- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Gold At Support, Twitter On Air (Crash In The Balance?)

Now I'm not going to beat up on old Twitter Inc, (TWTR) here; indeed several valued proponents have suggested I get on their social networking system and "tweet" when I see something viably signaling our in stuff. (I can then say that in the pluperfect I have "twut", although I'd hesitate in using the past indicative or imperfect subjunctive).

"It's 'tweeted', mmb..."

Thank you for the clarification Squire. And vis-à-vis Gold which banged about in spirited volatility on Thursday upon the ECB cutting its benchmark interest rate to the lowest common denominator of 0.25%, hours later the microblogging service's IPO certainly embarked on its own effervescent start.

Albeit upon my being introduced to the futures markets back in the mid-1990s, in turn leaving the world of stocks, minutes before the Stateside stock market opened this past Thursday, out of both character and amateur curiosity I searched for the Twitter ticker symbol and punched it up on my screen for one-minute bars. Never in memory had I watched an IPO's secondary market opening. The stock market then opened and nothing happened.

Maybe I didn't have the right date. Maybe the stock's opening got delayed. So in violation of house rules I actually flipped on Bloomy TV. Goodness gracious were they all a-flutter about Twitter. But still nothing about the open. So I dubiously changed over to CNBC and they said it had yet to open, displaying a blank screen that looked just like my blank screen superimposed on their screen. And were they ever chortling away like children, all unintelligibly talking over one another as if Santa was to appear at any moment. They certainly had no interest in broadcasting anything of substance, and come 20 minutes into the stock market's session I gave up, shutting off the infantilism and changing my screen back to tracking the 25-contract volume candles on Silver. Welcome to real life.

That episode brings us to the point of the graphic at the outset, which I trust speaks for itself threefold:

1) The S&P 500 has blown up into a unconscionable bubble, void of any rational, nor apparently, responsible managerial oversight, (I know you portfolio folks are doing the best you can out there and have performed really well, but...);

2) Twitter, (whilst not yet a constituent of the S&P), went public as folks forked over $40+/share for something that earns nothing, (and "yet" because 7% of the companies in that storied Index have negative bottom lines, Twitter one day might become eligible); and

3) Gold dropped as was our notion a week ago in anticipation of a negative MACD (moving average convergence divergence) crossing on the daily bars, confirmed upon Tuesday's settle at 1312, price then reaching per our Market Rhythms at least 20 points lower by yesterday (Friday) ... Yet there's a reason why the man clasping the Gold bar is smiling: he understands that the likes of a Twitter will be smashed in the next market crash, whilst he is holding time-honoured, hard-asset cash. And we'll get specific to Gold momentarily, but with respect to a stock market crash, allow me the following.

Many will recall the infamous 1987 Black Monday call which made Elaine "Go-Go" Garzarelli a financial household name, proclaiming with exquisite timing such crash that saw the S&P close down better than 20% in a single day. Realistically, far be it from any of us to prognosticate with such pinpoint accuracy when the next stock market crash will occur. But 'tis coming. For the stars as we've enumerated them in recent missives are ever so aligned, or perhaps better stated mis-aligned, for it to happen.

Indeed in the wee hours of Wednesday morning, a Bloomy Radio commentator put forth this quintessential question (paraphrased) to his guest analyst: "What will happen to the stock market when it returns to trading on fundamentals?" The somewhat shot-from-the-hip response was: "Well, we're seeing solid earnings growth."

'Tis the old "market-of-stocks rationale" which does entail the thoughtful process of sifting through many issues for both value and momentum. But if earnings growth is truly solid, why has the price/earnings ratio of the S&P Index itself been soaring this year, hmmmmmm? Our "live" reading now has it at 34.5x. Specific thereto, the waning Q3 Earnings Season finds one-third of the 422 S&P firms thus far reporting having not bettered their year-over-year quarterly results.

And then there's the "Baby Blues" for the Spoos, (aka the S&P 500 Futures Contract). Uh-oh: looks at the very least like we're in for another episode of "As The Dots Turn"...

..then followed by "How Low Can You Go?" (Check your local listings).

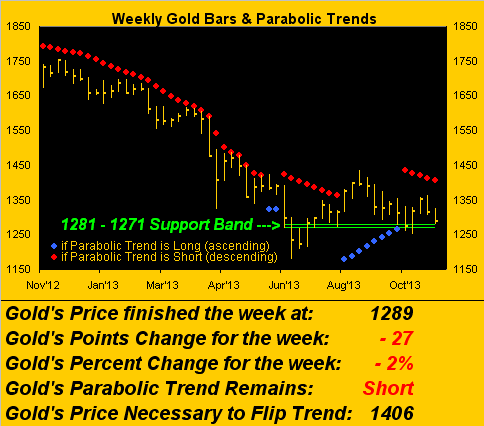

To substance: Gold for the week worked lower as 'twas penned "by a little bit, but not a lotta bit", the cited 1281-1271 trading profile support holding the line as intended. 'Twas Gold's fourth-narrowest trading week since mid-April, again evidence that the relentless selling seen earlier in the year has abated, replaced by the more recent ebb and flow of consolidation. And now five weeks into the parabolic Short trend, (per the rightmost red dots), we find price (1289) actually above the low (1251) of this cycle:

Note as well that the level of the current red dots' spate is in fact higher than that of the June-August run. "Grasping at straws", some might say, and it goes without further saying that the now somewhat "aged" 1281-1271 support band maintain enough life to buoy price through next week. If so, then I'd expect Gold to transit once again up through the 1300s, in turn tripping the parabolic trend back to Long leading us to later deal with the more porous 1400s.

