- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Gartner (IT) Up 2.9% Since Earnings Report: Can It Continue?

It has been about a month since the last earnings report for Gartner, Inc. (NYSE:IT) . Shares have added about 2.9% in that time frame.

Will the recent positive trend continue leading up to its next earnings release, or is IT due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

Gartner Misses on Q4 Earnings Despite Higher Revenues

Gartner reported relatively healthy fourth-quarter 2017 results with year-over-year growth in revenues and total contract value. Adjusted earnings for the reported quarter were $108 million or $1.17 per share compared with $81.2 million or 97 cents per share in the year-ago quarter. The year-over-year increase in adjusted earnings was primarily attributable to top-line growth and favorable impact from the Tax Act. Adjusted earnings for fourth-quarter 2017, however, missed the Zacks Consensus Estimate of $1.28.

Gartner recorded GAAP net income of $107.3 million or $1.16 per share compared with $66.5 million or 79 cents per share in the prior-year quarter. The year-over-year increase in GAAP earnings was largely due to higher revenues which increased 44% year over year. For full year 2017, GAAP earnings were $3.3 million or 4 cents per share compared with $193.6 million or $2.31 per share in 2016. Despite higher revenues, GAAP earnings for 2017 decreased year over year due to higher operating expenses.

Total non-GAAP revenue for the reported quarter increased to $1,064.6 million from $703.2 million due to solid contract value growth and accretive acquisitions. Total contract value for traditional Gartner business was approximately $2.2 billion, up 15% year over year. For full year 2017, non-GAAP revenues were $3,516.9 million compared with $2,444.5 million in 2016.

Adjusted EBITDA (earnings before interest, tax, depreciation and amortization) for the quarter increased to $220.9 million from $145.1 million in the prior-year period.

Segmental Performance

Research segment’s revenues increased 43% to $692.8 million and accounted for 68.3% of GAAP revenues. Client retention was 84%, while wallet retention was 106%. The quarterly gross contribution margin was 67% for the quarter, down from 68% in the year-ago period.

Consulting revenues declined to $85.3 million from $81.1 million in the prior-year period, accounting for 8.4% of total revenue. Backlog, the key leading indicator of future revenue growth for the Consulting business, was $95.2 million compared with $88.6 million in the prior-year period. Gross contribution margin was 26% compared with 23% in the year-earlier quarter.

Events revenue was significantly up from $136.3 million to $166.5 million. Gross contribution margin was 51%, down from 54% in the fourth quarter of 2016.

Talent Assessment & Other revenue for fourth-quarter 2017 was $70 million, while gross contribution margin was 60%.

Balance Sheet and Cash Flow

At quarter end, Gartner had about $538.9 million in cash and cash equivalents with long-term debt of $3,278.8 million compared with respective tallies of $474.2 million and $694.4 million in the prior-year period. Net cash from operating activities for 2017 was $254.5 million compared with cash flow of $365.6 million in the year-earlier period, resulting in respective free cash flow of $264.6 million and $347.2 million.

During 2017, Gartner used $2.6 billion for acquisitions, $41.3 million to repurchase shares and $110.8 million for capital expenditures. As of Dec 31, 2017, the company had $558 million of additional borrowing capacity under its revolving credit facility.

Guidance

Gartner offered preliminary guidance for full year 2018. The company currently expects GAAP revenues in the range of $4,095–$4,200 billion and adjusted EPS in the range of $3.71–$4.11. Operating cash flow is likely to be within $460–$510 million.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed a downward trend in fresh estimates. There has been one revision lower for the current quarter.

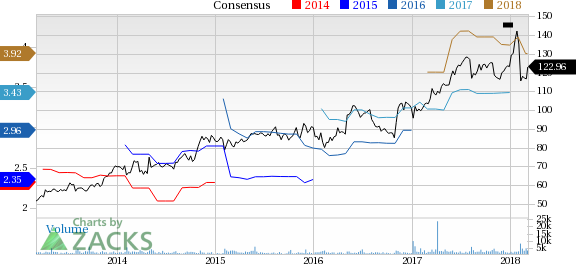

Gartner, Inc. Price and Consensus

VGM Scores

At this time, IT has an average Growth Score of C, a grade with the same score on the momentum front. Charting a somewhat similar path, the stock was allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of D. If you aren't focused on one strategy, this score is the one you should be interested in.

Zacks' style scores indicate that the company's stock is suitable for growth and momentum investors.

Outlook

Estimates have been broadly trending downward for the stock and the magnitude of this revision indicates a downward shift. It's no surprise IT has a Zacks Rank #4 (Sell). We expect a below average return from the stock in the next few months.

Gartner, Inc. (IT): Free Stock Analysis Report

Original post

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.