- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Factors Likely To Hit J.C. Penney (JCP) In Q3 Earnings

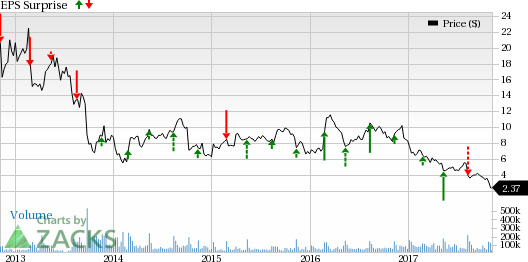

J. C. Penney Company, Inc. (NYSE:JCP) is slated to release third-quarter fiscal 2017 results on Nov 10. The question lingering in investors’ minds is, whether this department store retailer will be able to deliver a positive earnings surprise in the quarter to be reported. Well the company reported a wider-than-expected loss in the last quarter. Let’s see how things are shaping up prior to this announcement.

What to Expect?

The current Zacks Consensus Estimate for the quarter under review is pegged at a loss of 43 cents, which is considerably worse than the year-ago period loss of 21 cents. In fact, this estimate has widened over the last 30 days. Moreover, analysts polled by Zacks expect revenues of $2,759 million, down 3.4% from the year-ago quarter.

Factors at Play

J. C. Penney has been reeling under a tough retail landscape on account of stiff competition from online retailers and waning store traffic. Owing to these hurdles, the company has been witnessing soft comparable store sales (comps) for nearly a year now. While J.C. Penney is undertaking several strategic initiatives to draw traffic, we expect the retail landscape to remain challenged and hurt the company’s profits. Also, J.C. Penney’s store closures are likely to weigh upon its performance.

Further, management recently provided an update on its third-quarter performance, wherein it also curtailed its outlook for fiscal 2017. Shares of J. C. Penney have lost 35.2% since the announcement, wherein the company stated that in an effort to clear “slow-moving” goods mostly in women’s apparel department, it increased markdowns in September and October. We believe that this remains a threat to the company’s margins. Management also stated that following the liquidation of slow moving inventory, the company’s fund has increased. This will help to invest in fresh as well as trending merchandise categories.

For third-quarter fiscal 2017, the company expects comps to inch up 0.6%-0.8%. However, cost of goods (excluding depreciation and amortization) is likely to escalate 300-320 basis points (bps) year over year. Consequently, the company expects adjusted loss for the third quarter to be in the range of 45-40 cents per share. This is much wider than the company’s loss of 21 cents per share reported in third-quarter fiscal 2016.

What the Zacks Model Unveils?

Our proven model does not conclusively show that J. C. Penneyis likely to beat bottom-line estimates this quarter. This is because a stock needs to have both a positive Earnings ESPand a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. You can uncover the best stocks to buy or sell before they’re reported with ourEarnings ESP Filter.

J. C. Penney currently has an Earnings ESP of 0.00% and a Zacks Rank #4 (Sell). Notably, we caution against sell-rated (#5) stocks going into earnings announcement.

Stocks With Favorable Combination

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Zumiez Inc (NASDAQ:ZUMZ) has an Earnings ESP of +0.69% and flaunts a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Ross Stores Inc (NASDAQ:ROST) has an Earnings ESP of +0.27% and carries a Zacks Rank #2.

Home Depot Inc (NYSE:HD) has an Earnings ESP of +0.50% and carries a Zacks Rank #2.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Home Depot, Inc. (The) (HD): Free Stock Analysis Report

Zumiez Inc. (ZUMZ): Free Stock Analysis Report

Ross Stores, Inc. (ROST): Free Stock Analysis Report

J.C. Penney Company, Inc. Holding Company (JCP): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Professional traders get paid because of one skill and one skill only: the ability to foresee what the world (or the economy, at least) might look like in six to nine months....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.