- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Factors To Note Ahead Of United Natural's (UNFI) Q2 Earnings

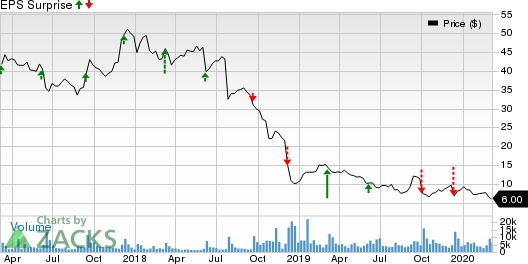

United Natural Foods, Inc. (NYSE:UNFI) is slated to release second-quarter fiscal 2020 results on Mar 11. The provider of natural, organic and specialty food, and non-food products has trailing four-quarter positive earnings surprise of 6.7%, on average.

The Zacks Consensus Estimate for fiscal second-quarter earnings is pegged at 27 cents per share, which indicates a 38.6% decline from the year-ago quarter’s reported figure. Nevertheless, the consensus mark has moved up by a couple of cents in the past 30 days. The Zacks Consensus Estimate for revenues is pegged at $6,156 million, which suggests a 0.1% improvement from the year-ago quarter’s reported figure.

Key Factors to Note

United Natural has been struggling with reduced gross margin for a while now. The inclusion of SUPERVALU, with lower gross margin, has been keeping the metric under pressure. Also, gross margin has been affected by a shift in the consumer mix. Moreover, challenges at several distribution centers due to headwinds such as store closures have been threatening.

Nevertheless, United Natural has been benefiting from strong brands and rising consumer demand across various channels. Additionally, contributions from SUPERVALU (acquired in October 2018) have been driving the company’s top line for a while now. Moreover, United Natural has been gaining from the focus on enhancing the customer base and expanding the broad-line distribution channel. Also, the company’s cost-saving efforts bode well.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for United Natural this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

United Natural carries a Zacks Rank #5 (Strong Sell) but an Earnings ESP of +4.67%.

Stocks With Favorable Combination

Here are some companies that you may want to consider as our model shows that these have the right combination of elements to post an earnings beat.

DICK'S Sporting (NYSE:DKS) has an Earnings ESP of +5.16% and a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Casey's General (NASDAQ:CASY) currently has an Earnings ESP of + 3.45% and a Zacks Rank #3.

RH (NYSE:RH) presently has an Earnings ESP of +1.61% and a Zacks Rank #3.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft (NASDAQ:MSFT) in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

DICK'S Sporting Goods, Inc. (DKS): Free Stock Analysis Report

United Natural Foods, Inc. (UNFI): Free Stock Analysis Report

RH (RH): Free Stock Analysis Report

Casey's General Stores, Inc. (CASY): Free Stock Analysis Report

Original post

Related Articles

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Broadcom stock is in a dynamic rebound phase. Markets seem optimistic ahead of the earnings release. Let's take a deep dive into what to expect from the report. Get the...

Consumers are feeling the pinch from inflation every time they go to the grocery store. Money is a zero-sum game; as disposable income and buying power erodes, consumers are...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.