- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

General Mills (GIS) Q2 Earnings Meet, Ups Organic Sales View

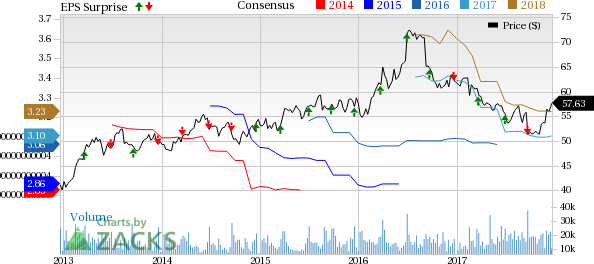

After witnessing a negative earnings surprise of 7.79% in first-quarter fiscal 2018, General Mills, Inc. (NYSE:GIS) delivered in-line earnings in the second-quarter of fiscal 2018. Meanwhile, the top line came ahead of the Zacks Consensus Estimate after missing the same in three of the last four quarters. Again, the company raised its fiscal 2018 organic sales outlook mirroring the positive impact of its strong second-half plans.

Shares surged 1.5% in premarket trading after the earnings release.

In-Line Earnings

The food giant reported second-quarter fiscal 2018 adjusted earnings per share of 82 cents, in line with the Zacks Consensus Estimate. Earnings, however, decreased 4% year over year. On a constant currency basis, earnings decreased 5%.

Adjusted earnings exclude certain items, influencing comparability of results. Including these items, reported earnings came in at 74 cents per share, reflecting a decrease of 7.5% year over year.

Sales Beat

Total revenues of $4.2 billion surpassed the Zacks Consensus Estimate of $4.06 billion and improved 2.1% year over year, owing to higher sales across the board.

Organically, excluding currency and acquisitions/divestures, sales increased 1% against the 4% drop in the prior quarter.

Price/mix had a 1% positive impact on its quarterly revenues but volumes remained unchanged in the quarter. Currency had a 1% positive impact on quarterly revenues.

Margins Decline

Adjusted gross margin declined 240 basis points (bps) to 34.4% due to higher input costs.

Adjusted operating margin also plunged 220 bps to 17.4%, owing to lower adjusted gross margins and an increase in advertising and media expense.

Segment Performance

North America Retail: Revenues from this segment grew 1% year over year to $2.77 billion due to a 7% increase in the U.S. Cereal operating unit and a 5% increase in U.S. Snacks.

Organic sales were flat versus down 5% in the prior quarter. Volumes increased 1%, but price/mix had a 1% negative impact on revenues.

Segment operating profit declined 4% year over year, owing to higher input costs and advertising and media expense.

Convenience Stores & Food Service: Revenues were up 5% year over year at $512 million. Growth in the Focus 6 platforms, including frozen meals, cereal, and snacks, as well as benefits from market index pricing on bakery flour had a positive effect on the segment’s results. Organically, sales were up 5%, too. Volumes increased 3%, and price/mix had a 2% positive impact on revenues.

However, segment operating profit decreased 2% from the year-ago level owing to higher input costs.

Europe & Australia: On a year-over-year basis, the segment’s revenues improved 7% to $467 million, thanks to benefits from favorable foreign currency exchange and higher volumes. Organically, sales were up 1%.

Foreign exchange and volume had a 6% and 1% favorable impact on revenues, respectively, in the quarter.

However, the segment’s operating profit dropped 34.1% year over year. This was due to major input cost inflation.

Asia & Latin America: Revenues were up 2% year over year to $448 million. The upside was mainly driven by a favorable currency impact and benefits of net price realization. Organically, sales were on a par with the year-ago level.

While volumes were down 7%, price/mix had a favorable impact of 7% on the quarter’s results. Segment operating profit was down 41.4% year over year.

Fiscal 2018 Guidance

The company now expects organic sales growth between flat and down 1%, higher than its prior forecast of a decline of 1% to 2%. This reflects an improvement of 300-400 bps (previously up 200 to 300 bps) over fiscal 2017 results.

The company maintained its expectation for adjusted earnings per share (constant currency) growth of 1-2% from the fiscal 2017 level of $3.08 per share. The company expects currency-related translation to have a one cent benefit on fiscal 2018 adjusted earnings per share.

Adjusted operating profit margin is now anticipated to be less than the year-ago level of 18.1%, compared with the prior expectation of year-over-year improvement.

Total segment operating profit was reaffirmed in the range of flat to up 1%, on a constant-currency basis. The company expects to generate double-digit growth in the second half, driven by favorable net price realization and mix and higher cost savings, including savings from its new global sourcing initiative.

Zacks Rank & Key Picks

General Mills carries a Zacks Rank #3 (Hold).

Investors can consider a few top-ranked stocks in the Consumer Staples sector that includes Nomad Foods Limited (NYSE:NOMD) , Conagra Brands Inc. (NYSE:CAG) and Medifast, Inc. (NYSE:MED) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Nomad Foods is expected to witness 22.8% growth in earnings this year and 18.1% for the next.

Conagra Brands’ earnings are expected to grow 9.2% this year and 8.7% in the next.

Medifast is expected to witness 14.8% growth in earnings this year and 19.8% for the next.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

General Mills, Inc. (GIS): Free Stock Analysis Report

Conagra Brands Inc. (CAG): Free Stock Analysis Report

MEDIFAST INC (MED): Free Stock Analysis Report

Nomad Foods Limited (NOMD): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.