- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Gap (GPS) Stock Surges On Earnings Beat, Strong Same-Store Sales & Guidance

Gap Inc. (NYSE:GPS) just released its third quarter fiscal 2017 financial results, posting earnings of 58 cents per share and revenues of $3.84 billion. Currently, GPS is a #4 (Sell) on the Zacks Rank, and is up almost 7% to $29.34 per share in trading shortly after its earnings report was released.

Gap:

Beat earnings estimates. The apparel retailer reported adjusted earnings of 58 cents per share, beating the Zacks Consensus Estimate of 55 cents per share. Net income was $229 million for the quarter.

Beat revenue estimates. The company saw revenue figures of $3.84 billion, beating our consensus estimate of $3.77 billion.

Gap reported total comparable store sales of 3%, marking the fourth consecutive quarter of positive comparable sales growth. By brand, Old Navy reported comps of 4%, Gap Global saw comps of 1%, but Banana Republic saw negative 1% in this area (compared to negative 6% last year).

Looking ahead, Gap increased its reported adjusted EPS guidance for fiscal year 2017 to the range of $2.08 to $2.12 per share versus previous guidance of $2.02 to $2.10. The company also expects comps for the year to be up low-single-digits.

“Today, we are happy to report our fourth consecutive quarter of positive comps, reflecting the continued momentum in key parts of our business,” said Art Peck, president and chief executive officer, Gap Inc. “We continue to make progress against the balanced growth strategy we outlined in September, driving efficiency at our more mature brands, while growing our footprint in the value and active space, and investing in our online and mobile experience.”

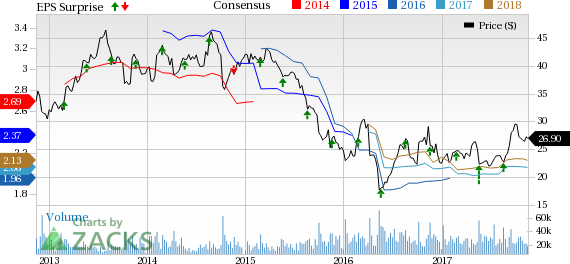

Here’s a graph that looks at Gap’s price, consensus, and EPS surprise:

The Gap, Inc. is a global specialty retailer which operates stores selling casual apparel, personal care and other accessories for men, women and children under the Gap, Banana Republic and Old Navy brands. The company designs virtually all of its products, which in turn are manufactured by independent sources, and sells them under its brand names.

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, and for the next month, you can follow all Zacks’ private buys and sells in real time. Our experts cover all kinds of trades: value, momentum, ETFs, stocks under $10, stocks that corporate insiders are buying up, and companies that are about to report positive earnings surprises. You can even look inside portfolios so exclusive that they are normally closed to new investors. Click here for Zacks' private trades >>

Gap, Inc. (The) (GPS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

In a striking reversal of fortunes, equities in developed markets ex-US are now leading the major asset classes in 2025 while US shares are posting a modest loss year to date,...

US index futures broke lower after Marvell Technology's earnings missed. Nasdaq and S&P 500 are now testing key support zones. Meanwhile, Amazon, Oracle, Tesla and...

There was some modest buying today from the open, but volume was light and markets are below trading range support established during the latter part of 2024. It's hard to see...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.