- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Federal Realty (FRT) Q4 FFO Misses, Revenues Beat Estimates

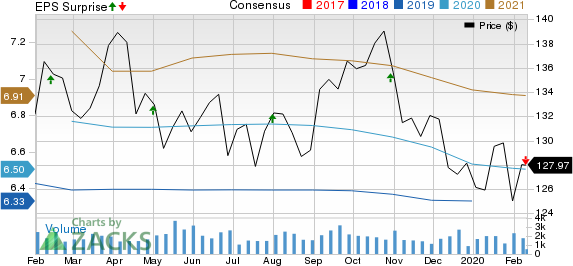

Retail REIT Federal Realty Investment Trust’s (NYSE:FRT) fourth-quarter 2019 funds from operations (FFO) per share of $1.58 missed the Zacks Consensus Estimate of $1.60. However, the reported figure improved from the prior-year tally of $1.57.

Total revenues inched up 1.6% year over year to $239.1 million in the reported quarter. The top-line figure also surpassed the Zacks Consensus Estimate of $238.7 million.

Results reflect rise in property operating income and cash-basis rollover growth on comparable spaces.

For 2019, the company reported FFO per share of $6.17, down from the prior-year tally of $6.23. However, full-year revenues of $935.8 million increased 2.2% year on year.

Quarter in Details

During the reported quarter, Federal Realty signed 112 leases for 494,768 square feet of retail space. On a comparable space basis, the company leased 461,952 square feet at an average rent of $37.78 per square foot. This denotes cash-basis rollover growth of 7%.

As of Dec 31, 2019, the company’s overall portfolio was 94.2%, shrinking 40 basis points (bps) year over year. As of that date, comparable property portfolio was 94.9% leased, down 20 bps from the prior-year period. However, property operating income (POI) for comparable properties grew 2.4% for the fourth quarter.

Federal Realty exited fourth-quarter 2019 with cash and cash equivalents of approximately $127.4 million, up from the $64.1 million posted at the end of 2018.

During the December-end quarter, Federal Realty sold under threat of condemnation of an 11.7-acre portion of San Antonio Center, located in Mountain View, CA, for $155 million. Moreover, the company acquired a 147,000-square-foot grocery-anchored neighborhood shopping center — Georgetowne Shopping Center — with surface parking on 9 acres in Brooklyn, NY, for $83.7 million cash.

Outlook

For 2020, Federal Realty expects FFO per share of $6.40-$6.58. The Zacks Consensus Estimate for the same is currently pinned at $6.50, well within the guided range.

Dividend

Federal Realty announced a quarterly cash dividend of $1.05 per share. The dividend will be paid on Apr 15, to shareholders on record as of Mar 16, 2020.

Federal Realty currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

We, now, look forward to earnings announcement from REITs like Regency Centers Corporation (NASDAQ:REG) , Welltower Inc. (NYSE:WELL) and SITE Centers Corp. (NYSE:SITC) releasing this week.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

Federal Realty Investment Trust (FRT): Free Stock Analysis Report

Regency Centers Corporation (REG): Free Stock Analysis Report

SITE CENTERS CORP. (SITC): Free Stock Analysis Report

Welltower Inc. (WELL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Tesla (NASDAQ:TSLA) (NYSE: TSLA), the electric vehicle giant, has recently experienced a significant drop in its stock value, which has fallen nearly 45% since December. This...

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.