- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Genpact's (G) Q3 Earnings And Revenues Surpass Estimates

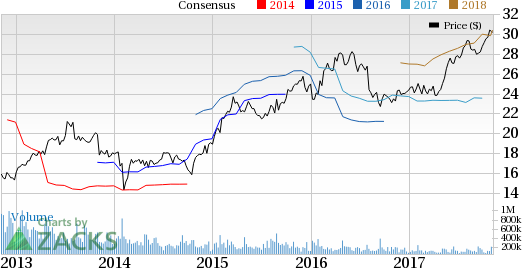

Genpact Limited (NYSE:G) reported third-quarter 2017 non-GAAP earnings of 46 cents per share, which increased 23% on a year-over-year basis. The figure also came ahead of the Zacks Consensus Estimate of 40 cents per share.

Revenues of $708.8 million increased 9% (up 10% on a constant currency basis) from the year-ago quarter. Revenues also surpassed the Zacks Consensus Estimate of $686 million.

The company’s recently launched artificial intelligence (AI) - based platform called Genpact Cora and its recent acquisitions of AI and design thinking based companies such as Tandem Seven are proving to be beneficial for the top line.

Management was particularly optimistic about the positive response to Genpact’s newly launched tagline, "Transformation happens here." Genpact stock has gained 24.1% year-to-date substantially outperforming the 4.3% rally of the industry it belongs to.

Quarter Details

Total BPO revenues (82% of total revenues) increased 10% year over year to $583 million. Total IT services revenues (18% of total revenues) were up 6% year over year to $126 million.

Global Client (90% of total revenue) revenues increased 13% (14% at constant currency) to $637 million driven by the strong performance of transformation services (comprising of consulting, digital and analytics segments), which witnessed year-over-year growth of 25% and represented almost 20% of Global Client revenues.

Global Client BPO segment revenues of $541 million recorded 15% (16% at constant currency) growth backed by robust performance of industry verticals like insurance, banking, manufacturing, CPG, high tech, life sciences, finance and accounting. Global Client IT revenues were up 2% year over year to $96 million.

Global Client IT revenues were up 2% year over year to $97 million, driven by stabilizing investment banking industry. The industry has been facing challenging business conditions over the past several quarters.

Revenues from General Electric (NYSE:GE) represented around 10% of total revenues and fell 15% during the quarter to $72 million. Management noted that the company is on track to meet the expected annual revenue figures from GE. GE BPO revenues decreased 30% year over year to $43 million. GE IT revenues of $30 million increased 21% from the year-ago quarter.

Gross margin was 39.5%, in line with the year-ago quarter, owing to favorable product mix.

Balance Sheet & Dividend

During the third quarter, the company generated $148 million in cash from operations. In the third quarter, the company returned around $12 million to shareholders via quarterly dividend of 6 cents per share.

Guidance

For full-year 2017, revenues are now anticipated in the range of $2.72–$2.73 billion. Net foreign exchange adverse impact is now expected to be approximately $15 million. This expected figure will represent growth of 6% or 7% on a constant currency basis.

Global Client revenues for 2017 are now expected to grow approximately 9% (10% on a constant currency basis).

Non-GAAP operating income margin is expected to be 15.7%. Earnings are anticipated to come in the range of $1.59–$1.60 per share.

Conclusion

Genpact’s domain expertise in business analytics, digital and consulting sectors is a key catalyst for the company’s growth.

Notably, management is positive about the growing pipeline on the back of increasing adoption of the company’s transformation services. The enthusiastic approach of the C-level of different companies in transforming business models through digital, data and analytics is turning out to be a positive for the company.

Additionally, supply chain management is another sector where the company has growth opportunities. Being recognized as one of the top three leaders in supply chain management by The Everest Group is another positive.

We believe its diverse portfolio, enhanced by the offerings of the acquired organizations, will provide Genpact with a competitive advantage against peers like Cognizant Technology Solutions (NASDAQ:CTSH) and Accenture plc (NYSE:ACN) .

Zacks Rank

Genpact currently has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Cognizant Technology Solutions Corporation (CTSH): Free Stock Analysis Report

General Electric Company (GE): Free Stock Analysis Report

Accenture PLC (ACN): Free Stock Analysis Report

Genpact Limited (G): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Professional traders get paid because of one skill and one skill only: the ability to foresee what the world (or the economy, at least) might look like in six to nine months....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.