- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

GFT Technologies: Revenues Maintained, EPS Edge UP

GFT Solutions organic growth 30% in Q3

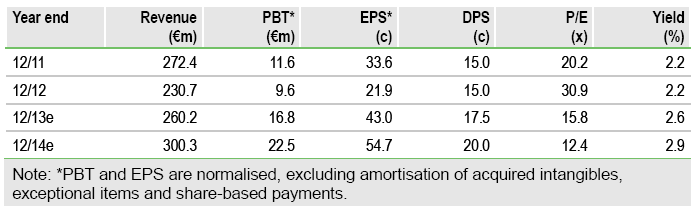

GFT Technologies AG, (GFTG) reported a strong set of Q3 results, with the group’s core GFT Solutions business growing 30% organically, up from 21% in Q2. The growth was driven by strong demand from investment banks and GFT says customers are increasingly investing in new projects for growth. Sempla, a similar Italian business acquired early in Q3, performed in line with expectations while emagine, the group’s resourcing business, is showing signs of stabilising. We are maintaining our revenue forecasts but, noting GFT has edged up its PBT guidance by €1m, we have increased EPS by 3% in FY13 and 4% in FY14. Despite the recent large share price gains, the stock still looks attractive trading on c 12x our FY14 EPS.

Q3 results: Nine-month organic revenue growth 9%

Group revenue grew 6% to €185.4m over the first nine months. Excluding the terminated TPM contracts and Sempla, the organic growth was 9%. GFT Solutions continued to drive the expansion, with organic growth of 19% over the nine months, and following the acquisition of Sempla, represented 68% of group revenues in Q3. Group headcount jumped to 2,029 at 30 September from 1,503 at 30 June, with Sempla adding c 460 employees. Edison adjusted operating profit jumped 43% to €11.1m for a 6.0% operating margin, up from 4.4% in 2012. 80% of Sempla was acquired on 3 July for €20.7m, but the acquired company included €5.5m in cash. The group ended the period with €20.3m of cash and investments and €7.3m of financial liabilities, for a net cash position of €13.0m. Additionally, there are earn-out liabilities of c €5.6m. GFT typically generates its strongest cash flows in Q4.

Forecasts: Revenues maintained, EPS edge up

The company edged up its earnings guidance, and we have increased our GFT Solutions contribution forecast, so that group adjusted operating profit increases to €17.0m in FY13 and €22.4m in FY14, from €16.2m and €21.6m respectively. Our adjusted EPS forecasts rise to 43c and 54.7c from 41.8c and 52.5c. We now forecast the group to end FY13 with €30.4m in net cash (previously €24.7m), with the increase mainly due to the lower-then-expected cost for Sempla.

Valuation: Cheap on most measures

The stock trades on 0.6x FY14 revenues and 7.7x operating profit. These numbers look favourable when compared to c 1.4-2.3x sales and c 10-14x operating profits for larger global IT services businesses. Our DCF model (which assumes a WACC of 12%) values the shares at €7.45 (previously €7.02), or 10% above the current share price. The increase is due to the lower Sempla price and the upgrades.

To Read the Entire Report Please Click on the pdf File Below.

Related Articles

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Nvidia is scheduled to release its Q4 earnings report at 4:20PM ET on Wednesday. A call with CEO Jensen Huang is set for 5:00PM ET. The chipmaker’s results will serve as a...

Warren Buffett has always critiqued airline stocks for being overly capital-intensive, exhibiting low growth, and relying heavily on cyclical consumer travel patterns—further...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.