- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Fox's (FOXA) Tubi Acquisition To Boost Streaming Platform

Fox (NASDAQ:FOXA) is set to expand its footprint in the streaming space through the acquisition of Tubi. The company will pay $440 million per the buyout agreement for this free ad-supported streaming provider, which is currently available on more than 25 digital platforms in the United States.

Tubi, which is particularly popular among younger viewers, boasts an enviable content portfolio of more than 20,000 titles and 56,000 hours of film and episodic television programming from more than 250 partners including a number of major studios. Tubi’s users spend more than 160 million hours monthly on viewing content.

The deal will grow the strength of Fox’s direct-to-consumer audience and its capabilities, as suggested by CEO Lachlan Murdoch. Fox will integrate its digital advertising, direct-to-consumer features and personalization technology into Tubi's advertising platform.

The company plans to run Tubi as an independent service but doesn’t expect to add original programming in the near future. Instead, the company will focus on adding national and local news plus sports programming content, spaces in which it has a solid expertise.

Notably, Fox, which became a standalone, publicly-traded company on Mar 21, 2019, following the merger of Disney and Twenty-First Century Fox, will add Tubi to a portfolio that comprises FOX News, FOX Business, FOX Sports and 28 owned-and-operated local Fox television stations.

Fox will fund the deal from the proceeds of a roughly 5% stake sale in Roku (NASDAQ:ROKU) . The Tubi transaction is expected to close before Jun 30, 2020.

Tubi Takeover to Amplify Fox’s Ad Sales

The Tubi acquisition will drive Fox’s brand value among advertisers. Notably, advertising revenues, which accounted for 53.2% of Fox’s revenues in the last-reported quarter, inched up 1.2% year over year to $2.01 billion. This uptick was attributable to higher sports and entertainment advertising revenues at the FOX Network.

Fox’s Tubi acquisition will help it generate solid advertising revenues. Per an IHS Markit report, new advertising video-on-demand (AVOD) rollouts and improved ad-tech are expected to augment U.S. online video advertising revenues to $27 billion in 2023, seeing a CAGR of 11% between 2018 and 2023.

This projection indicates sturdy growth prospects not only for Fox but also for the likes of Comcast (NASDAQ:CMCSA) and ViacomCBS (NASDAQ:VIAC) owing to their acquisitions of Xumo and PlutoTV, respectively.

Notably, Xumo, an advertising-supported free streaming service pulls streams from partners like ABC News, Fox Sports and USA Today and comes pre-installed on smart televisions. Xumo has around 10 million monthly active users (MAUs), up from 5.5 million MAUs reported in the spring of 2019, per a Variety report.

Moreover, Pluto TV has more than 22 million active users, up 75% year over year. ViacomCBS expects the ad-supported service to garner 30 million subscribers by December 2020 end. Notably, Pluto TV is already available across the United Kingdom, Germany, Austria and Switzerland and is set to launch in Latin America.

Zacks Rank

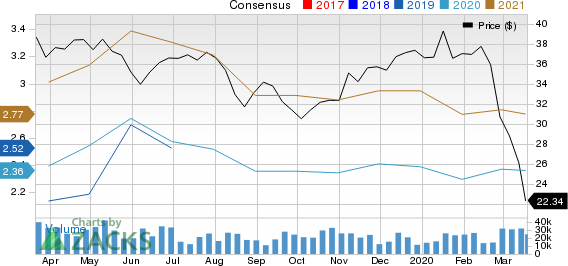

Fox currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Comcast Corporation (CMCSA): Free Stock Analysis Report

Fox Corporation (FOXA): Free Stock Analysis Report

Roku, Inc. (ROKU): Free Stock Analysis Report

ViacomCBS Inc. (VIAC): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

Bitcoin has gained legitimacy as it has achieved mainstream status these days. Even the United States Securities and Exchange Commission (SEC) has acknowledged its legitimacy with...

Stocks fell sharply, with the S&P 500 leading the decline, finishing the day down almost 1.6% at 5,860. Meanwhile, the Nasdaq 100 dropped nearly 2.75%, closing at 20,550. This...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.