slide to 2750/40 and perhaps as far as 2710/00.

A break above 2855 can be taken as a buy signal for today targeting 2900 for profit taking.

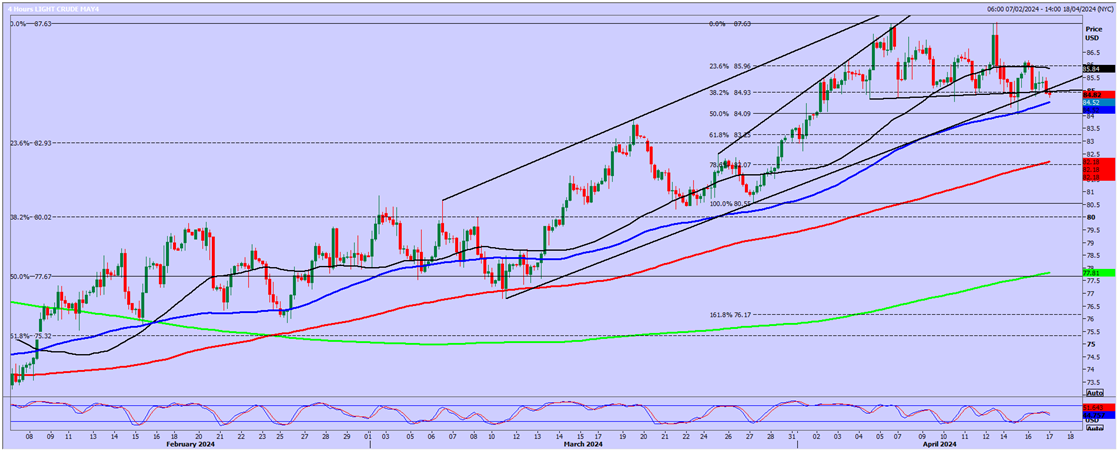

WTI Crude MAY future

- WTI Crude has been yo-yoing now for 10 days as we held mostly within Monday's range.

- For this reason, it is a very tricky time to position trade. Moves are random and erratic, with no clear pattern or trend. Although I think this is a consolidation so I think eventually we will break above 8800 and continue higher.

- On the downside, we should have a buying opportunity at 8320/8280 and longs need stops below 8240.

Targets: 8390, 8480

A break above 8800 however should target 8900/20 and even 9050/80.

Video Analysis:

Related Articles

Gold miners rallied Friday despite gold’s drop, hinting at a turnaround. This comes as gold struggles below key support, keeping downside risks in play. However, GDX’s bounce...

Gold, silver rebounding after breaking key support Risk assets overriding traditional drivers Gold in a falling wedge, eyeing a topside break Silver’s hammer candle signals...

Not that we’ve been rooting for Gold to fall, but it being one of the world’s most substantive liquid markets, it implicitly both rises and falls in its interactive role — that...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.