- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Gap Shares Rally On Strong Earnings, Total Comps Up 5%

Gap Inc. (NYSE:GPS) just released its fourth quarter fiscal 2017 financial results, posting earnings of 61 cents per share and revenues of $4.8 billion. The stock is 9% to $34.55 per share shortly after the report was released.

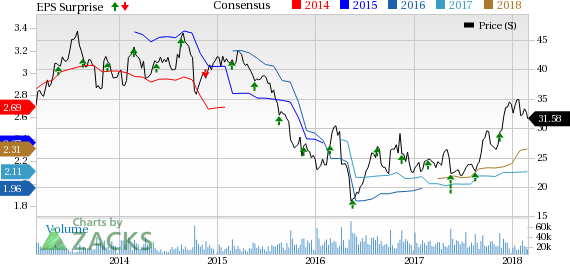

Currently, GPS is a #2 (Buy) on the Zacks Rank, and our consensus estimate trend has increased for the next few periods.

Gap:

Beat earnings estimates. The retail giant reported earnings of 61 cents per share, surpassing the Zacks Consensus Estimate of 59 cents per share.

Beat revenue estimates. The company saw sales of $4.8 billion, topping our consensus estimate of $4.68 billion and growing 8% year-over-year.

Gap delivered its fifth consecutive quarter of positive comparable sales growth, up 5% this quarter. Breaking it down by brand, Old Navy saw 9% comps, Gap Global saw flat, and Banana Republic had 1% growth.

The company also reported fiscal 2017 gross margin expansion of 200 basis points.

For fiscal 2018, Gap expects diluted EPS in the range of $2.55 to $2.70 and comparable sales to be flat to up slightly.

“Our strong positive comp and margin expansion during the critical holiday quarter affirms our balanced growth strategy,” said Art Peck, president and chief executive officer, Gap Inc. “Our outlook for 2018 demonstrates confidence in our strategy and a meaningful step up in earnings capacity for the company.”

“We are positioning the company for long term growth,” said Teri List-Stoll, executive vice president and chief financial officer, Gap Inc. “In addition to leveraging productivity initiatives to fund investments in the business, recent tax reform changes provide a meaningful increase in future earnings.”

Here’s a graph that looks at Gap’s price, consensus, and EPS surprise:

The Gap, Inc. is a global specialty retailer which operates stores selling casual apparel, personal care and other accessories for men, women and children under the Gap, Banana Republic and Old Navy brands. The company designs virtually all of its products, which in turn are manufactured by independent sources, and sells them under its brand names.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Gap, Inc. (The) (GPS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Nvidia is scheduled to release its Q4 earnings report at 4:20PM ET on Wednesday. A call with CEO Jensen Huang is set for 5:00PM ET. The chipmaker’s results will serve as a...

Warren Buffett has always critiqued airline stocks for being overly capital-intensive, exhibiting low growth, and relying heavily on cyclical consumer travel patterns—further...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.