- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Foot Locker (FL) Q4 Earnings Top, Sales Miss, Stock Declines

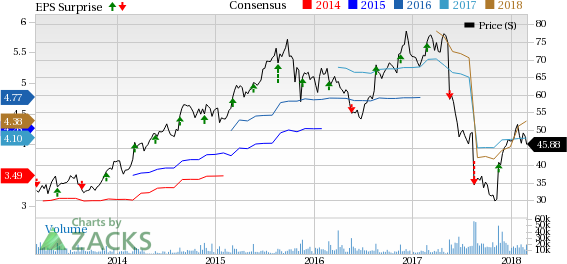

Shares of Foot Locker, Inc. (NYSE:FL) fell during pre-market trading hours, in spite of reporting positive earnings surprise for the second straight quarter. The stock is down more than 7% following the announcement of fourth-quarter fiscal 2017 results due to lower-than-expected top-line results and muted outlook.

We note that in the past three months, the stock has increased 0.3% compared with the industry’s decline of 1.7%.

This operator of athletic shoes and apparel retailer posted quarterly earnings of $1.26 per share that beat Zacks Consensus Estimate by a penny. However, the bottom line fell 8% year over year, following declines of 23% and 34% in the third and second quarter, respectively. Management highlighted that the 53rd week contributed 12 cents a share to earnings. Excluding this, earnings plunged 16.8% year over year.

The New York-based retailer generated total sales of $2,210 million that fell short of the Zacks Consensus Estimate of $2,222 million, after surpassing the same in the preceding quarter. However, sales improved 4.6% year over year, after sliding 0.8% and 4.4% in the third and second quarter, respectively. Excluding the impact of foreign currency fluctuations, total sales grew 2%.

.jpg)

Comparable-store sales fell 3.7% during the quarter under review, following declines of 3.7% and 6% in the third and second quarter, respectively.

Gross margin contracted 230 basis points to 31.4% primarily due to intense promotional environment. SG&A expense rate increased 40 basis points to 19.1% during the quarter.

Store Update

During the quarter under review, Foot Locker opened 28 new outlets, remodeled or relocated 45 outlets, and shuttered 67 outlets. As of Feb 3, 2018, the company operated 3,310 outlets across 24 countries in North America, Australia, New Zealand and Europe. Apart from these, there are 98 franchised Foot Locker stores in the Middle East. Germany has 14 franchised Runners Point stores.

Other Financial Details

Foot Locker ended the quarter with cash and cash equivalents of $849 million, long-term debt and obligations under capital leases of $125 million, and shareholders’ equity of $2,519 million. During the quarter, the company repurchased 2.8 million shares of worth $105 million and paid a quarterly dividend of 31 cents a share.

Management incurred capital expenditures of $270 million during the fiscal year in its fleet of stores, digital platform, logistics capabilities and infrastructure.

Outlook

Management now envisions comparable-store sales to be flat to up low single-digit for fiscal 2018 compared with 3.1% decline registered in fiscal 2017. Further, Foot Locker expects gross margin to recover from 2017’s level. However, SG&A expense rate is expected to increase by 100 basis points in fiscal 2018 due to increase in digital investments.

Foot Locker expects first-quarter sales and margins in line with trends witnessed in the second half of fiscal 2017. However, management stated that it remain optimistic that comparable-store sales will turn positive by the middle of 2018. Moreover, pace of sales is likely to improve in the second half of the year.

Further, taking into account lower share count and effective tax rate in the band of 27-28% management projects double-digit percentage growth in annual earnings per share.

Wrapping Up

Foot Locker is certainly trying to improve performance through operational and financial initiatives. This Zacks Rank #2 (Buy) company revealed a capital expenditure program of $230 million for 2018. The company plans to spend the capital strategically with primary focus being on developing digital competencies and supply chain. The company’s digital endeavors comprise improvement of mobile and web platforms, implementation of new point-of-sale software worldwide, and expansion of data analytics capabilities.

Interested in Retail Space? Check These 3 Trending Stocks

Zumiez (NASDAQ:ZUMZ) delivered an average positive earnings surprise of 22.2% in the trailing four quarters. The company has a long-term earnings growth rate of 18% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

G-III Apparel (NASDAQ:GIII) delivered an average positive earnings surprise of 6.1% in the trailing four quarters. It has a long-term earnings growth rate of 15% and a Zacks Rank #2.

The Children's Place, Inc. (NASDAQ:PLCE) delivered an average positive earnings surprise of 14% in the trailing four quarters. It has a long-term earnings growth rate of 9% and a Zacks Rank #2.

Don’t Even Think About Buying Bitcoin Until You Read This

The most popular cryptocurrency skyrocketed last year, giving some investors the chance to bank 20X returns or even more. Those gains, however, came with serious volatility and risk. Bitcoin sank 25% or more 3 times in 2017.

Zacks’ has just released a new Special Report to help readers capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 4 crypto-related stocks now >>

Zumiez Inc. (ZUMZ): Free Stock Analysis Report

Foot Locker, Inc. (FL): Free Stock Analysis Report

Children's Place, Inc. (The) (PLCE): Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.