- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

FEMSA (FMX) To Enter Specialized Distribution Industry In US

Fomento Economico Mexicano, S.A.B. de C.V. (NYSE:FMX) , alias FEMSA, signed pacts with shareholders of WAXIE Sanitary Supply (“WAXIE”) and North American Corporation (“North American”), to enter a new platform within the Jan-San (the janitorial, sanitary supply), Packaging and Specialized distribution industry in the United States. The new platform will benefit from the expertise of two market leaders — WAXIE and North American — with FEMSA having a majority stake in the combined company. FEMSA plans to invest nearly $900 million in the venture.

Following the completion of the aforesaid deal, the current shareholders of WAXIE and North American will be the investors in the combined company. The companies will retain their management teams, with the current CEOs serving as the co-CEOs of the new enterprise.

The investment is in sync with FEMSA’s strategic plan of investing in adjacent businesses, which can leverage capabilities across different markets, and providing an opportunity for attractive growth and risk-adjusted returns. With the presence of its OXXO business and other retail operations, the company has become an expert in the organization and management of supply chains and distribution systems. Notably, FEMSA serves large numbers of businesses and retail customers through millions of interactions in different industries.

The company expects the aforementioned transaction to close in the first semester of 2020, after receiving the required regulatory approvals.

WAXIE and North American are leading consumable distributors in the janitorial, sanitary supply and packaging industry, with complementary market footprints. These companies currently operate 26 distribution centers across the country and serve more than 27,000 customers in industries like building service contractors, education, government, retail and hospitality.

The companies together generate annual revenues of more than $900 million. WAXIE has headquarters in San Diego, CA, and North American is headquartered in Chicago, IL.

Notably, FEMSA has been benefiting from its growth via acquisition strategy. The recent acquisitions of a minority stake in Jetro Restaurant Depot, AGV and a 40% stake in Grupo Socofar as well as the joint venture with Raízen reveal its commitment to invest in the expansion of core businesses. Additionally, FEMSA Comercio’s drugstore business, operating under the brands YZA, Farmacon, Moderna, Cruz Verde, Fybeca and SanaSana, is viewed to have significant growth potential.

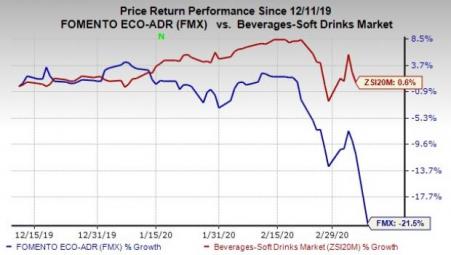

However, shares of the Zacks Rank #4 (Sell) company have declined 21.5% in the past three months against the industry’s 0.6% growth. The soft stock performance can be attributed to the company’s soft operating results across some divisions in the past few quarters. Operating margins at FEMSA Comercio’s Health and Proximity Divisions in third-quarter 2019 were hurt by operating expense deleverage in these units. Tariff-related and higher input costs are headwinds hurting its bottling unit.

3 Better-Ranked Picks From the Consumer Staples Sector

Monster Beverage Corporation (NASDAQ:MNST) , with a Zacks Rank #2 (Buy), has delivered a positive earnings surprise of 2.6%, on average, in the trailing four quarters. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Coca-Cola Company (NYSE:KO) currently has a long-term earnings growth rate of 7.2% and a Zacks Rank #2.

Campbell Soup Company (NYSE:CPB) , also a Zacks Rank #2 stock, has a long-term earnings growth rate of 6%.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.7% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Campbell Soup Company (CPB): Free Stock Analysis Report

Coca-Cola Company (The) (KO): Free Stock Analysis Report

Fomento Economico Mexicano S.A.B. de C.V. (FMX): Free Stock Analysis Report

Monster Beverage Corporation (MNST): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

These stocks provide a compelling case as safe-haven stocks in the face of an escalating trade war. Each company operates within sectors that are relatively resilient to economic...

When the market narrative becomes too widely accepted, excess seems to be created in some areas of the economy as businesses prepare for what’s coming their way. Today’s stock...

Markets are bouncing back as investors bet on technical support, tariff relief, and Germany’s stimulus plans. But with ISM and NFP data ahead, Fed rate cut bets could shift,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.