- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Factors Likely To Impact Abercrombie's (ANF) Q3 Earnings

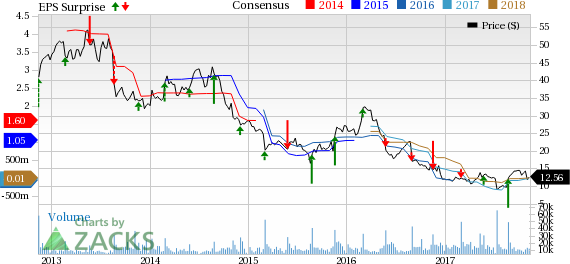

Abercrombie & Fitch Co. (NYSE:ANF) is slated to release third-quarter fiscal 2017 results on Nov 17. The question lingering in investors’ minds is, whether this specialty retailer of premium, high-quality casual apparel will be able to deliver a positive earnings surprise in the to be reported quarter.

The company’s bottom line has lagged the Zacks Consensus Estimate in two of the last four quarters, with an average miss of 10.8%.

In fact, the Zacks Consensus Estimate for the quarter under review has been stable in the past 30 days at 23 cents, reflecting a substantial increase from 2 cents earned in the year-ago quarter. Further, analysts polled by Zacks expect revenues of $818.8 million, down 0.4% from third-quarter fiscal 2016.

So, let’s see how things are shaping up prior to this announcement.

Factors at Play

Abercrombie’s shares have rallied 29.3% in the past three months compared with the industry’s gain of 2.2%. This outperformance can be attributable to strategic capital investments, cost saving efforts, loyalty and marketing programs. Moreover, management remains focused on reviving its brands, enhancing performance and returning to profitable growth.

Consequently, the company has started implementing several steps to spur on its business forward. These initiatives are reflected in its second-quarter fiscal 2017 results, when Abercrombie delivered a positive earnings surprise for the first time in last six quarters, following in-line results in the first quarter.

Furthermore, the company’s top line outpaced the consensus mark for the second straight quarter. This marked a significant progress on its strategic initiatives and reflected strength in Hollister and direct-to-customer businesses. As a result, management provided an encouraging outlook for fiscal 2017 and the fiscal second half.

Additionally, it expects foreign currency to be a tailwind going forward, reflecting slight gains in sales and operating income.

However, performance at its namesake brand remains a major concern. While the company is making strides to improve performance at Abercrombie based on learning from Hollister, we believe full turnaround for the brand is still away.

Additionally, the company has been witnessing strained margins for last few quarters owing to soft traffic at stores and a highly promotional environment. Abercrombie’s ongoing strategic initiatives to improve profitability have also been weighing on the margins.

What the Zacks Model Unveils?

Our proven model does not show that Abercrombie is likely to beat earnings estimates this quarter. This is because a stock needs to have both — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Abercrombie has an Earnings ESP of -6.25%. Although its Zacks Rank #3 increases the predictive power of ESP, the stock’s negative ESP makes earnings prediction difficult.

Stocks With Favorable Combination

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Zumiez Inc. (NASDAQ:ZUMZ) has an Earnings ESP of +0.69% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Home Depot, Inc. (NYSE:HD) has an Earnings ESP of +0.57% and a Zacks Rank #2.

Lowe's Companies, Inc. (NYSE:LOW) has an Earnings ESP of +0.18% and a Zacks Rank #3.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Home Depot, Inc. (The) (HD): Free Stock Analysis Report

Lowe's Companies, Inc. (LOW): Free Stock Analysis Report

Zumiez Inc. (ZUMZ): Free Stock Analysis Report

Abercrombie & Fitch Company (ANF): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.