- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Fresenius Medical (FMS) Q4 Earnings Beat, View Impressive

Fresenius Medical Care (NYSE:FMS) posted adjusted earnings of 69 cents per American Depositary Share (ADS) in the fourth quarter of 2017, beating the Zacks Consensus Estimate of 61 cents. Earnings per ADS increased 9.5% on a year-over-year basis.

In the quarter under review, revenues increased 11.3% year over year to $5,216 million but missed the Zacks Consensus Estimate of $5,370 million. At constant currency (cc), revenue improved 8% year over year.

The stock has a Zacks Rank #3 (Hold).

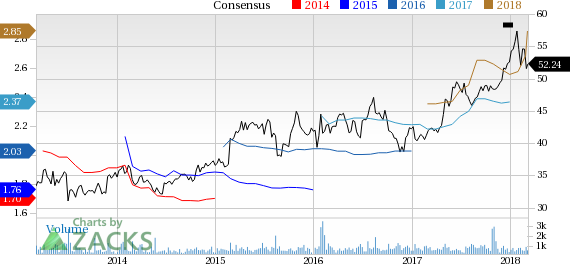

Fresenius Medical Care Price and Consensus

Segmental Details

Health Care Services revenues rose 8% at cc on a year-over-year basis. The segment gained from increased organic revenues from Care Coordination, growth in dialysis services and contributions from acquisitions.

Health Care Products revenues increased 8% at cc on a year-over-year basis. Higher sales of dialyzers, machines, peritoneal dialysis products, renal pharmaceuticals, bloodlines and products for acute care were the driving factors.

Geographical Growth

North America Revenues

By geography, North America revenues rose 8% at cc on a year-over-year basis and accounted for 71.4% of total revenues. Health Care Services in the region grew 8% at cc while Health Care Products revenues improved 9% at cc on a year-over-year basis. Fourth-quarter organic growth at the segment was solid at 19% on a year-over-year basis.

This was fueled by higher dialysis treatments and an increase in U.S. revenues per treatment. The Dialysis Care business grew 3% at cc on a year-over-year basis in the region. Meanwhile, the Care Coordination segment delivered an improvement of 24% at cc.

Unfavorable foreign exchange rates partially offset solid growth in the region.

EMEA Revenues

Revenues in the region increased 6% on a year-over-year basis at cc. Health Care Services revenues from the EMEA segment increased 4% at cc on a year-over-year basis. Health Care Products revenues rose 7% at cc in the fourth quarter.

The Health Care Services segment was primarily driven by growth in same-market treatments, partially offset by a decline in organic revenue per treatment. The growth in Dialysis Products revenues in the region was boosted by higher sales of products for acute care, products for peritoneal dialysis and machines. However, this was partially offset by lower sales of dialyzers.

Asia-Pacific Revenues

Revenues from Asia Pacific grew 12% at cc on a year-over-year basis. Net Health Care Services Unit increased 17% at cc. Meanwhile, Health Care Products Business increased 7% at cc on a year-over-year basis.

The Health Care Services segment in the Asia-Pacific region was supported by the acquisition of Cura Group in Australia. Dialysis treatments in the region increased 7% at cc, which drove Health Care Products sales in the segment.

Latin America Revenues

Revenues in the region increased 16% at cc on a year-over-year basis. Notably, Health Care Services segment at the region increased 16%, while Health Care Products increased 15% year over year.

Solid sales of machines and disposables and Dialysis treatments drove revenues in Latin America.

Guidance

For full-year 2018, Fresenius estimates revenue growth of 8% at cc. Net income attributable to shareholders is likely to increase around 13-15%.

Our Take

Fresenius Medical’s strong guidance for 2018 instills optimism. The company reconfirmed the mid-term outlook of its ‘Growth Strategy 2020,’ under which it aims to boost revenues to $28 billion by 2020, corresponding to an average annual growth rate of around 10%. A wide range of dialysis products, initiatives to gain market traction, strong international foothold, strategic acquisitions and divestments act as major catalysts for the company.

However, higher costs related to dialysis services, peritoneal dialysis product business in China and the impact from foreign currency transaction effects are likely to dent margins. Having a strong international foothold, Fresenius Mediacal faces a highly regulated environment in almost every country in which it operates. Furthermore, the company has to fulfill specific legal requirements that include tough antitrust regulations. Thus, regulatory hurdles and competition in the niche markets are major headwinds.

Key Picks

A few better-ranked stocks in the broader medical sector are MEDNAX, Inc. (NYSE:MD) , ICU Medical, Inc. (NASDAQ:ICUI) and athenahealth, Inc. (NASDAQ:ATHN) . All the stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

MEDNAX has an expected long-term growth rate of 10%. The stock delivered a positive earnings surprise of 3.6% in the last quarter.

ICU Medical has an expected long-term growth rate of 10%. The stock delivered a positive earnings surprise of 204.1% in the last quarter.

athenahealth has a projected long-term growth rate of 20.7%. The stock delivered a positive earnings surprise of 73.4% in the last quarter.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

athenahealth, Inc. (ATHN): Free Stock Analysis Report

Fresenius Medical Care (FMS): Free Stock Analysis Report

ICU Medical, Inc. (ICUI): Free Stock Analysis Report

Mednax, Inc (MD): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Stocks fell sharply, with the S&P 500 leading the decline, finishing the day down almost 1.6% at 5,860. Meanwhile, the Nasdaq 100 dropped nearly 2.75%, closing at 20,550. This...

The stock market has hit a rough patch lately, with the benchmark SPDR S&P 500 (NYSE:SPY) sliding nearly 3% in a single week. Most sectors have followed the downward trend,...

Regimes are changing in the market, and this could mean a few things, but today, it means that volatility is back. Whenever these shifts come, specifically to the S&P 500...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.