- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Fluor (FLR) Led Joint Venture Selected By MBTA In Boston

Fluor Corporation (NYSE:FLR) recently declared that the Massachusetts Bay Transportation Authority (“MBTA”) selected Fluor-led joint venture (JV) as the design-build team for the projected $2 billion Green Line Light Rail Extension in Boston. Share of the contract value will be booked into backlog of the company in the fourth quarter of this year.

Fluor will lead the JV team consisting of Balfour Beatty Infrastructure, Herzog Contracting Group and The Middlesex Corp. The project is scheduled to begin construction next year and open for service in late 2021.

Working in collaboration with MBTA, the project includes seven new stations including a vehicle storage and maintenance facility, the relocated Lechmere Station and two distinct branches. It also includes a mainline branch in Cambridge as well as a branch line in Somerville.

The project is anticipated to solve longstanding transportation problems by improving local as well as regional mobility by providing a one-seat ride to downtown Boston. This in turn will reduce greenhouse gas emissions as well as congestion. The estimated daily ridership at these seven stations is projected to be 45,000 by 2030.

Our Take

Fluor’s strategy of maintaining a good business portfolio mix permits it to focus on the more stable business markets and capitalize on developing the cyclical markets at suitable times. The long-term prospects of the company remain strong with existing growth opportunities in renewable energy, gas-fired combined cycle generation and air emissions compliance projects for existing coal-fired power plants.

The company maintains a strong focus on enhancing competitive position in the market through prudent leadership initiatives and strategic alliances. In this regard, it has undertaken a restructuring initiative under its construction and fabrication operations to improve control and delivery of projects, consequently enhancing client satisfaction. Such strategic collaborations are expected to be accretive to the company’s financials and contribute to long-term growth.

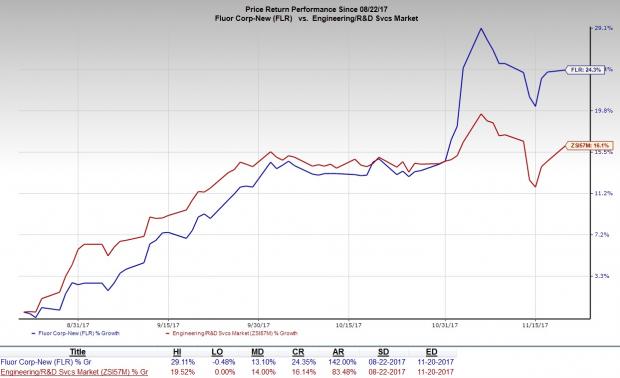

This apart, the company keeps an impressive track record of receiving awards, and management remains optimistic about continuation of this trend in future as well, which is expected to drive growth for the company. Further, the company has strong long-term prospects in fields like in renewable energy, gas-fired combined cycle generation and air emissions compliance projects. The company has returned 24.4% in the past three months, outperforming the industry’s gain of 16.1%.

However, the fact remains that, the Zacks Rank #3 (Hold) company has been witnessing continuous backlog erosion over the past few quarters. The backlog erosion can be attributable to exclusion of large reimbursable nuclear projects. Moreover, the company’s margins are under pressure as it is transitioning from higher margin engineering to lower margin construction activities, particularly related to Energy & Chemicals and Mining segment.

This apart, volatility in commodity prices, and the cyclical nature of the company’s commodity-based business lines, poses significant challenges in the near term. Moreover, going forward, the company believes that clients of Energy, Chemicals and Mining segment will maintain a cautious approach while taking investment decisions which is likely to add to the woes.

Stocks to Consider

Some better-ranked stocks from the same space include EMCOR Group, Inc. (NYSE:EME) , Jacobs Engineering Group Inc. (NYSE:JEC) and Willdan Group, Inc. (NASDAQ:WLDN) . While EMCOR Group sports a Zacks Rank #1 (Strong Buy), Jacobs Engineering Group and Willdan Group carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

EMCOR Group has surpassed estimates thrice in the trailing four quarters, with an average positive earnings surprise of 17.0%.

Jacobs Engineering Group has surpassed estimates thrice in the trailing four quarters, with an average positive earnings surprise of 4.8%.

Willdan Group has outpaced estimates in the preceding four quarters, with an average earnings surprise of 44.8%.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Jacobs Engineering Group Inc. (JEC): Free Stock Analysis Report

EMCOR Group, Inc. (EME): Free Stock Analysis Report

Fluor Corporation (FLR): Free Stock Analysis Report

Willdan Group, Inc. (WLDN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Walgreens Boots Alliance Inc. (NASDAQ:WBA) is on the brink of a significant transformation as it nears a deal with Sycamore Partners to become a private entity. The transaction,...

Using the Elliott Wave Principle (EWP), we have been successfully tracking the most likely path forward for the S&P 500 (SPX) over several months. Although there are many ways...

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.