- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Foot Locker (FL) Beats On Q3 Earnings & Sales, Stock Up

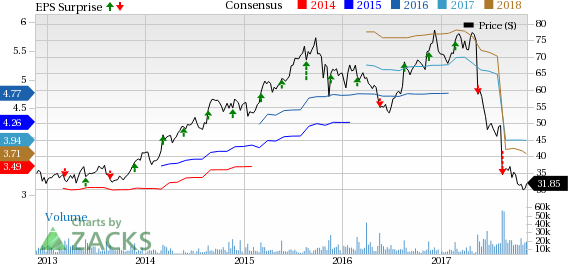

Foot Locker, Inc. (NYSE:FL) , the operator of athletic shoes and apparel retailer, came out with third-quarter fiscal 2017 results, wherein adjusted earnings of 87 cents a share beat the Zacks Consensus Estimate of 80 cents but declined 23% year over year.

Earnings Estimate Revision: The Zacks Consensus Estimate for fiscal 2017 has decreased by a penny in the past 30 days. In the trailing four quarters (excluding the quarter under review), the company has underperformed the Zacks Consensus Estimate by an average of 6.6%.

Revenues: Foot Locker generated total sales of $1,870 million that came ahead of the Zacks Consensus Estimate of $1,843 million but decreased 0.8% year over year. Comparable-store sales fell 3.7% during the quarter. Excluding the impact of foreign currency fluctuations, total sales dropped 2.3%.

Key Events: During the quarter under review, Foot Locker opened 12 new outlets, remodeled or relocated 41 outlets, and shuttered 22 outlets. As of Oct 28, 2017, the company operated 3,349 outlets. During the quarter, the company repurchased 8.69 million shares of worth $304 million.

Zacks Rank: Currently, Foot Locker carries a Zacks Rank #3 (Hold), which is subject to change following the earnings announcement. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stock Movement: Foot Locker’s shares are up nearly 14% during pre-market trading hours following the earnings release.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Foot Locker, Inc. (FL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

US index futures broke lower after Marvell Technology's earnings missed. Nasdaq and S&P 500 are now testing key support zones. Meanwhile, Amazon, Oracle, Tesla and...

There was some modest buying today from the open, but volume was light and markets are below trading range support established during the latter part of 2024. It's hard to see...

As the digital economy starts to go online across businesses and the world, investors have to be aware of the companies and services that will be at the forefront of this...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.