- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

U.S. Economy Likely To Sustain Longest Expansion: 5 Top Picks

With the advent of July 2019, the U.S. economy officially entered into the longest stretch of economic expansion at least since 1854. According to the National Bureau of Economic Research (NBER), the country is in the 121st month of economic expansion, outpacing the previous longest chain of March 1991 to March 2001. Notably, per NEBR, the current expansion started in June 2009.

Meanwhile, economists and financial experts are divided on the continuation of economic momentum. A section of economists and financial experts are concerned that the next downturn is approaching. However, fundamentals of the U.S. economy remain solid although the pace has slowed down. Despite the presence of near-term concerns, a closer look at the U.S. economy has a different story to tell, with enough reasons for further expansions.

U.S. Economy on Solid Ground

During the current expansion period, the U.S. economy has grown at an average of around 2.3%, much lower than the average growth of 4.2% during previous expansions. However, the reality is that, the current expansion started once the economy got rid of the great recession of 2008-2009, which was the severest downturn for the U.S. economy since the great depression of 1930s. It takes time for the economy to grow fast after collapsing.

U.S. GDP grew at 2.9% in 2018 and 3.1% in the first quarter of 2019. Major decisions by the Trump administration like tax cut to a historic low level, increase in government spending and deregulation helped the economy to increase pace. However, trade-related concerns raised questions about the future growth of the economy. Meanwhile, the Fed is still projecting that the U.S. economy to grow by 2.2% in 2019.

U.S. Economy Still Best Globally

The most important driver of the current expansion is the U.S. labor market. Despite a slowdown of in nonfarm payroll in May, the economy continues to add fabulous number of jobs with unemployment rate at its 69 year low of 3.6%. The wage rate started picking up a healthy rate in the last three years. Despite these, inflation remains muted at just 1.6% far below the 2% target rate of the Fed.

The IHS Markit reported that U.S. manufacturing PMI rose 50.6 in June from 50.1 in May. This is a significant achievement given the fact that trade negotiations between the United States and China broke down abruptly in early May. However, manufacturing PMI of China, Eurozone (especially Germany), the U.K. and Russia fell below 50, hinting at contraction.

Moreover, U.S. industrial production recorded its highest gain in May since December 2018. Most importantly, U.S. manufacturing output registered its first monthly gain of 2019. In addition, core durable goods order –- a key metric to track business investment plan –- jumped significantly in May. These two metrics provide a major relief to the market’s concern that investment softened in the manufacturing sector, which constitutes 12% of the U.S. GDP.

Meanwhile, year to date, three major stock indexes of Wall Street --- the Dow, S&P 500 and Nasdaq Composite --- jumped 14.8%, 18.6% and 22.2%, respectively.

Trade and Fed to Play Major Roles

At present, major concerns of the U.S. economy is the trade conflict with China. Although a quick solution to this problem is out of question, companies will heave a sigh of relief if the tariff war does not escalate further. A solution to the trade spat will also inject global economic growth.

Moreover, a dovish stance taken by the Fed since the beginning of this year is considered as a major boost to the U.S. economy. So far, the central bank has kept its benchmark leading rate at 2.25 – 2.5%, and has hinted at rate cut this year itself.

On Jun 19, in his speech following the FOMC meeting the Fed has removed the term “patient’’ from its minutes and added that “the FOMC will closely monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion”. Investors are considering a rate cut at least by 25 basis points in July and one or two more cuts the rest of this year.

Our Top Picks

At this stage, it will be prudent to invest in stock with strong growth potential and a favorable Zacks Rank. We have narrowed down our search to five such stocks with a Growth Score of A and Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here. Each of these stocks has moved higher year to date and still has upside left.

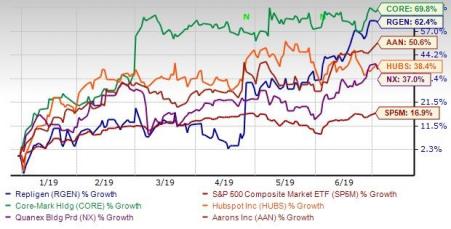

The chart below shows price performance of our five picks year to date.

Core-Mark Holding Co. Inc. (NASDAQ:CORE) is one of the largest marketers of fresh and broad-line supply solutions to the convenience retail industry in North America. The company has expected earnings growth of 13.7% for the current year. The Zacks Consensus Estimate for the current year has improved by 3.3% over the last 60 days. The stock has surged 69.8% year to date.

Repligen Corp. (NASDAQ:RGEN) develops, manufactures, and sells products used to enhance the interconnected phases of the biological drug manufacturing process in North America, Europe, APAC and internationally. The company has expected earnings growth of 27.4% for the current year. The Zacks Consensus Estimate for the current year has improved by 8.2% over the last 60 days. The stock has surged 62.4% year to date.

Aaron's Inc. (NYSE:AAN) operates as an omnichannel provider of lease-purchase solutions to underserved and credit-challenged customers. It operates in three segments: Progressive (NYSE:PGR) Leasing, Aaron's Business, and DAMI. The company has expected earnings growth of 14% for the current year. The Zacks Consensus Estimate for the current year has improved by 0.8% over the last 60 days. The stock has surged 50.6% year to date.

HubSpot Inc. (NYSE:HUBS) provides a cloud-based marketing and sales software platform for businesses in the Americas, Europe and the Asia Pacific. The company has expected earnings growth of 44.9% for the current year. The Zacks Consensus Estimate for the current year has improved by 12.2% over the last 60 days. The stock has surged 38.4% year to date.

Quanex Building Products Corp. (NYSE:NX) is an industry-leading manufacturer of components sold to Original Equipment Manufacturers in building products industry. The company has expected earnings growth of 30.8% for the current year. The Zacks Consensus Estimate for the current year has improved by 11.8% over the last 60 days. The stock has surged 37% year to date.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

HubSpot, Inc. (HUBS): Free Stock Analysis Report

Quanex Building Products Corporation (NX): Free Stock Analysis Report

Aaron's, Inc. (AAN): Free Stock Analysis Report

Core-Mark Holding Company, Inc. (CORE): Free Stock Analysis Report

Repligen Corporation (RGEN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.