- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Generic Drugs Industry's Prospects Uncertain Amid Coronavirus

The Medical - Generic Drugs industry comprises companies, which develop and market chemically/biologically identical versions of a brand-name drug once patents providing exclusivity to the branded drugs expire. These drugs can be divided into two categories — generic and biosimilar — based on their composition.

The generic segment is controlled by a few large generic drugmakers and generic units of large pharma companies. However, several smaller companies also develop generic versions of branded drugs. Generic/biosimilar drugs are significantly cheaper than the original drug. However, competition in this segment is stiff, which results in thin margins for the manufacturing companies. A few companies in this industry also have some branded drugs in their portfolio, which helps them tap a higher-margin market. A prominent stock in this industry is Mylan (NASDAQ:MYL).

Let’s take a look at the industry’s three major themes:

- The generic drug industry faces stiff competition and pricing pressure. However, the pricing environment showed signs of stabilization in 2019. Price stabilization along with launches of new products has strengthened businesses of major generic drugmakers. Meanwhile, patent litigations are increasing expenses.

- Generic drug companies mainly bank on the loss of patent exclusivity of branded drugs. They may have to face litigation to market the generic version of these drugs. A company may launch an authorized generic version of a branded product, gaining exclusivity of several months over other generic versions of the same drug. Although the development of biosimilars is a complex process, these companies have already launched a few.

- Generic drugs increase competition in the market as these are available at a significantly lower price and are accessible to a wider patient population. In contrast, some branded drugs have sales running into billions of dollars. Although generics have thin margins, their high sales volumes help generic drugmakers reap significant profits. Meanwhile, the government is focusing on instilling competition in the pharma space with faster approval to generic/biosimilars. This will boost the companies’ prospects as many blockbusters drugs are set to lose patent protection in the coming years.

The generic drug industry has performed well in 2019. Moreover, strong fundamentals of the industry players are expected to continue in 2020. However, the industry has been significantly impacted by the coronavirus crisis so far in 2020. The prospect of the industry also remains uncertain due to the coronavirus pandemic.

Zacks Industry Rank Indicates Solid Prospects

The Zacks Medical – Generic Drugs industry is a small 24-stock group, which is housed within the broader Zacks Medical sector. It carries a Zacks Industry Rank #98, which places it in the top 39% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates encouraging near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Before we present a few generic drugmaker stocks that are well positioned to outperform the market based on a strong earnings outlook, let’s take a look at the industry’s stock-market performance and its current valuation.

Industry Underperforms Sector but Outperforms S&P 500

The Zacks Medical – Generic Drugs industry has lagged the broader Zacks Medical sector but outperformed the S&P 500 Index so far this year.

The industry has declined 23.2% over this period compared with the broader sector’s 20% decrease and S&P 500’s fall of 25.3%.

Year-to-Date Price Performance

Industry’s Current Valuation

On the basis of forward 12 months price-to-sales ratio (P/S F12M), which is a commonly used multiple for valuing generic companies, the industry is currently trading at 1.22 compared with the S&P 500’s 2.58 and the Zacks Medical sector’s 2.24.

Over the last five years, the industry has traded as high as 4.35X, as low as 1.19X, and at the median of 1.97X, as the chart below shows.

Price-to-Sales Forward Twelve Months (F12M) Ratio

Bottom Line

Stable prices of generic drugs will help industry players enjoy steady revenues in the days ahead. Majority of companies had encouraging performance in 2019. Moreover, product launches are bringing in significant revenues. This trend is expected to continue in 2020 as several products are slated to be launched soon. Moreover, launch of biosimilar drugs, which especially target oncology indications, should boost revenues.

Although pricing pressure seems to have eased, the coronavirus crisis may mar generic drugs industry’s near-term prospects. Several major companies expect headwinds due to the ongoing coronavirus pandemic. They also remain uncertain about the impact of supply-chain disruptions caused by the coronavirus outbreak on their businesses.

Meanwhile, competition in the generic market is intensifying. The market is already crowded and faster approval by the FDA will bring in more drugs. The first company to launch a generic version of a brand product, which has lost exclusivity, is likely to capture significant market share. Hence, companies with a strong pipeline of generic drugs and a large portfolio of abbreviated new drug applications are likely to reap substantial profits. Moreover, coronavirus crisis may also drive costs of materials higher for industry players.

Moreover, some companies have a huge debt burden, which may compel them to keep away from acquisitions and deals. Pipeline or regulatory setbacks can delay generic launches, which may deal a severe blow to prospects.

In the Generic Drug industry, no stock currently sports a Zacks Rank #1 (Strong Buy), while two companies have a Zacks Rank #2 (Buy) and the rest carry a Zacks Rank of 3 (Hold). Most of these companies have witnessed positive earnings estimate revisions in the past 60 days.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Here we present three stocks from the industry with a favorable Zacks Rank that investors may consider adding to their portfolios.

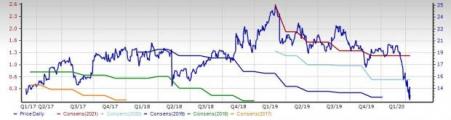

Amphastar Pharmaceuticals, Inc. (AMPH): The Zacks Consensus Estimate for this Rancho Cucamonga, CA-based drugmaker’s earnings per share for 2020 has remained stable over the past 30 days. Amphastar has a Zacks Rank #2.

Price and Consensus: AMPH

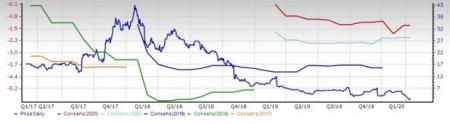

Adamas Pharmaceuticals, Inc. (ADMS): The Zacks Consensus Estimate for this Emeryville, CA-baseddrugmaker for 2020 has narrowed 1.9% over the past 30 days. Adamas currently carries a Zacks Rank #3.

Price and Consensus: ADMS

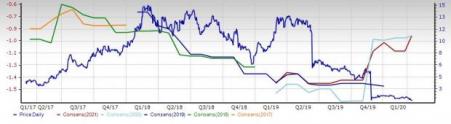

CymaBay Therapeutics Inc. (CBAY): The Zacks Consensus Estimate for this Emeryville, CA-based drugmaker for 2020 has narrowed 2.1% over the past 30 days. CymaBay currently carries a Zacks Rank #3.

Price and Consensus: CBAY

CymaBay Therapeutics Inc. (CBAY): Free Stock Analysis Report

Amphastar Pharmaceuticals, Inc. (AMPH): Free Stock Analysis Report

Adamas Pharmaceuticals, Inc. (ADMS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

There are more than two reasons why NVIDIA’s (NASDAQ:NVDA) stock price can rally another 30% or more in 2025, but the two that underpin the others are data center and automotive...

Stocks fell sharply, with the S&P 500 leading the decline, finishing the day down almost 1.6% at 5,860. Meanwhile, the Nasdaq 100 dropped nearly 2.75%, closing at 20,550. This...

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.