- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Fed Chair Powell Vows To Support The U.S. Expansion

It was far from the equivalent of Mario Draghi’s muscular “whatever it takes” comment in 2012, when the European Central Bank president famously outlined his resolve to save the euro. Yesterday’s comments from Federal Reserve Chair Jerome Powell were considerably more nuanced, in part because the US economy is in far better shape than the euro area, either in 2012 or today. Yet Powell’s remarks still serve as a reminder that US growth has slowed and so the Federal Reserve is focused on extending the expansion, which is set to become the longest on record at the end of this month.

Powell vowed to “act as appropriate” to keep growth alive, signaling that a rate cut is a possibility at the July 31 monetary policy meeting. Citing several potential threats to the economy, he said that “many FOMC participants judged at the time of our most recent meeting in June that the combination of these factors strengthens the case for a somewhat more accommodative stance of policy.”

The market is certainly expecting a rate cut. Fed funds futures continue to price in a virtual certainty that the central bank will reduce the current 2.25%-2.50% target rate on July 31 by either 25 or 50 basis points, based on CME data.

The prospect of a rate cut has perplexed some hawkish observers, who say that the economy is still expanding and so the need is weak for a new round of monetary stimulus. But some analysts counter that the Fed has learned to be more proactive. As The Economist notes this week:

Central banks’ tendency during expansions has long been to continue raising rates even after bad news strikes, cutting them only when it is too late to avoid recession. Before each of the last three American downturns the Fed continued to raise rates even as bond markets priced in cuts.

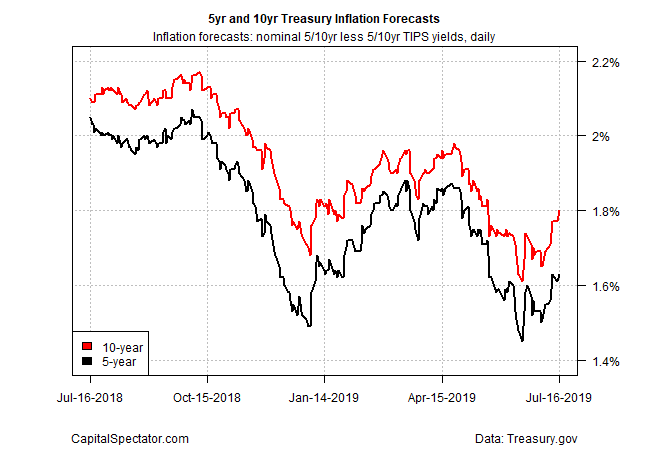

Can you teach an old dog new tricks? The answer may be clearer by the end of the month, depending on the Fed’s policy announcement. Meantime, the worrisome slide in inflation expectations in recent months appears, for now, to have subsided. That takes off some of the pressure to cut rates, if only slightly. For example, the yield spread for the 5-year nominal Note less its inflation-indexed counterpart rose to 1.63% yesterday (July 16). Although that’s still moderately below the Fed’s 2.0% inflation target, the current spread marks a rebound from a month ago, when the market’s implied inflation outlook was 1.45%.

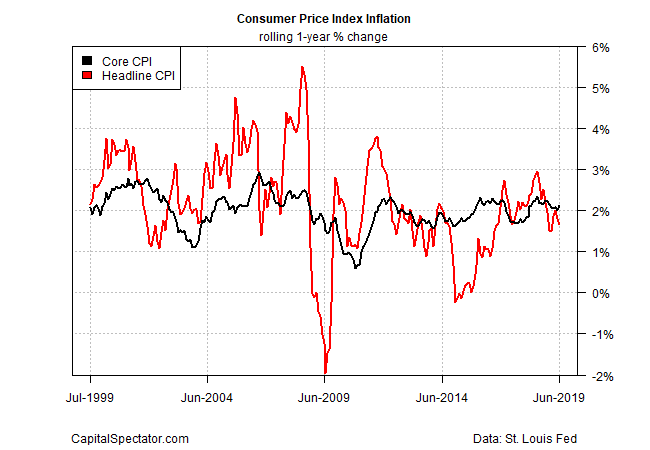

Note, too, that official inflation data is showing signs of firming, if only marginally. The one-year core rate of consumer inflation ticked up in June to 2.1%, suggesting that the Fed has succeeded in keeping pricing pressure more or less steady at its target.

For the moment, inflation’s subdued but steady pace allows the central bank to focus on economic growth, or the lack thereof. As The Capital Spectator reported last week, the median estimate (via a set of nowcasts) for the upcoming second-quarter GDP report (scheduled for July 26) is on track to post a substantial slowdown in growth after Q1’s strong 3.1% increase. A week later, the outlook for Q2 data remains more or less the same. Yesterday’s update of the Atlanta Fed’s GDPNow model, for instance, projects that economic activity for Q2 will rise by a sluggish 1.6%.

Analysts in support of rate cut are quick to note that parts of the Treasury yield curve are inverted, which implies that recession risk is elevated for the near term. Notably, the 10-Year/3-Month spread continues to be slightly negative. By contrast, the 10-year/2-year spread is still modestly positive, offering a counterpoint to those who say the curve’s recession signal is clear.

But the labor market still reflects strength. After stumbling in May, US payrolls bounced back in July, although the one-year trend for private employment continued to tick down. Yet jobless claims, a widely followed leading indicator, still signal strength. New filings for unemployment benefits remain close to a half-century low, suggesting that the US macro trend remains robust.

The data may be mixed, but the Fed looks set to err on the side of caution and take out a bit of insurance in favor of growth. “It still looks like the Fed will opt for 25bp rather than 50bp at the July meeting,” predicts Tim Duy, an economist at the University of Oregon who blogs frequently about central bank policy. “The message from Powell and others is that the primary motivation for a rate cut is a recalibration of policy considering greater downside risks while the underlying economy, in the words of Powell, remains in ‘a very good place.’”

If the Fed can extend the economic cycle into uncharted territory in terms of duration, it will be no small achievement. The US central bank has been widely criticized over the years for remaining blind to signs of slowing growth that turned into recession. Is this time different? Unclear, in part for the usual reasons, namely: real-time signals are always fuzzy for deciding if the economy is in a soft patch that will soon right or in the early stages of recession. Nonetheless, the possibility remains that the Fed has learned how to sidestep a recession. We are, perhaps, in the midst of a grand experiment in monetary policy. The outcome, however, remains a work in progress.

Related Articles

Telegram Group Inc. is a globally recognized messaging service company, offering a cloud-based mobile and desktop messaging application. Known for its strong focus on security,...

Many investors regard passively managed index mutual funds or ETFs as favorable options for stock investing. However, they may also find that actively managed funds offer...

President Trump’s comments and executive orders have roiled markets and investor expectations, but from the vantage of the Treasury market, a relative calm prevails. This could...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.