- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Fed's Emergency Rate Cut A Boon For These 5 Stocks

In a rare inter-meeting move, the Fed announced an emergency rate cut on Mar 3. The central bank trimmed its fed funds target rate by half a percentage point to a range of 1-1.25%. In fact, the last time the Fed cut rates on an emergency basis was in the December 2008 financial crisis.

The rate cut aims at thwarting the coronavirus threat to the economy. After all, worries over how the outbreak will impact corporate profit margins and global economy have been roiling the U.S. stock market of late.

Several well-known companies like Apple (NASDAQ:AAPL), Nike (NYSE:NKE), United Airlines and Mastercard (NYSE:MA) raised concerns about their upcoming earnings and revenue results. They are worried that the outbreak will dent demand for goods and services. And since the impact is mostly in China, the virus will lead to both a demand and a supply shock for the global economy. After all, China is one of the world’s largest exporters and importers of goods.

Fed Chair Jerome Powell in the meantime said to officials that “we’ve come to the view now that it is time to act in support of the economy, and that our action will provide a meaningful boost to the economy.” The Fed’s decision, which was undivided, came after G-7 finance ministers as well as central bankers agreed to take a “coordinated effort” to curb the impact of the coronavirus.

In fact, Bank of Japan Governor Haruhiko Kuroda has already said that Japan will strive to provide ample liquidity and ensure stability in financial markets through appropriate market operations and asset purchases” (read more: Coronavirus Fears Holding You Back? 3 Smart Ways to Invest).

Stocks That Will Make the Most of a Rate Cut

Thanks to the rate cut, shares of rate-sensitive real estate and utilities will certainly climb. Rate cuts are a boon to real estate activities. After all, lower interest rates will decrease borrowing costs for projects, which will significantly help companies, predominantly involved in the construction business.

Utilities, in the meanwhile, are capital-intensive businesses and the funds generated from internal sources are not always sufficient to meet requirements. Consequently, these companies have high levels of debt. Thus, low interest rates will help pay off debts and book profits.

If we look at others sectors, healthcare stocks generally outperform after a rate cut. Barclays (LON:BARC) had compiled data that showed healthcare stocks generally rise nearly 7% in the nine months following a rate cut. And what makes this set of stocks stand out is that they tend to rise consistently. Moreover, healthcare stocks are known for paying hefty dividends, which makes them more alluring when rates decline in uneasy economic conditions. Needless to say, lower interest rates mostly tend to raise prices of high-yielding stocks.

Top 5 Picks

We have, thus, selected five solid stocks from the aforesaid sectors that are poised to gain from the rate cut. These stocks flaunt a Zacks Rank #1 (Strong Buy) or 2 (Buy).

D.R. Horton, Inc. (NYSE:DHI) has a Zacks Rank #2. The Zacks Consensus Estimate for its current-year earnings has jumped 7.3% over the past 60 days. The company’s expected earnings growth rate for the current quarter and year is 21.5% and 22.8%, respectively.

PulteGroup, Inc. (NYSE:PHM) has a Zacks Rank #1. The Zacks Consensus Estimate for its current-year earnings has climbed 6.4% over the past 60 days. The company’s expected earnings growth rate for the current quarter and year is 18.6% and 18.3%, respectively. You can see the complete list of today’s Zacks #1 Rank stocks here.

Atmos Energy Corporation (NYSE:ATO) , known for natural gas distribution, and pipeline and storage business, has a Zacks Rank #2. The Zacks Consensus Estimate for its current-year earnings has moved up 0.4% over the past 60 days. The company’s expected earnings growth rate for the current quarter and year is 5.5% and 7.8%, respectively.

Medtronic plc (NYSE:MDT) , known for manufacturing and selling device-based medical therapies to hospitals, physicians, clinicians, and patients, has a Zacks Rank #2. The company has a dividend yield of 2.1%. The Zacks Consensus Estimate for its current-year earnings has moved up 0.7% over the past 60 days. The company’s expected earnings growth rate for the current quarter and year is 5.2% and 8.1%, respectively.

AmerisourceBergen Corporation (NYSE:ABC) , known for distributing pharmaceutical products, has a Zacks Rank #2. The company has a dividend yield of 1.93%. The Zacks Consensus Estimate for its current-year earnings has risen 2.7% over the past 60 days. The company’s expected earnings growth rate for the current quarter and year is 8.1% and 8.5%, respectively.

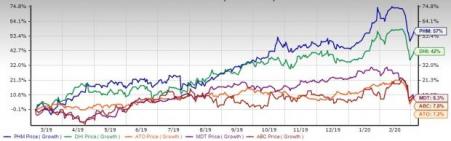

Shares of D.R. Horton, PulteGroup, Atmos Energy, Medtronic and AmerisourceBergen have gained 42%, 57%, 7.2%, 8.3% and 7.8%, respectively, over the past year. Take a look —

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Medtronic PLC (MDT): Free Stock Analysis Report

AmerisourceBergen Corporation (ABC): Free Stock Analysis Report

PulteGroup, Inc. (PHM): Free Stock Analysis Report

D.R. Horton, Inc. (DHI): Free Stock Analysis Report

Atmos Energy Corporation (ATO): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.