- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Fed Cuts Rates To Limit Coronavirus Impact: 4 Gold Stocks

Gold prices gained 3% to close at $1,640.55 an ounce on March 3 as the U.S. Federal Reserve lowered the benchmark U.S interest rate by 0.5% as a pre-emptive move to safeguard the economy against the threat of coronavirus. The move marked the Fed’s first surprise cut since the 2008 financial crisis.

Per the World Health Organization’s situation report as of Mar 3, 2020, the number of confirmed cases globally has catapulted to 90,870. In fact, 1922 new cases have been reported in the past 24 hours, according to the report. In China, the confirmed cases stand at 80,304. Meanwhile, 10,566 cases have been confirmed outside China, with three countries — the Republic of Korea, Italy and Iran — making up 79% of the cases.

Factory closures in China, disruption in global supply chains, reduced demand for goods and services, among others, are expected to weigh on the global economy. In fact, the eyes are fixed on the initiatives that the major global economies are taking in order to avert the economic crisis.

Per the Organisation for Economic Cooperation and Development (OECD), an escalation in the coronavirus outbreak could cut global economic growth in half and plunge several countries into recession. It projects the world economy to grow a meager 2.4% this year — the lowest rate since 2009. Growth of China is anticipated to fall below 5% this year, down from 6.1% last year, which was the weakest growth rate in almost 30 years.

Gold Emerges as the Silver Lining

The U.S. Federal Reserve decided to lower the target range for the federal funds rate to 1-1.25%, as the outbreak poses "evolving risks" to economic activity. This triggered a market sell-off with all three major stock indexes declining overnight. The Dow Jones Industrial Average fell 786 points or 2.94% to close at 25,917.41. The S&P 500 declined 86.86 points or 2.81% to close at 3003.37. The Nasdaq Composite lost 2.99% to close at 8,684.09.

Meanwhile, gold for April delivery rose $49.6, or 3.7%, to settle at $1,644.4 an ounce on Mar 3. The yellow metal has been gaining so far this year thanks to the coronavirus outbreak, which triggered its safe-haven demand. The bullion touched a high of $1,688.6 on Feb 24, the highest since January 2013. So far in 2020, gold has gained around 5%. Gold also tends to attract buyers in a low interest-rate environment. The precious metal was also boosted by weaker greenback. The U.S. dollar index, which measures the buck against six rivals, went down 0.22% to 97.15.

The metal had gained 19% last year — its biggest annual increase since 2010, aided by the U.S-China trade war, geopolitical concerns, the Brexit mayhem, a weak manufacturing sector and apprehensions regarding the global economic outlook. Further, three rate cuts by the Fed only added to the rally.

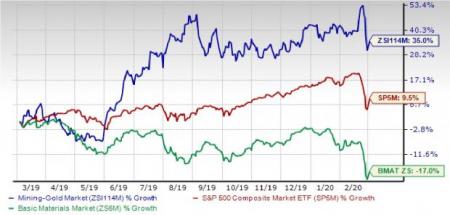

In tandem with gold prices, the Gold Mining industry has rallied 35% over the past year, compared with the S&P 500’s growth of 9.5%. The industry falls under the broader Basic Material sector, which declined 17%. The industry currently carries a Zacks Industry Rank #66, which places it at the top 26% of 256 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

We thus believe that the time is rife for investors to add some gold stocks to their portfolio. We have employed our Zacks Screener to pick four top-ranked gold stocks. Our research shows that stocks with a VGM Score of A or B when combined with a Zacks Rank #1 (Strong Buy) or 2 (Buy) offer good investment opportunities.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Sibanye Stillwater Limited (NYSE:SBSW) : This Weltevreden Park, South Africa-based company currently has a Zacks Rank #1 and a VGM Score of A. The company has a long-term estimated earnings growth rate of 20.4%. The Zacks Consensus Estimate for earnings for 2020 suggests year-over-year growth of 1075%.

Alamos Gold Inc. (TSX:AGI) : Based in Toronto, Canada, this company has a Zacks Rank #2 and a VGM Score of B. It has an estimated long-term earnings growth rate of 59.1%. The Zacks Consensus Estimate for 2020 earnings indicates year-over-year growth of 10%. The company has a trailing four-quarter positive earnings surprise of 9.82%, on average.

Equinox Gold Corp. (TSX:EQX) : The Zacks Consensus Estimate for earnings for 2020 for this Vancouver, Canada-based company indicates year-over-year growth of 79.3%. The estimate has also moved up 11% over the past 30 days. This Zacks Ranked #2 stock has a VGM Score of B.

Kinross Gold Corporation (NYSE:KGC) : Based in Toronto, Canada, this company has a Zacks Rank #2 and a VGM Score of A. The Zacks Consensus Estimate for 2020 earnings has moved up 7% in the past 30 days. The estimate indicates year-over-year rise of 38%. It has a trailing four-quarter positive earnings surprise of 182.5%, on average.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Kinross Gold Corporation (KGC): Free Stock Analysis Report

Alamos Gold Inc. (AGI): Free Stock Analysis Report

Sibanye Gold Limited (SBSW): Free Stock Analysis Report

Equinox Gold Corp. (EQX): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.