- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

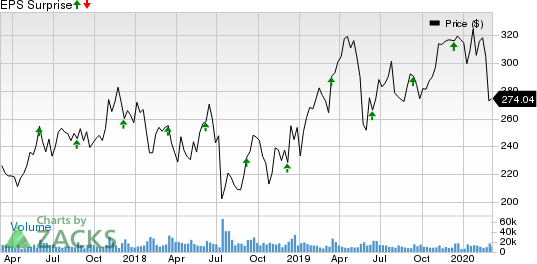

Factors Setting The Tone For Broadcom's (AVGO) Q1 Earnings

Broadcom (NASDAQ:AVGO) is scheduled to report first-quarter fiscal 2020 results on Mar 12.

The Zacks Consensus Estimate for fiscal first-quarter revenues is pegged at $5.93 billion, indicating an improvement of 2.4% from the year-ago quarter.

We note that the Zacks Consensus Estimate for earnings has remained stable in the past 30 days at $5.22 per share. The figure suggests a decline of approximately 6% from the year-ago reported figure.

Notably, the company has surpassed the Zacks Consensus Estimate in the trailing four quarters by 2.31%, on average.

Factors to Consider

Synergies from the acquisitions of CA and Symantec’s enterprise security business are anticipated to have benefited Broadcom’s fiscal first-quarter performance.

Symantec’s strength in enterprise business and substantial customer base is expected to have aided Broadcom in expanding presence in infrastructure software space. This, in turn, is likely to have driven the fiscal first-quarter Infrastructure software revenues.

Nonetheless, muted demand for SAN switching, even as OEMs work down on inventories, is likely to have weighed on the fiscal first quarter performance.

Notably, the Zacks Consensus Estimate for the Infrastructure Software segment revenues for the fiscal first quarter is pegged at $1.489 billion. In the fourth quarter of fiscal 2019, Infrastructure software revenues soared 134% on a year over year to $1.20 billion.

However, sequential decline in global semiconductor sales in November, December and January, is likely to have impacted Broadcom’s Semiconductor Solutions segment performance in the fiscal first quarter.

Notably, in fourth quarter of fiscal 2019, Semiconductor solutions’ revenues totaled $4.553 billion, down 7% from the year-ago reported quarter.

Nevertheless, seasonal uptick in demand for smartphone parts driven by accelerated ramp of 5G smartphones, and incremental adoption of latest offerings including enterprise and residential suite of Wi-Fi 6E-compliant solutions, are likely to have aided segmental performance.

However, growing expenses on product development and debt financing for strategic acquisitions, amid stiff competition from peers including Qorvo (NASDAQ:QRVO) and Skyworks (NASDAQ:SWKS) in the RF semiconductor market are likely to have limited the fiscal first-quarter margins.

Noteworthy Developments in Q1

During the quarter under review, Broadcom launched Automation.ai, an AI-based software platform for supporting decision making processes across different industries.

Moreover, the company inked two separate multi-year agreements with iPhone maker, Apple (NASDAQ:AAPL) . Per the 8K filed with the SEC, the deal is expected to generate $15 billion for Broadcom.

Zacks Rank

Broadcom currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft (NASDAQ:MSFT) in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Apple Inc. (AAPL): Free Stock Analysis Report

Skyworks Solutions, Inc. (SWKS): Free Stock Analysis Report

Broadcom Inc. (AVGO): Free Stock Analysis Report

Qorvo, Inc. (QRVO): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Broadcom stock is in a dynamic rebound phase. Markets seem optimistic ahead of the earnings release. Let's take a deep dive into what to expect from the report. Get the...

Consumers are feeling the pinch from inflation every time they go to the grocery store. Money is a zero-sum game; as disposable income and buying power erodes, consumers are...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.