- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

GE Still Going Downhill: Dump Or Buy On The Cheap?

Shares of industrial goods manufacturer General Electric Company (NYSE:GE) continued to fall for the second consecutive day on massive dividend cut and radical business restructuring policies made public by CEO John Flannery. Its shares fell 5.9% to close at $17.90 yesterday to a nearly five-year low, after tanking 7.2% on Monday for its biggest one-day selloff since Apr 20, 2009.

It appears that the proposed steps of Flannery have failed to arrest the negative investor perception. Under the current scenario, let's discuss whether it would be a wise move to dump the stock straightaway or buy it at a discounted price.

Dividend Cut & Businesses Trimmed

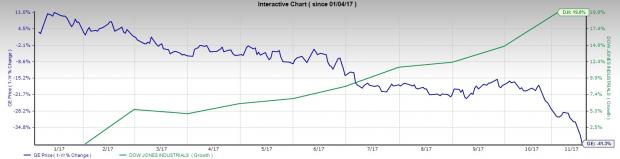

GE has been the worst performer in the Dow Jones Industrial Average this year, with a decline of 41.3% year to date as against a gain of 19.8% for the index. In order to boost its sagging shares, Flannery has decided to focus on just three core segments — power, aviation and health-care equipment — and gradually exit all other businesses.

This puts on the chopping block its much-publicized acquisition of Baker Hughes along with its railroad and lighting businesses. Consequently, the company would retrench a sizable number of its employees and reduce its board of directors to 12 members from 18. GE further intends to have asset sales worth $20 billion to improve its liquidity.

At the same time, the company halved its quarterly dividend to 12 cents per share — the first dividend cut since 2009 at the peak of the recession. For 2018, the dividend allocation will be $4.2 billion, down from more than 100% of free cash flow to 60-70% while the dividend yield will be trimmed from 4.7% to 2.3%. A healthy dividend yield was one of the strongest enticements for GE investors and the dramatic plunge in share prices are testament to the fact that shareholders have been very critical of the turnaround plan.

Guidance Lowered

For 2017, the company has lowered its adjusted earnings guidance to $1.04-$1.12 per share, significantly down from earlier expectations of $1.60-$1.70. For 2018, GE expects adjusted earnings to be further down to $1.00-$1.07 per share and free cash flow at significantly reduced levels of $6 billion to $7 billion.

The company intends to restructure employee bonuses by eliminating the three-year cash long-term performance awards by swapping it with a program that conforms to "market norms." Specifically, GE plans to adjust its compensation policies to include a higher equity mix target for its top 5,000 employees and cut costs to the tune of $3 billion.

Bumpy Road Ahead

Flannery has termed 2018 as “a reset year” and expects the company to stage a turnaround to reward its shareholders with risk-adjusted returns. Critics, however, have widely raised concerns about the efficacy of such steps. Although the dividend cut was expected, the proposed exits from other businesses surprised the investor community, who argued how a much smaller and more focused GE could actually be beneficial with lower revenue-generating opportunities. Deane Dray, analyst at RBC Capital Markets, observed, “The company’s turnaround will now be more protracted than previously anticipated.”

The drastic fall in share price has mostly strengthened this opinion. Although some optimists would like to view this scenario as glass being half full rather than half empty, investors should remain cautious and weigh their options for the future.

Zacks Rank & Key Picks

GE presently has a Zacks Rank #5 (Strong Sell). Better-ranked stocks in the industry include Danaher Corp. (NYSE:DHR) , Federal Signal Corp. (NYSE:FSS) and Leucadia National Corp. (NYSE:LUK) , each carrying Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Danaher has a long-term earnings growth expectation of 10.6%. It has beaten earnings estimates in each of the trailing four quarters with an average positive surprise of 2.6%.

Federal Signal has beaten earnings estimates thrice in the trailing four quarters with an average positive surprise of 11.5%.

Leucadia has a long-term earnings growth expectation of 18%. It has beaten earnings estimates thrice in the trailing four quarters with an average positive surprise of 21.2%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Danaher Corporation (DHR): Free Stock Analysis Report

Leucadia National Corporation (LUK): Free Stock Analysis Report

General Electric Company (GE): Free Stock Analysis Report

Federal Signal Corporation (FSS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Defense stocks took a tumble heading into 2025 as President Trump returned to the White House for his second term. Trump has stated his intent as a peacemaker to bring the wars in...

Using the Elliott Wave Principle (EWP), we have been tracking the most likely path forward for the Nasdaq 100 (NDX). Although there are many ways to navigate the markets and to...

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.