- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

GameStop's (GME) Q4 Earnings Beat Estimates, Stock Rises

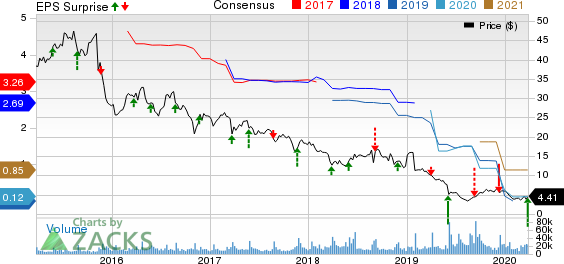

Shares of GameStop Corp. (NYSE:GME) increased roughly 10% during the after-market trading session on March 26. This upside can be attributed to the company’s positive earnings surprise during fourth-quarter fiscal 2019, which follows a miss in the preceding two quarters. Further, management’s commentary that it is experiencing a positive impact on its business due to the coronavirus outbreak contributed to the stock’s upside.

However, we note that the company continued to grapple with dismal top-line performance. Net sales not only missed the Zacks Consensus Estimate for the fifth quarter in row but also declined year over year. Comparable store sales results also disappointed. Further, management highlighted that the company continues to witness temporary headwind related to lower current generation console hardware and software sales. This is due to customers delaying console purchases in anticipation of new platform launches expected in the later part of 2020.

Nonetheless, this Grapevine, TX-based company is trying all means to uplift performance. GameStop is exiting loss-incurring businesses and closing underperforming stores. The company began to wind down operations in Denmark, Finland, Norway and Sweden to counter the weak industry trends, and is likely to exit these markets by late July. The company is utilizing the proceeds from sale of non-core business units to lower debt burden.

Undoubtedly, GameStop remains focused on containing costs, optimizing inventory and expanding high margin product categories such as PC gaming accessories, private label and collectibles. The company also plans to augment store experience, expand and redesign PowerUp Rewards loyalty program, enhance digital capabilities and improve engagement with vendors and partners. The company is also augmenting omni-channel features such as “Buy Online Pick Up In Store.”

Notably, the company attained cost reduction of $130 million on an adjusted basis, lowered inventory by 31% that contributed to gross margin expansion and reduced debt load by $401 million during fiscal 2019. The company closed net 321 stores — inclusive of 333 closings and 12 openings — during fiscal 2019, and plans to close an equivalent number of stores or more in fiscal 2020.

Shares of this Zacks Rank #2 (Buy) company have surged 22.5% in a month against the industry’s decline of 23.7%.

Q4 Performance

GameStop’s adjusted earnings of $1.27 per share surpassed the Zacks Consensus Estimate of 84 cents. However, the quarterly earnings came below the prior-year adjusted figure of $1.45 per share. Net sales of $2,194.1 million declined 28.4% year over year thanks to soft comparable store sales performance, store closures and adverse currency fluctuations. Moreover, the top line lagged the Zacks Consensus Estimate of $2,363 million.

We note that consolidated comparable store sales fell 26.1%, following a decline of 23.2% in the preceding quarter. The downside can be attributed to lower traffic. The company also witnessed declines across all three categories namely, hardware and accessories, software and collectibles.

By sales mix, hardware and accessories sales declined 32.5% to $964.8 million. This is reflective of announcements for next generation console launches in 2020. Software sales fell 27.8% to $984.3 million owing to lower number of new title launches. Collectibles sales decreased 9.2% to $245 million due soft traffic.

Moving on, gross profit fell 20.2% year over year to $597.3 million. However, gross margin expanded 280 basis points to 27.2%, driven by mix shift to higher-margin categories and better inventory management.

Adjusted SG&A expenses declined 10.7% to $488.1 million in the reported quarter on account of cost reduction initiatives. However, as a percentage of net sales, the metric deleveraged 440 basis points to 22.2%. The company reported adjusted operating income of $109.2 million, down 46.1% from the prior-year quarter. Again, adjusted operating margin contracted 160 basis points to 5%.

Other Financial Aspects

GameStop ended the quarter with cash and cash equivalents of $499.4 million, long-term debt of $419.8 million (down 49% year over year) and stockholders’ equity of $611.5 million. Accounts payable were down 64% to $380.8 million. The company ended the quarter with total inventory of $859.7 million, compared with $1,250.5 million in the prior year. During the quarter, the company incurred capital expenditures of $17 million.

During the quarter, the company bought back 3.5 million shares of worth $20.1 million. This brings the total repurchase activity to $199 million for 38.1 million shares for fiscal 2019. The company had roughly $101 million remaining under its share buyback authorization at the end of the fourth quarter.

Check These 3 Trending Stocks

Genesco (NYSE:GCO) has a long-term earnings growth rate of 5% and a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Best Buy (NYSE:BBY) has a long-term earnings growth rate of 7.6% and a Zacks Rank #2.

Costco (NASDAQ:COST) has a long-term earnings growth rate of 8.4%. The stock carries a Zacks Rank #2.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Best Buy Co., Inc. (BBY): Free Stock Analysis Report

GameStop Corp. (GME): Free Stock Analysis Report

Costco Wholesale Corporation (COST): Free Stock Analysis Report

Genesco Inc. (GCO): Free Stock Analysis Report

Original post

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.