- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Factors To Know Ahead Of Lionsgate (LGF.A) Q2 Earnings

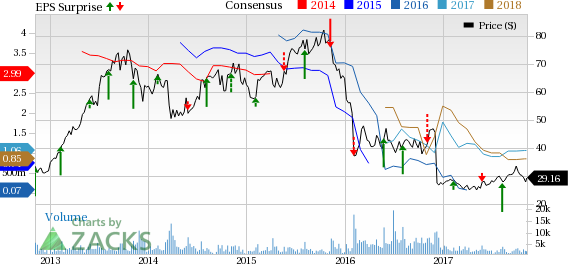

Lions Gate Entertainment Corp. LGF.A, producer and distributor of motion pictures for theatrical and straight-to-video release, is scheduled to report second-quarter fiscal 2018 results on Nov 9, after the closing bell. In the trailing four quarters, the company outperformed the Zacks Consensus Estimate by an average of 39.8%. Let’s see how things are shaping up for this announcement.

Which Way are Estimates Treading?

The current Zacks Consensus Estimate for the quarter under review is a loss of 13 cents, which has improved by a penny in the last seven days. It also fared far better than the loss of 50 cents reported in the year-ago period. Analysts polled by Zacks, expect revenues of roughly $947.4 million, up 48% from the prior-year quarter.

Factors Influencing the Quarter

From abovementioned figures it is quite evident that Lions Gate is likely to report sharp improvement in both the top and bottom lines on a year-over-year basis. The company’s strategic acquisitions and alliances to enhance competitive position and maximize returns, along with building a diversified portfolio bode well for the stock.

In first-quarter fiscal 2018, Media Networks’ segment formed after the acquisition of Starz reported revenues growth of 9.2% year over year on account of Starz new series American Gods and The White Princess. Earlier, Lions Gate acquired Summit Entertainment which further expanded its filmed entertainment library, while boosting feature film and home entertainment offerings.

Notably, the addition of Starz is aiding Lions Gate to emerge as a major player in the TV space and helping it regain lost ground in streaming network. Moreover, the company has invested in The Immortals to capitalize on the increasing popularity of eSports. It expects eSports market to grow over $1 billion by the next year.

However, fewer movie releases in fiscal 2018 compared with the previous year may hurt Motion Pictures revenue performance. Dismal television production performance in the past few quarters has been also a concern for investors. In first-quarter fiscal 2018 Television Production revenues tumbled 18.6% following a decline of 3.5% in the preceding quarter. Further, the escalating cost of motion picture production and marketing in recent years may jeopardize Lions Gate’s margins.

What Does the Zacks Model Unveil?

Our proven model does not conclusively show that Lions Gate is likely to beat earnings estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Lions Gate sports a Zacks Rank #1 but an Earnings ESP of -38.46%. Thus making surprise prediction difficult.

Stocks with Favorable Combination

Here are some companies you may want to consider as our model shows that these too have the right combination of elements to post an earnings beat:

News Corporation (NASDAQ:NWSA) has an Earnings ESP of +3.70% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

DISH Network Corporation (NASDAQ:DISH) has an Earnings ESP of +1.68% and a Zacks Rank #3.

MSG Networks Inc. (NYSE:MSGN) has an Earnings ESP of +0.31% and a Zacks Rank #3.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

DISH Network Corporation (DISH): Free Stock Analysis Report

MSG Networks Inc. (MSGN): Free Stock Analysis Report

Lions Gate Entertainment Corporation (LGF.A): Free Stock Analysis Report

News Corporation (NWSA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Professional traders get paid because of one skill and one skill only: the ability to foresee what the world (or the economy, at least) might look like in six to nine months....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.