- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

GBP/JPY Oscillates Within Sideways Range

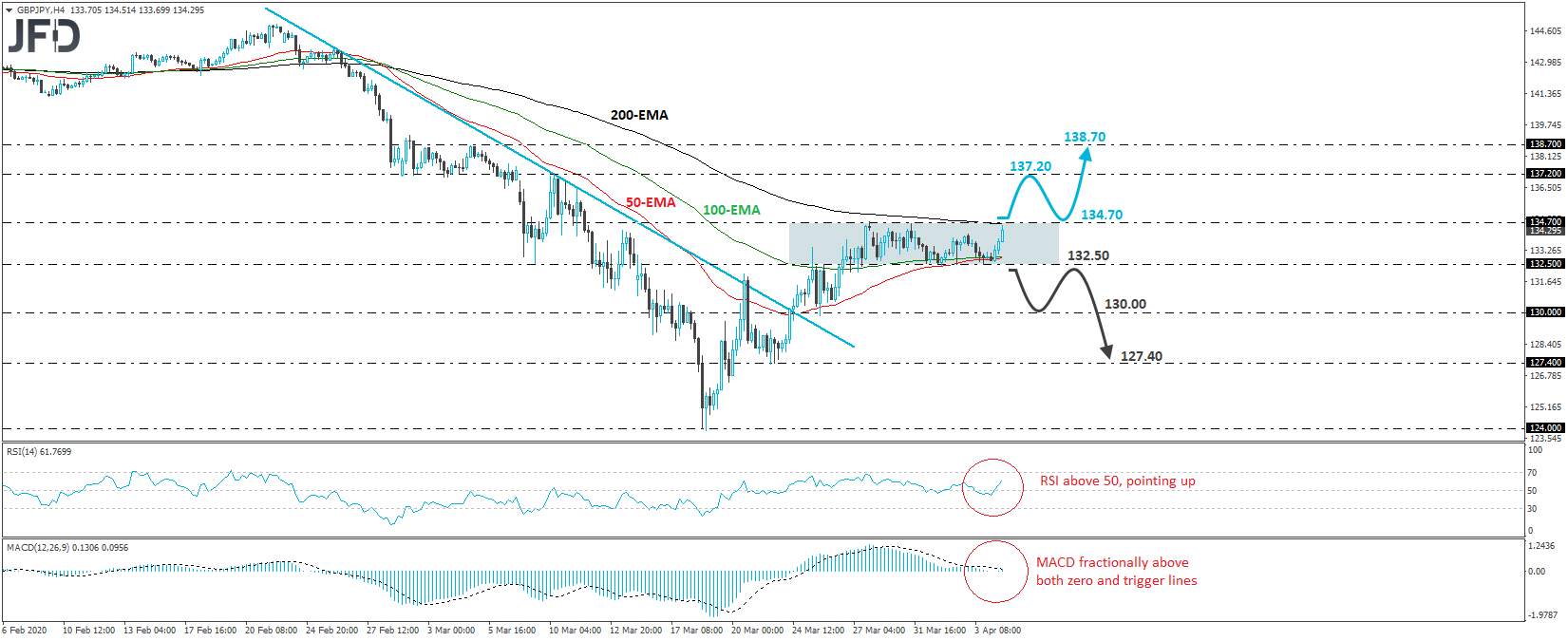

GBP/JPY traded higher today after hitting support once again near the 132.50 zone. Overall, the pair oscillates between that hurdle and the resistance of 134.70 since March 26th, and thus, we will adopt a flat stance with regards to the short-term outlook. That said, bearing in mind the rate’s proximity to the upper bound of the range, we would see slightly more chances for an upside exit, rather than a downside one.

A decisive break above 134.70 would not only confirm a forthcoming higher high on the 4-hour chart, but it would also bring the rate above the 200-EMA. This may encourage the bulls to climb towards the 137.20 obstacle, marked by the high of March 10th, the break of which could extend the advance towards the 138.70 zone, which provided decent resistance between March 3rd and 5th.

Shifting attention to our short-term oscillators, we see that the RSI rebounded back above its 50 line and now points to the upside, while the MACD sits fractionally above both its zero and trigger lines. Both indicators suggest that the rate may start picking up upside speed soon and support the notion that the chances of an upside exit out of the range are more than those of a downside one.

In order to start examining whether the bears have taken the steering wheel, we would like to see GBP/JPY breaking below 132.50. This would confirm a forthcoming lower low on the 4-hour chart and may initially allow declines towards the psychological zone of 130.00, which is also marginally above the low of March 25th. If the bears are not willing to stop there, then a move lower could pave the way towards the low of March 23rd, at around 127.40.

Related Articles

As investors attempt to keep up with the daily shift in President Trump’s tariff policies, the February CPI report out of the United States on Wednesday will likely come as a...

Japanese yen extends rally for a third consecutive day BoJ’s Uchida says rate hikes still on the table despite tariff concerns US nonfarm payrolls expected to edge slightly The...

EUR/USD is trading near 1.0806 on Friday, maintaining its position despite failing to extend its gains further. Investors’ focus is on February’s upcoming US employment data,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.