- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Factors Likely To Impact Hillenbrand (HI) In Q4 Earnings

Hillenbrand, Inc. (NYSE:HI) is slated to report fourth quarter and fiscal 2017 results on Nov 15, after the closing bell. We expect the company’s results to gain from the flourishing Process Equipment business. However, headwinds in the Batesville unit and negative impact of adverse currency translation are expected to mar the company’s performance this season.

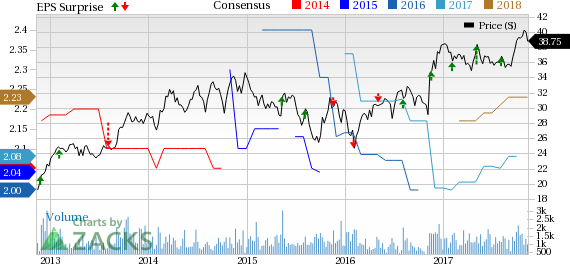

The company’s earnings have surpassed the Zacks Consensus Estimate in the preceding five quarters, with an average beat of 10.6% in the trailing four quarters.

Let’s take a look at some of the factors that are likely to impact Hillenbrand’s upcoming results.

What to Expect?

The Zacks Consensus Estimate for fourth quarter and fiscal 2017 has been stable in the past 30 days at 60 cents and $2.08 per share, respectively. Estimates for the fourth quarter are within management’s guided range of $2-$2.10. Notably, the consensus mark for the fourth quarter and the fiscal depicts year-over-year increase of more than 3%.

Further, analysts polled by Zacks expect net revenues of $426.5 million for the fourth quarter, which reflects a 0.5% dip from the year-ago quarter. However, the consensus estimate for fiscal 2017 sales is pegged at $1.57 billion, which represents a 1.9% improvement from last year.

Price, Consensus and EPS Surprise

Factors Impacting the Quarter

Hillenbrand’s Process Equipment business segment appears impressive on the back of higher demand for screening and separating equipments as well as plastics projects. The company has been focusing on capitalizing the opportunities provided by the process equipments market. Also, the acquisition of Coperion has aided Hillenbrand’s pricing and productivity initiatives in this segment. Driven by such upsides, the company expects the process equipments business to flourish and deliver favorable results in the fourth quarter and fiscal 2017 results.

However, Hillenbrand has been struggling with its Batesville business segment for quite some time, due to lower burial volumes in North America, as consumers depict a radical shift toward cremation. Moreover, the performance of this segment remains challenged with higher commodity and fuel costs as well as lower promotional activity. Hillenbrand expects these hurdles to continue hurting the performance of the Batesville business. Additionally, Hillenbrand expects currency headwinds to persist and drag the top-line performance in the fourth quarter.

Nevertheless, the company has been planning to improve working capital structure, through cost reduction and restructuring of operations. These efforts are likely to aid the bottom-line performance in the fourth quarter.

What Does the Zacks Model Unveil?

Our proven model does not conclusively show that Hillenbrand is likely to beat earnings estimates this quarter. This is because a stock needs to have both a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) and a positive Earnings ESP for this to happen. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Hillenbrand carries a Zacks Rank #3. However, it’s Earnings ESP of 0.00% makes surprise prediction difficult.

Stocks With Favorable Combinations

Here are some companies which, according to our model, have the right combination of elements to deliver earnings beat.

Energizer Holdings Inc (NYSE:ENR) has an Earnings ESP of +6.31% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here

United Natural Foods, Inc. (NASDAQ:UNFI) has an Earnings ESP of +6.33% and a Zacks Rank #2.

Tyson Foods Inc (NYSE:TSN) has an Earnings ESP of +1.28% and a Zacks Rank #2.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Energizer Holdings, Inc. (ENR): Free Stock Analysis Report

United Natural Foods, Inc. (UNFI): Free Stock Analysis Report

Tyson Foods, Inc. (TSN): Free Stock Analysis Report

Hillenbrand Inc (HI): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.