- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Facebook Deploys Artificial Intelligence To Prevent Suicides

Facebook Inc. (NASDAQ:FB) announced recently that it is expanding its artificial intelligence (AI) efforts to identify users with suicidal motives by recognizing patterns in their posts and live videos. The company is set to roll out this feature globally except the European Union where data protection rules are different.

In March this year, the company started an experiment to determine suicidal intent in text-based posts in the United States by using AI-based suicide prevention tools. The success of the test led the company to announce this global rollout.

Regarding this latest initiative, although not much of technical details were shared, the company mentioned in a blog post that comments such as “Are you ok?” and “Can I help?” will act as signals.

The company is also increasing the number of reviewers for such posts. AI will help the reviewers from the Community Operations team to prioritize the most serious ones. Reviewers can also escalate such issues to local authorities apart from directing users to connect to support organizations or friends.

Facebook has been working on suicide prevention for a really long time. The company collaborated with suicide prevention groups like Forefront, Now Matters Now, the National Suicide Prevention Lifeline and Save.org to provide users with suitable help.

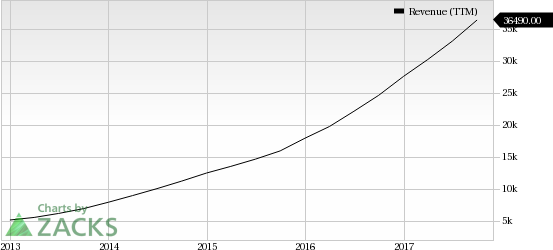

We believe these initiatives will significantly drive user dependence and reliability on Facebook, draw more users to the platform and thereby sustain its share price momentum. Notably, Facebook has gained 59.1% year to date, substantially outperforming the industry’s 27.3% rally.

Building a Better Community With AI

Facebook’s attempts to protect the community indicate its new mission, which is to “give people the power to build community and bring the world closer together."

The company continues to invest heavily on developing AI technology as CEO Mark Zuckerberg considers AI to have “different strengths than people do.”

Facebook set up an AI research center in Montreal, Canada in September. The company already has a research facility in Paris. In addition to these, Facebook operates two more AI focused labs in Menlo Park, CA and in New York City.

The company strongly believes that technologies like AI will revolutionize the future and emerge as big business opportunities. Research firm IDC estimates that AI will be worth close to $46 billion by 2020.

A few months back, Facebook deployed AI technology to contain terrorist activities on its platform. Facebook said that it will deploy advanced algorithms that can detect images, text, pages or groups that seem to promote extremism and take it down.

The company also used AI to look at satellite images to locate survivors and victims in Hurricane Maria affected areas so as to provide them with connectivity and other resources.

On the last conference call, management said that after being criticized for its Live feature where suicide-related activities were also streamed, the company made investment in AI tools, increased the number of reviewers working on it and brought down the time taken to review those Live videos to less than 10 minutes. The company expects to reduce the time further.

The CEO was quoted saying, “Our community continues to grow and our business is doing well. But none of that matters if our services are used in ways that don't bring people closer together. We're serious about preventing abuse on our platforms. We're investing so much in security that it will impact our profitability. Protecting our community is more important than maximizing our profits.”

We therefore believe, Facebook’s efforts in AI technologies bode well for long-term growth but the high investments remain an overhang on margins.

Zacks Rank & Key Picks

Facebook carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the broader technology sector include IPG Photonics Corporation (NASDAQ:IPGP) , NetApp Inc. (NASDAQ:NTAP) and NVIDIA Corporation (NASDAQ:NVDA) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Long-term earnings growth rate for IPG Photonics, NetApp and NVIDIA is projected to be 19.7%, 11.3% and 11.2%, respectively.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

NetApp, Inc. (NTAP): Free Stock Analysis Report

Facebook, Inc. (FB): Free Stock Analysis Report

IPG Photonics Corporation (IPGP): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Two weeks ago, the rumor mill ramped up again about the potential restructuring of Intel Corporation (NASDAQ:INTC). The probing balloons centered around Taiwan Semiconductor...

More than a century ago, then-Representative William McKinley pursued an aggressive tariff strategy that sought to protect American industry and reduce reliance on foreign...

Early in 2025, value stocks emerged as a popular choice among investors seeking market-beating returns. However, factor-based investing strategies can be notoriously difficult to...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.