- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Facebook Online Video Ad Plans For IGTV To Boost Ad Revenues

Facebook (NASDAQ:FB) continues to bolster video initiatives in a bid to generate further advertisement revenues. This is evident from the company’s latest plans to test advertisements on its Instagram developed video application namely IGTV this spring.

The social media giant intends to sell advertisements on IGTV in an attempt to strengthen its IGTV monetization efforts. Reportedly, Instagram is aggressively pursuing deals with its top video creators for testing ads on IGTV.

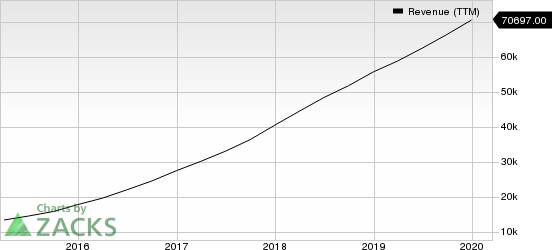

With the growing popularity of online video advertisements, increasing video content watching hours and solid adoption of video apps, we believe the latest move is expected to drive Facebook’s advertisement revenues. Notably, advertisement revenues remain the company’s key growth driver.

Notably, advertisement accounted for 98.5% of the company’s total revenues in 2019. Further, strengthening advertisement endeavors are aiding the stock in gaining investors’ confidence.

Consequently, the latest move is likely to aid the company in gaining further traction among investors in the near term.

Coming to the price performance, Facebook has returned 6.1% over a year, against the industry’s decline of 15.9%.

Additionally, the move will help the company in expanding footprint further in the online video market where competition is intensifying with the growing online video advertisement efforts of other players.

GOOGL & Others in Fray

With the IGTV advertisement plans, Facebook ups its ante in the online video advertising battle against peers like Alphabet (NASDAQ:GOOGL) , Roku (NASDAQ:ROKU) , Amazon (NASDAQ:AMZN) and Disney’s Hulu, which are also leaving no stone unturned to capitalize on growing online advertisement spending worldwide.

Per a report from Statista, this particular spending is pegged at $37.9 billion for 2020 and is expected to see a CAGR of 4.3% over a period of 2020 to 2023. Further, it is likely to reach $43.1 billion by 2023.

Notably, Alphabet’s YouTube, which holds the dominant position in the online video market, generated advertising sales worth $15.1 billion in 2019, accounting for 9.4% of the total revenues.

YouTube remains a strong contributor to the company’s growth. Notably, more than thousand creators are currently engaged in the platform, bringing in thousands of subscribers every day.

Meanwhile, Amazon also offers online video advertisement and is increasingly ramping up ad offerings across its ecosystem. The e-commerce giant is constantly investing in ad business in a bid to expand beyond display ads on its e-commerce platform and mobile shopping app.

Its ad-supported video service IMDb TV, and live-streaming video platform Twitch and planned ad-supported channels for Fire TV, to name a few remain noteworthy.

Further, increasing video ad impressions on Roku’s video platform is a major positive.

Facebook’s Growing Ad Endeavors

Facebook intends to cash in on the ever-increasing trend of video viewing on social media platforms. Advertisers prefer video advertisements, as these appear to be the most lucrative medium to attract audience.

As video ads generate more revenues than photo and text-based substitutes, Facebook is trying to incorporate more and more video-oriented content to bring in more ad revenues. The company’s Watch, a dedicated tab for video viewing, is acting as a tailwind.

Notably, the company is gaining on increasing popularity of Stories. This is likely to continue driving its ad revenues in the near term.

Further, its product named Automated Ads for small businesses remains noteworthy. Additionally, the updated Ad Library of the company is driving user momentum.

All these endeavors will continue to strengthen the company’s position in the advertising market.

Currently, Facebook carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Facebook, Inc. (FB): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Roku, Inc. (ROKU): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

• Trump’s trade war, U.S. jobs report, and last batch of Q4 earnings will be in focus this week. • Costco's earnings report is seen as a potential catalyst for growth, making it a...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.