- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Gap Stock Up 30% YTD As Turnaround Efforts Reap Benefits

The Gap, Inc. (NYSE:GPS) looks good backed by its new growth strategy, solid focus on enhancing product quality and responsiveness to changing consumer trends. Also, the company has been making constant efforts to boost digital and mobile offerings, besides improving product acceptance. Though currency headwinds and its Banana Republic brand continue to play spoilsport, we believe these to be offset by initiatives undertaken.

In fact, Gap’s endeavors are well reflected in its share price movement. So far this year, the stock is up 30%, as against the industry’s decline of 13.8%. The company’s shares have also outpaced the broader Retail-Wholesale sector’s gain of 26.3%. Additionally, this Zacks Rank #3 (Hold) stock exhibits a VGM Score of B with a long-term earnings growth rate of 8%, highlighting its inherent potential.

Let’s Dive Deep

Growth Drivers

Gap’s new growth strategy looks quite appeasing. The company is now shifting focus to its two growth brands — Old Navy and Athleta. Over the next few years, it expects net sales of more than $10 billion and $1 billion, respectively, at each of the brands owing to U.S. store expansion and mobile and e-commerce growth.

Additionally, management plans to open 270 Old Navy and Athleta stores while closing 200 underperforming Gap and Banana Republic stores, simultaneously, over the next three years.

As consumers have been gradually shifting to online shopping, Gap is enhancing its e-commerce and omni-channel capabilities by adopting a number of initiatives. To this end, the company has increased its online presence across all of its brands. In fact, its online division is posting double-digit sales growth. Gap also announced plans to launch the buy online, pick-up in store service, a new personalization engine that is powered by customer data, and continued significant investment in its omni-channel services. We believe these initiatives should boost Gap’s top line and overall performance.

Robust Surprise History & Upbeat Outlook

Gap delivered its third consecutive positive earnings surprise with fourth straight sales beat in third-quarter fiscal 2017. In addition, comparable store sales (comps) reflected strength for the fourth consecutive quarter amid a tough retail scenario. Though comps growth was backed by continued gains at Old Navy brand and growth at its namesake brand, it was partly offset by comps decline at Banana Republic.

Driven by its initiatives and a solid performance in the first three quarters of fiscal 2017, management raised full-year outlook. Gap now envisions adjusted earnings in the range of $2.08-$2.12 per share compared with $2.02-$2.10, projected earlier. Further, comps are anticipated to be up low-single-digits versus previous projection of flat to marginal improvement.

Consequently, the Zacks Consensus Estimate for fiscal 2017 has moved up by 4 cents to $2.10 in the last seven days.

Concerns/Weaknesses

Gap’s significant international presence exposes the company to adverse currency fluctuations. Though its earnings and sales topped estimates in third-quarter fiscal 2017, currency headwinds caused earnings to decline year over year. Evidently, the bottom line fell 3.3% in the quarter compared with the year-ago period. In the fiscal second quarter, earnings and revenues were down on a year-over-year basis.

Also, the company has been witnessing persistent softness across Banana Republic for a while now. Evidently, its comps declined 4%, 5% and 1% in the first, second and third quarters, respectively.

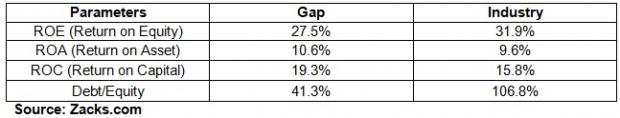

Gap Vs Industry

Looking for Solid Picks, Check These

Some better-ranked stocks in the same industry include Urban Outfitters, Inc. (NASDAQ:URBN) , The Buckle, Inc. (NYSE:BKE) and Zumiez Inc. (NASDAQ:ZUMZ) .

Urban Outfitters, with a long-term earnings growth rate of 11.5% has pulled off an average positive earnings surprise of 5.7% in the last four quarters. It also sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Buckle, with a Zacks Rank #1 has delivered an average positive earnings surprise of 3.8% in the last four quarters.

Zumiez, with a long-term earnings growth rate of 18% carries a Zacks Rank #2 (Buy). Also, its earnings have outpaced the Zacks Consensus Estimate in each of the trailing four quarters by an average of 27.1%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Zumiez Inc. (ZUMZ): Free Stock Analysis Report

Gap, Inc. (The) (GPS): Free Stock Analysis Report

Urban Outfitters, Inc. (URBN): Free Stock Analysis Report

Buckle, Inc. (The) (BKE): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Whenever Wall Street authoritative figures, such as a large institution or individual investor, decide to shift a view on a specific stock or industry, retail traders can...

Monster Beverage (NASDAQ:MNST) faces headwinds that make it a potentially scary buy, including weakness in the alcohol segment. With the alcohol business contracting in Q4 2024,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.