Irrespective of whether Gold in broader terms has indeed bottomed, the venerable Bruce Weinstein of Goldeneye Investment Strategies wrote to us this week as follows (condensed and with permission): "GLD distorted the picture, but that distortion in my opinion is over. The ETF made it easy to get in and get out, causing extreme price movements. With the large funds now having already reduced their positions, I believe we have bottomed. But the bottom is not good enough. We need to know what will cause it to rise again. The fundamentals are all still in tact, but something changed. We have had wars, unrest, uncertainty, missile test firings, printing, deficits, central banks buying, etc. But gold was not catching a bid. I believe this changed when the US dollar index peaked in the summer of this year when gold bottomed. It would appear that of all the fundamentals that underpin and cause movements in the price of the metals, the most important fundamental, the most important driver at least for now is the direction of the US dollar."

The rational entirety of that is my kind of Gold Positive. Thank you BW. Indeed, let's get on the cutting edge for a moment, literally. Late in the week, as noted: The ECB cut rates; then S&P cut France; next shall Banks cut deposits(?) Coming to a EuroZone nation near you, or so they say. Meanwhile Stateside, twice as many jobs were created in October as was first thought and so "here comes the taper". (Rubbish). The point is: anyway you cut it, in the dog-eat-dog world of foreign exchange, both the Euro and Swiss Franc succumbed to Dollar strength, and thus Gold slipped. But at the end of the day as are we wont to say, from one bow-wow currency into another ought really be Gold Neutral. And the more bow-wows there are in the world, the less they're worth...

..now don't take that personally Rochelle: just like you, Gold is of practically fixed supply and very valuable. 'Tis just that things are so extraordinarily at out-of-sorts extremes these days -- Gold being illogically low and the S&P inanely high -- that were both to simply regress to their broad-based means, they'd still be respectively too low and too high. And at some point 'twill all snap back (understatement!) to sanity.

In the interim and active interest of the Gold trader, we next turn to "The Now" via a look at three charts.

First is the updated Market Profile comprised of Gold's comparative volume (length of the bars) per price point over the past two weeks, the lowly 1289 level in white:

Again, there is that "aged" profile support that extends below the lower boundary of the profile chart from 1281-1271. That is the key zone under which we do not want to see Gold go. Rather supported by that zone, we'd like to see Gold get back atop the chart's central clump of resistance spanning from 1309 to 1317.

Second we look at Gold's stance relative to its Market Magnet wherein a week ago we saw the "animated" downside move of price across the thicker magnet line:

The current distance of price below the magnet (-34.1 points) is not that excessive, thus reinforcing the notion that the 1281-1271 support band could well be tested in the new week.

Third let's move on to what in hindsight testing ranks as our best Market Rhythm for trading Gold: confirmed MACD crossovers on the 8-eight bars. The key to trading the Market Rhythms is to join on a trend already in progress that likely still offers a specific degree of profit prior to the eventual MACD crossover back in the opposite direction. Whilst arithmetically "late to trigger", 10 of the last 10 such confirmed crossings for Gold's MACD on this time-frame have furthered by at least 11 additional points ($1,100/contract). The chart below of Gold's 8-hour bars from 17 July into yesterday displays them as green when the MACD is in positive disposition, and red when negatively so. 'Tis not historically perfect, but 10 of the last 10 for at least 11 points each is not bad. For 'tis what's working best in "The Now" that counts:

Moreover, the red bars' current stint in terms of duration compares similarly to those prior such that a turn back up to green ought be fairly nigh.

As for the notion of the next stock market crash, consider this final graphic. For Gold we've the one year daily run (253 days) from September 2010 up into its All-Time High of 1923 on 06 September 2011. 'Twas dubbed a "bubble" and we rightly wrote at that time that price had "gotten ahead of itself". For the S&P, in comparison you can now see its own run from a year ago to date. Beyond Bubblicious Baby! (Write it down).

Finally as mentioned, "hélas", France's cherished "+" has been removed from its credit rating by S&P. "Mais nous avons deux 'A' quand-même..." Yes, you've still the "AA" bit, but losing the "+" lowers you from the likes of Austria, Guernsey, the Isle of Man and the United States to those of Abu Dhabi, Belgium, Kuwait, New Zealand and Qatar. Bonne journée mes vieux!

Related Articles

Brent crude prices continue to face downside pressure as technical indicators and fundamentals hint at further downside. Markets are digesting a host of factors at present and...

Gold Gold (XAU/USD) continues to hit heavy selling pressure on every rally, as we established a week ago. Yesterday we collapsed to support at 2904/00 but longs were stopped...

Energy prices are under pressure amid demand concerns and improving prospects for a Russia-Ukraine peace deal. But tariff risks continue to hit metal markets Energy-WTI Below...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.