- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Genworth Financial (GNW) Up 4.1% Since Earnings Report: Can It Continue?

It has been about a month since the last earnings report for Genworth Financial Inc. (NYSE:GNW) . Shares have added 4.1% in that time frame.

Will the recent positive trend continue leading up to its next earnings release, or is GNW due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important drivers.

Genworth Financial Q4 Earnings Beat, Revenues Miss

Genworth Financial, Inc. reported fourth-quarter 2017 adjusted operating income of 65 cents per share, surpassing the Zacks Consensus Estimate of 20 cents by a whopping 225%. Adjusted operating income compared favorably with adjusted operating loss of 27 cents in the year-ago quarter.

The company reported net income per share of 70 cents against net loss of 25 cents in the prior-year period.

Full-Year Highlights

For 2017, Genworth reported adjusted operating income per share of $1.39 versus adjusted operating loss of 63 cents in the prior-year quarter.

Total operating revenues of $8 billion fell 3.2% year over year.

Operational Performance

Total revenues of Genworth Financial declined 23.9% year over year to $1.6 billion. Also, the top line missed the Zacks Consensus Estimate of $2.2 billion by 24%.

Total benefits and expenses decreased 12.3% year over year to $1.9 billion, primarily owing to fall in benefits and other changes in policy reserves, interest credited along with lower acquisition and operating expenses, net of deferrals and amortization of deferred acquisition costs and intangibles, respectively.

Segment-Wise Quarterly Review

U.S. Mortgage Insurance: Adjusted operating income of $74 million rose nearly 21.3% year over year. Loss ratio for the quarter improved 600 basis points (bps) year over year to 22%.

Canada Mortgage Insurance: Adjusted operating income was $43 million, up 10.3% year over year. Loss ratio improved 900 bps year over year to 9%, mainly owing to a decline in new delinquencies, net of cures and lower average reserve per delinquency, representing the ongoing housing market strength and underlying economic conditions.

Australia Mortgage Insurance: Net operating loss of $125 million compared unfavorably with the operating income of $14 million from the year-ago quarter. Loss ratio was (7%) compared with that of 30% from the year-ago quarter due to change in the earnings recognition pattern in the quarter under review.

U.S. Life Insurance: Adjusted operating loss of $69 million was substantially narrower than the $154 million loss in the comparable quarter last year.

Runoff: Adjusted operating income of $13 million skyrocketed 116.7% year over year, primarily driven by a continued strong equity market performance supporting the company’s variable annuity business.

Corporate And Other: Adjusted operating income came in at $390 million in contrast to the year-ago loss of $103 million.

Financial Update

Genworth exited the quarter with cash, cash equivalents and invested assets of $76.9 billion, up about 2.5% from the year-end 2016.

Long-term borrowings of Genworth Financial totaled $4.2 billion as of Dec 31, 2017, up approximately 1.1% at 2016-end.

Book value per share was $26.88 as of Dec 31, 2017, up 5.9% from the level at 2016-end.

Business Update

In October 2016, Genworth Financial inked a definitive agreement with China Oceanwide Holdings Group Co., Ltd. in order to be acquired by the latter for $2.7 billion or $5.43 per share in cash. This transaction will be executed via Asia Pacific Global Capital Co. Ltd., one of China Oceanwide’s investment platforms. Both the companies are working toward the transaction’s completion as soon as possible.

Both Genworth Financial and China Oceanwide made progress with regulatory approvals.

Both the companies have re-filed a joint voluntary notice with the Committee on Foreign Investment in the United States.

The two consenting parties continue to deal with the Delaware Department of Insurance (Delaware), consistently working toward an acceptable solution with a view to move into the direction of transaction approval process.

Due to delay in receipt of regulatory approvals and the closure of the proposed transaction, Genworth has decided to pursue a secured debt transaction, acknowledging its upcoming 2018 debt maturity.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed a downward trend in fresh estimates. There has been one revision lower for the current quarter.

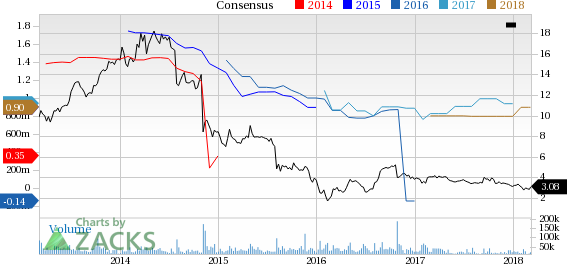

Genworth Financial Inc Price and Consensus

VGM Scores

At this time, GNW has a strong Growth Score of A, though it is lagging a lot on the momentum front with a C. However, the stock was allocated a grade of A on the value side, putting it in the top 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of A. If you aren't focused on one strategy, this score is the one you should be interested in.

Based on our scores, the stock is equally suitable for value and growth investors while momentum investors may want to look elsewhere.

Outlook

Estimates have been broadly trending downward for the stock and the magnitude of this revision looks promising. Notably, GNW has a Zacks Rank#3 (Hold). We expect an in-line return from the stock in the next few months.

Genworth Financial Inc (GNW): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.