- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Gap (GPS) Gains Momentum In A Month: Is It Sustainable?

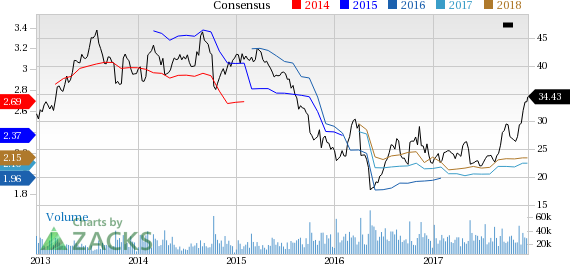

The Gap Inc. (NYSE:GPS) has picked up momentum in the past one month from robust top and bottom-line performance in third-quarter fiscal 2017 and a solid comparable store sales (comps) trend. Additionally, constant focus on product quality enhancement, new growth strategy and responsiveness toward changing consumer behavior has rewarded the company well.

Notably, Gap’s shares have gained 15% in the past month, outperforming the industry’s growth 12.9%. Moreover, the stock has witnessed a substantial 57.8% increase year to date.

.jpg)

Let us analyze the factors influencing the Zacks Rank #3 (Hold) company’s performance.

Robust Surprise Trend

The success of the company’s endeavors is clearly visible from its surprise history and upbeat outlook for fiscal 2017. Gap witnessed the third successive earnings beat in the last reported quarter and the fourth consecutive positive sales surprise. Also, improved traffic led to the fourth straight quarter of comps growth for the Old Navy brand. The company’s namesake brand also reflected comps strength. Clearly, Gap’s growth initiatives are paying off, which along with a solid performance in the nine months of fiscal 2017 encouraged management to raise the outlook for the full fiscal.

New Growth Strategy – Focus on Growth Brands

Over the past two years, Gap has significantly improved its customer satisfaction by delivering quality products faster and more consistently. Now, it has shifted its focus on growth brands, Old Navy and Athleta, as part of its new expansion strategy. The company expects net sales to exceed $10 billion for Old Navy and more than $1 billion for Athleta in the next few years.

Investments in Online and Digital Platforms Bode Well

Gap has been gaining from consistent focus on enhancing product quality and responsiveness to changing consumer trends. Constant efforts to bolster digital and mobile offerings, alongside improving product acceptance, are worth mentioning in this regard. Gap is strengthening its e-commerce and omni-channel capabilities to streamline the North American business. Recently, it announced a buy online, pick-up in store service and many more investments in omni-channel services, which have helped enriched customer experience. Notably, the company has increased its online presence across all of its brands, and its online division is one of its most profitable, posting double-digit sales growth.

Hurdles to Cross

While all is well with Gap’s fundamentals, currency headwinds may dampen its operating performance due to significant international presence. Though earnings and sales topped estimates in third-quarter fiscal 2017, currency headwinds caused earnings per share to decline year over year. Evidently, adverse currency movements dented third-quarter bottom-line growth by nearly 3 percentage points.

Do Retail-Wholesale Stocks Grab Your Attention? Check These

Investors interested in the retail sector may also consider stocks such as American Eagle Outfitters Inc. (NYSE:AEO) , Burlington Stores Inc. (NYSE:BURL) and Dollar Tree Inc. (NASDAQ:DLTR) . While American Eagle sports a Zacks Rank #1 (Strong Buy), Burlington Stores and Dollar Tree carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

American Eagle delivered an average positive earnings surprise of 2.6% in the trailing four quarters. It has a long-term earnings growth rate of 8.7%.

Burlington Stores has an average positive earnings surprise of 15.2% in the trailing four quarters. It has a long-term earnings growth rate of 17.5%.

Dollar Tree pulled off an average positive earnings surprise of 7.4% in the trailing four quarters. Also, it has a long-term earnings growth rate of 13.1%.

Zacks Editor-in-Chief Goes "All In" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Download it free >>

American Eagle Outfitters, Inc. (AEO): Free Stock Analysis Report

Gap, Inc. (The) (GPS): Free Stock Analysis Report

Dollar Tree, Inc. (DLTR): Free Stock Analysis Report

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

At the end of February, Lululemon (NASDAQ:LULU), DoorDash (NASDAQ:DASH), and Ulta Beauty (NASDAQ:ULTA) were among the Most Upgraded Stocks tracked by MarketBeat. Investors should...

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.